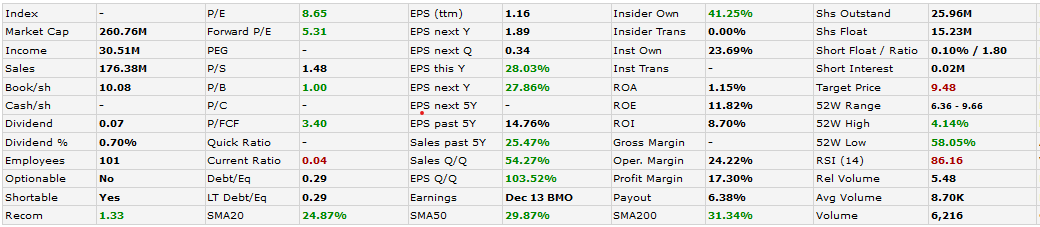

VersaBank (VBNK)* $10.06 – See Stats below. Other than the price pop this week the company looks perfect for a long term positioning to own. Trading might be a bit difficult due to the low float, wide spread in the bid/ask and daily trading volume below 10,000 shares.

VBNK is closing on the purchase of a small Minnesota Bank in the USA that will give them status as a US Bank licensed in all 50 states. The USA market is significantly larger than the Canadian market for what VersaBank does. Management believes the profit margin will be greater for VBNK in the USA than what they have in Canada. Future plans expressed, is expansion into Europe.

This appears to be a true little known FinTech Growth stock in the making.

About VersaBank

VersaBank is a Canadian Schedule I chartered (federally licensed) bank with a difference. VersaBank became the world’s first fully digital financial institution when it adopted its highly efficient business-to-business model in 1993 using its proprietary state-of-the-art financial technology to profitably address underserved segments of the Canadian banking market in the pursuit of superior net interest margins while mitigating risk. VersaBank obtains all of its deposits and provides the majority of its loans and leases electronically, with innovative deposit and lending solutions for financial intermediaries that allow them to excel in their core businesses.

In addition, leveraging its internally developed IT security software and capabilities, VersaBank established wholly owned, Washington, DC-based subsidiary, DRT Cyber Inc. to safeguard its digital infrastructure and to pursue significant large-market opportunities in cyber security and develop innovative solutions to address the rapidly growing volume of cyber threats challenging financial institutions, multi-national corporations and government entities on a daily basis.

VersaBank’s Common Shares trade on the Toronto Stock Exchange (“TSX”) and Nasdaq under the symbol VBNK. Its Series 1 Preferred Shares trade on the TSX under the symbol VBNK.PR.A.

Visit our website at: www.versabank.com

The share price has spiked on the record Q4 results announced December 13, 2023. It would be normal for the stock to exhaust itself on the run-up related to news. A possible pull-back might present a better opportunity to enter the shares or dollar-cost-average into the shares than buying into the current rally. A price of $10 US still presents a low forward expected price earnings ratio number between six and seven.

VersaBank’s focus and target market is the lending and purchasing of Account Receivables from businesses. VersaBank has no retail clients. This is a Business to Business banking and finance company. Note above that the company is not new, having been founded in 1993. They have no infrastructure (physical banks) and are 100% digital. This allows for excellent profit margins and low fixed costs. VersaBank is FinTech company not on most Institutional radar screens yet. This FinTech profile (VersaBank’s), is one Institutions love and will buy and accumulate for years.

As mentioned above VersaBank has a division that provides Cyber Security in the USA. Not mentioned is that they have a small footprint of a division that does custody of Digital (Crypto) Currency. We are not sure this will grow into anything, but it does show that management is forward thinking and innovative.

An account related to LOTM did begin a new position in VBNK this week. The stock price popped on this week’s earnings release prior to finishing research on the company. A dollar-cost-averaging method of both accumulating and risk management seems appropriate.

In the News this week:

VERSABANK REPORTS RECORD FOURTH QUARTER AND FISCAL 2023 FINANCIAL RESULTS AS IT CONTINUES TO BENEFIT FROM INCREASING OPERATING LEVERAGE IN ITS UNIQUE DIGITAL BANKING MODEL (story and financials linked here)

This is a small unknown true growth stock with scalability and no warts that I can find. Yes, it is volatile due to its small float (15 million shares) and large management ownership (41%). LOTM does not see volatility as a risk factor for longer-term holdings and the shares are not bought with borrowed money. This could be a ten year holding that one owns and selectively traded over that period. Chances are some company, bigger, will buy them out long before ten years pass. This is a special, inexpensive (fundamentally speaking), rapid growth with fat profit margin company from what I have seen so far.

For Actionable Stock Ideas, consider a subscription to Tom’s LOTM Blog.

LOTM Style – We are more a controlled speculator, than diversified investor or short-term trader. We allow 100% loss/risk on some purchases. Often, we dollar-cost-average into losing positions. Volatility is our friend, not something to be feared. We let our winners win, as much as possible. We do not like paying taxes. We love value, yet watch charts. Our goal is to find value stocks that might double in one to three-years.

Written December 13th, 2023 for paid subscribers – updated Dec 15th, by Tom Linzmeier, for Let’s Make a Million$ members.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()