Investment Assumption: The US Dollar is being devalued by roughtly 7 to 8% annually to deal with our unpayable debt.

What works from an investment perspective in this situation? Hard assets from land and natural resources to scarce assets and Rapid Growth that is higher than the depreciation of the US Dollar.

Bitcoin is both scarce (maxinum 21 million shares) and rapid growth with 99% annual appreciation for 13 years.

In the last 13 years, the Bitcoin index (in USD) had a compound annual growth rate of 99.39%

ZTA is heavily focuse on Physical Metal related investments, Oil & Gas dividend payments for “hard asset” exposure. On the rapid growth side we have exposure to Crypto/Blockchain, AI Data Centers and AI applications in the medical related field. Healwell AI (HWAIF*) is our expoosure to AI in the medical sector.

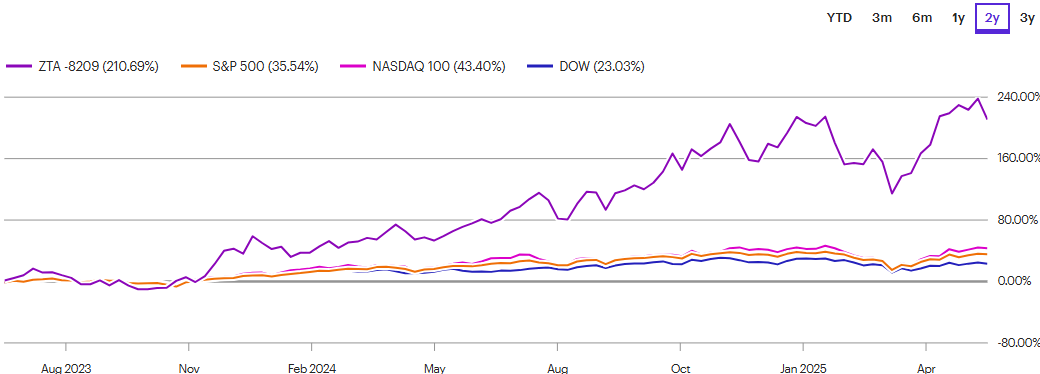

ZTA two year performance:

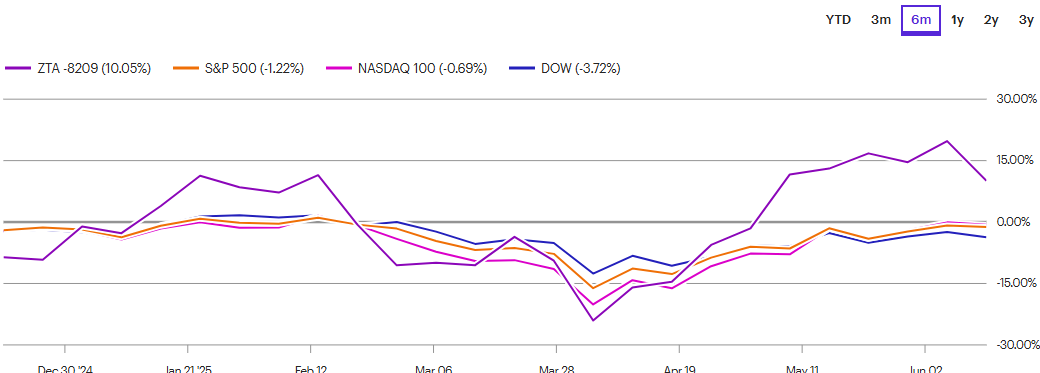

Six-month Preformance:

We have a heavy exposure to Bitcoin in direct holdings in Bitcoin ETFs as well as in Bitcoin Treasury Company holdings. Because of this heavy exposure I wanted to share with you, a commentary on Bitcoin Treasury companies.

Interview with Blake Canfield of note:

Bitcoin Treasury Companies: Risk, Reward & mNAV with Blake Canfield | SLP666

Excellent discussion for understanding Bitcoin Treasury Companies. Blake & host Stephan Livera, discuss the emerging concept of Bitcoin treasury companies, their role in the debt market, and the potential benefits and risks associated with them. Canfield emphasizes the proactive approach these companies take to bring capital into Bitcoin, the importance of understanding the mechanics behind their operations, and the sustainability of their net asset value (MNAV). The discussion also touches on investment strategies, personal perspectives on risk, and the future of Bitcoin treasury companies in the evolving financial landscape.

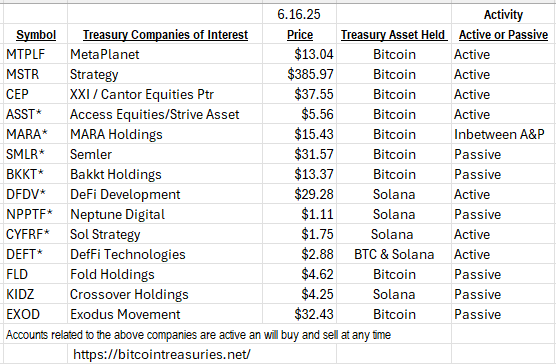

Leading Treasury Companies of Interest to LOTM.

*owned in some but not all LOTM related accounts

Solana (SOL) is becoming a popular second Crypto Treasury asset. This is primarly because companies who own Solana can earn a “yield” staking and or valadating Solana. The “Use Case” for Solana: Solana (SOL) is being used by Visa, PayPal and Sling for their debit and credit card activity around the globe so the use market is established.

A deep dive on Solana, a high performance blockchain network, published by Visa

9.11.23

DeFi Development (DFDV*) just set-up access to a $5 Billion dollar relationship to buy Solana. Cantor Fitgerald just issued a Buy recommendation with a $45 price target.

Small companies with crypto expertise are getting very large money partners to use that expertise.

2025-06-16 DJ DeFi Development Price Target Announced at $45.00/Share by Cantor Fitzgerald

Because we use margin in the ZTA account, we are accumulating Master Limited Partnerships (MLP) in Oil & Gas for their dividends. In this way we are slowly becoming our own Crypto Treasury company using MPLs (like BSM, TXO & MNR) or high dividned paying assets (like symbol IAF, the Australian Fund paying 11% dividend) to generate income for this account. Proceeds will be used to reduce debt or accumlate additional treasury reserve assets like Gold and Silver miners or Crypto holdings.

ASST (Access Equities) above, uses this strategy but is accumulating BioTech companies with high cash positions or Biotech companies with royality income for cash that is then invested in Bitcoin.

In using this theme/strategy, our ZTA Limited Partneship has exposure to some BioTech, AI, Gold and Silver, and crypto/blockchain assets as well as Oil & Gas cash flow. This maintains our past strategy in using a Barbell approach to investing –

- On one end of the barbell, we have rapid growth from Bitcoin, Crypto, Blockchain and AI. Our largest position, Galaxy Digital, has emerged as a leading developer of AI Data Centers. They have a 15 year contract to build out a 1000 acre campus Galaxy owns in Texas. The source of electric power is secured. When fully operational (about 3 three years), the contract is estimated to generate one Billion dollars in free cash flow per year. AI Data Center ownership is considered a real estate investment.

- Gold, Silver, Oil & Gas and Bitcoin are our exposure to hard assets as the second anchor of the barbell.

The “umbrella” theme over both ends of the barbell is that the US Dollar is being devalued by roughtly 7 to 8% annually to deal with our unpayable debt while hard assets and fast growth is the avenue to protect and grow assets in this “devalue the dollar” situation we find ourselves in.

Also of interest:

Public Firms Pivot to Solana as Treasury Asset Amid Crypto Market Shift

Sol Strategies (CYFRF) and Defi Development (DFDV) are mentioned in this article as leading companies in being Solana Treasury Reserve holders. While ZTA does not own DFDV, Galaxy Digital is a large owner of both Bitcoin and Solana, We own Sol Strategy, a large Solana owner and DeFi Technologies – a large owner of Solana and a smaller owner of Bitcoin. Neptune Digital, a ZTA position, is an asset holding company that is over-weight in Solana and a holder of some shares of a private company, Space X.

Call with thoughts feedback and questions, but best to text first at xxx-xxx-6609.

Tom

![]()