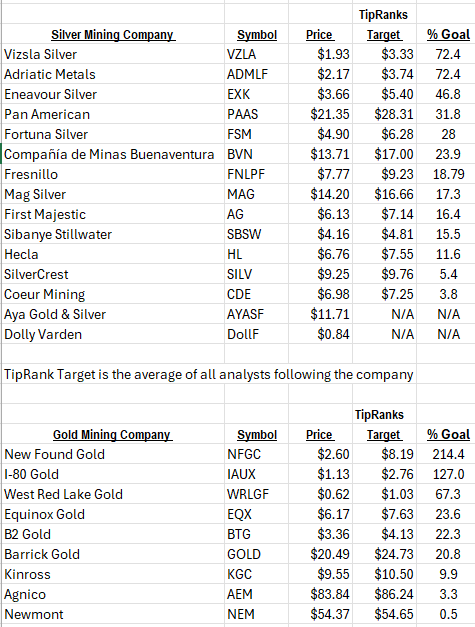

The numbers below tell me that Institutional Investors are invested in the biggest and best names in the Mining Industry. For the Big Miners to rally higher we will need Physical Gold and Silver price to move higher. The opportunity for larger than average gains in is in the smaller miners and explorers/developers. Most of the interesting small companies (Aya Gold and Silver as example) are not followed by many if any analysts. With the smaller companies the risk level / Volatility level is higher as is the opportunity.

Mining stocks are not for a buy and hold strategy. It is a cyclical Industry.

Based on stage analysis we are in the Stage Two chart pattern for the mining industry. Stage two is the rally stage. Many miners are up 50 to 100% over the past year. It does not seem like we have hit the euphoria stage of this mining stock rally. Perhaps there is another six months left for the rally. It does not happen every year but we are heading into the strongest seasonal months of the year. That is the extent of our vision at this time. Two to five years is also bullish. Some place between six months and the two-year area, there is a probability of a price correction for the miners. The next six months could be fun, however.

LOTM Subscribers are exposed to two Themes: Both are concentrated position accounts

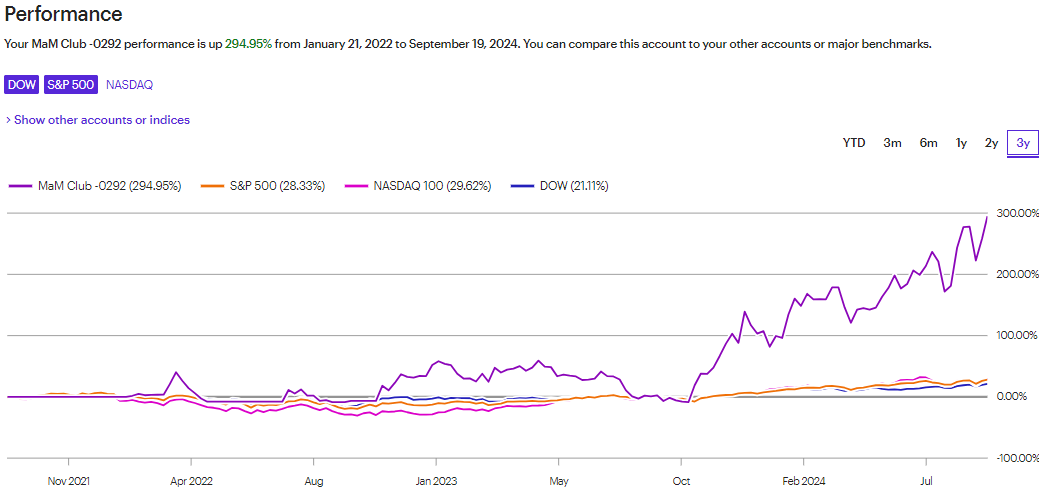

The first Theme started with $1,000 on July 22, 2022. No money has been added. The goal is to double the money annually. $1,000 doubled 10 time is over $1 Million dollars. Work the numbers. So far so good.

We call this game Let’s Make a Million$ Club (M&M Club). In this account we might hold as many as four positions or we might hold a single Position. It is incredibly Volatile. There is no assurance we can do this. I personally double $5,000 eight times to get to More than One Million dollars in the decade of the 1990’s. It took me ten years to get the eight doubles needed to reach the goal of a Million dollars. I want to see if I can do it again to prove that it was not luck.

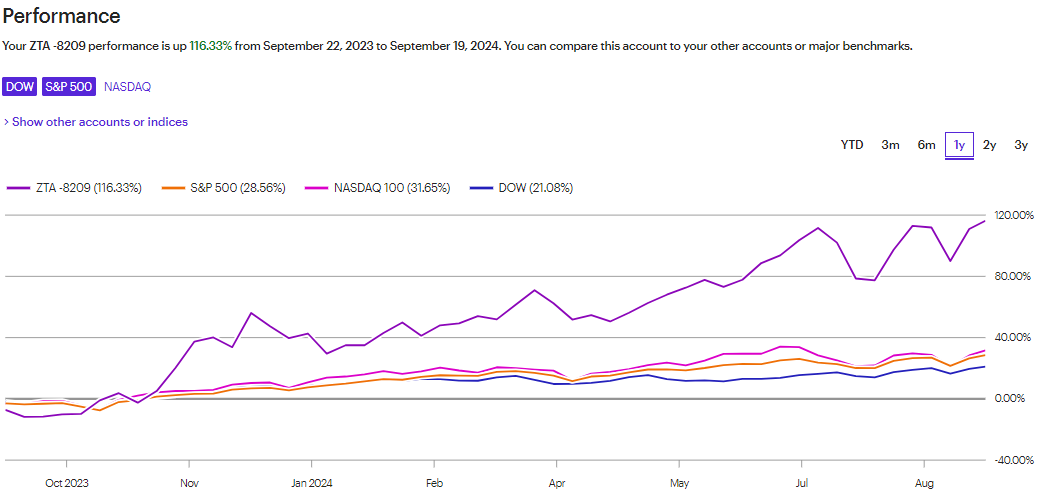

The second Theme is still concentrated but a bit more diversified. This is a small Limited Partnership called ZTA. This a low six figure account with usually hold eight to 12 stocks that make up 97% of the holdings.

It has been a great year. My best projection is that for the six months following the national election, no matter who wins, we will continue to have a good market. After that six months we’ll have to assess the situation and see what looks good. This account is also very volatile as we are not diversified by either companies or industries.

At this time LOTM is a free newsletter but following the election we will be behind a pay wall. This is a good time to try out the service if you have an interest. Send an email back to tl@livingoffthemarket.com

Silver miners on our master watch list with the daily performance on Sept 20, 2024..

We have additional silver miner watch lists where we follow the silver miners with “company” event catalysts happening in the next three to eighteen month time lines. Obtaining long-term capital gain status is one of our goals hence we are not short term trades but at times we do short-term trades. We more often than not dollar-cost-average into positions that are 7.5% to 25% of the account. When we get a winner, we tend to let that winner run. We have had times when the runners get to be 50% of the account size.

This intense focus is not for most people reading this.

- It is only for those with an intense interest in compounding money in limited position holdings and can tolerate intense volatility.

- Margin or borrowed money is strongly discouraged.

- We tend to buy companies that are out of favor or turnaround situations. This can be a higher risk and unpredictable than normal period to own a company. Or it can be a great value with two to five fold potential upside in its price.

- We like stocks under ten dollars per share. More stocks under ten dollars double than stocks at higher prices. This is especially true statistically if they fell from higher prices but are still healthy companies financially.

- We encourage you to think in terms of your money at risk being thought of as the initial capital invested. Any money above the initial investment is play money. Not everyone can detach from money emotionally in that way. You can always pull some money aside to spend, pay down debt or place in lower risk investments. Paid for land would be one such investment target.

- We profile and hunt for stocks that have the potential to double or more in price. Emotional maturity as applied to volatility and money is required. It helps if you identify as a fireman or firewoman running into a fire with a purpose type attitude. As I said – it is not for everyone.

- Example of this strategy as described by Patrick Bet-David founder of Valuetainment.com

EASY MONEY: Unlocking Success in the Doubles Game | Patrick Bet-David (41 seconds)

Longer version: Number 1 Rule Of Money(nine minutes)

It interested in receiving the LOTM letter free until the US National election, send your email and put “Yes, free trial,” into the subject line to tl@livingoffthemarket.com

You personal data will never be shared or sold!

Thanks for reading. Tom

![]()