I’m not sure what the shares will do in the short-term. Short-term for us is three to six months. Longer-term, (six months to 30-months) the news this week is “out of this world good”. We’re very positive on MKTY’s price potential over the next twelve to eighteen months.

- Are you buying companies or trading stocks?

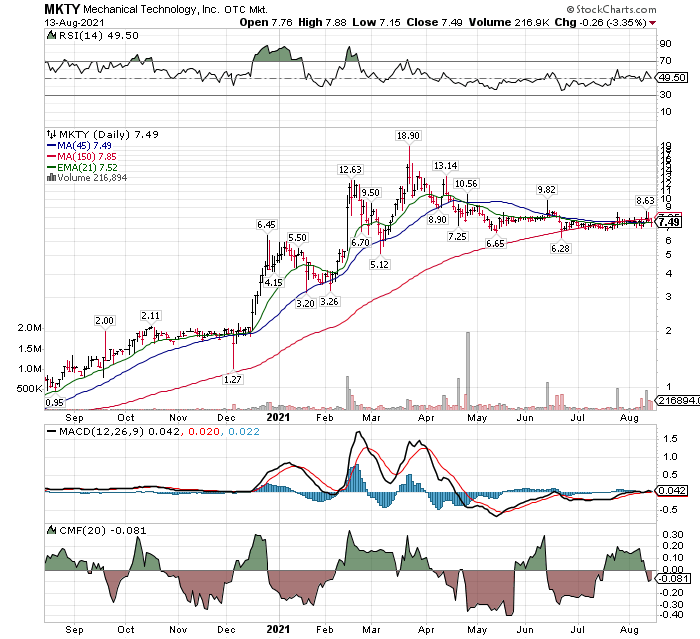

Many people only look at the value of their account as a daily or weekly measure of success. If it’s up, they are happy. If it’s down, it’s a problem and something has to change. Maybe it’s the stock and a change of positions is the decision. Maybe it’s the manager and a change of managers is the response. The world is more complicated than that. It takes time to build companies. LOTM is buying MKTY the Company. I say this because what I see developing is a second run in the share price of MKTY that can be equal to the run from August 2020. The stock was $0.75, to today’s price of $7.62 – a ten-fold move. What MKTY has announced, could produce another ten-fold move within the next year to eighteen months.

Institutional ownership is small. I believe it is about 3.8% of shares outstanding. I am not counting Brookstone who is the operating partner. I’m projecting, that as MKTY produces stats (operating results) that show up in numerical data screenings, Institutional ownership will grow to 50% to 60% of ownership. This is the coming “fuel’ that will increase the share price the next ten-fold move. The increase is likely to be more measured than the first move. Institutional investors are more methodical in accumulating shares than retail investors.

Revenue from yesterday’s days news, will grow from 2020’s $8.9 million for the year, into 2022 revenue in the hundreds of millions in revenue area. When MKTY gets to 300 megawatt of production, the projected (napkin) revenue would be $400 to $500 million annually. The news is that good. We took the current revenue per megawatt and scaled it up. Certainly, management has to execute. The margins could contract and perhaps revenue is shared with a Joint Venture partner. There are variables at play here.

It would be nice if market conditions are favorable – this we don’t know. Parts of the market are over-valued, and some are under-valued. What we do know is we have a tiger by the tail that is not discovered by institutional investors. This discovery will drive the price high.

- In the Aug 12,2021 release below, I have colored in red, the statement that I believe could power the shares, ten-fold in the coming two years.

If you are buying companies and building wealth, Vs measuring your success by the “daily” value of the stock or portfolio, it is my humble opinion, that we have another ten-fold move coming from MKTY – soon to be renamed Soluna Holdings.

NOTE THE RED TEXT BELOW:

MTI Releases Q2 Financials, Announces EcoChain Acquisition of Soluna Computing; PCG Digital Tech Watch Review

3:16 PM ET 8/12/21 | Dow Jones

NEW YORK, Aug. 12, 2021 /PRNewswire/ — Mechanical Technology Inc (Nasdaq: MKTY) released its 2021 Q2 financials this week, capping off a strong quarter on both the revenue and production sides. Total revenue was reported at $3.3 million, up 35% from the previous quarter. Cryptocurrency revenue through the Company’s EcoChain division, was $1.6 million.

Cash on hand was $12.1 million after a $15 million equity offering, a significant increase from the $2.7 million reported end of Q1. The additional purchase power opened up an opportunity for MTI to take advantage of crypto market disruptions in China by purchasing dormant S19s at a discounted price. The power density of these chips increases capacity.

On the production side, EcoChain moved forward with infrastructure improvements at its Washington and Southeast locations. Their TNT site location is now operating at capacity. MTI Instruments, which produces a PBS product line, semiconductors, and EV batteries, reported an increase in cost of sales, from 26% to 30%.

EcoChain Acquires Soluna Computing

In a strong opening move for Q3, EcoChain, a subsidiary of MTI, announced the acquisition of Soluna Computing, Inc (SCI), a developer of scalable data centers that buy excess renewable energy from solar and wind farms. The new company, called “Soluna Holdings,” improves the scalability of EcoChain’s renewable energy powered data centers.

The move increases MTI’s mining capacity from 50MW to 350MW, positioning the Company in the large-cap category for cryptocurrency mining operations. MTI will also absorb Soluna’s technical team, which is currently developing an additional 200MW capacity, adding expertise in project development, energy markets, finance, and computing.

Soluna’s ability to scale using renewable energy addresses one of the crypto mining industry’s greatest challenges — power consumption. It also solves the issue of excess energy the renewable energy sector is experiencing. MTI and EcoChain are now able to implement new power sources and scale their approach globally from megawatts to gigawatts.

Contact LOTM For One-on-One consultations.

Rates are $125 per hour / less for retainer

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()