- GoldSpot (SPOFF)*

- Karora Resources (KRRGF)*

- Calumet Special Products (CLMT)*

- Soluna Preferred (SLNHP)*

- Four Stocks at a Price cross-over of their 50-day MA – PayPal, StoneCo, Alliance Bernstein, Sprott Inc.

GoldSpot Discoveries (SPOFF)* $0.28

Nothing in the chart to suggest positive price action never-the-less, LOTM is very excited about buying ownership of GoldSpot at the current price. The company has announced a name change and restructuring of the company. The new name will be EarthLab. The company is tiny, but global leader in Artificial Intelligence (AI) and Machine Learning (ML) as it related to the Mineral Exploration industry. They are rolling up through M&A, other independents in AI & ML. EarthLab is very well connected through its leading investors. People like Eric Sprott, Rob McEwen & Palisades Goldcorp Group. My excitement is that as a consulting firm, the company charges enough to support its AI & ML consulting business. Revenue is up 54%, Q1 2022 from previous year. Earthlab accumulates assets through what is called in the construction industry, sweat equity. Each time the contract with an exploration company, they take part of the company they work for, as compensation. It might be stock warrants or options, it might be shares of stock, or it might be future royalty income stream. You and I will never be able to accumulate natural resource property as inexpensively as we can as through owning EarthLab. This is not a short-term play bur rather planting an acorn for three to five year growth. I believe a ten-X on investment from the current price is possible. $0.275 cost with a goal of $2.50 to $3.00. Earning will be lumpy because asset sales are part of the operational plan. Think about it. These are the people that prove up the minerals on properties they will know more about the property before the owners of the property. They have one of the leading Canadian Merchant Banks as a 13% owner of EarthLab – Palisades GoldCorp Group. They, Palisades and Earthlab, will have first opportunity to invest in properties they prove up. We can’t get any closer. If this is the decade of commodity investing, this sector will get very hot sometime in the near future. Timing is a tough game, so a three to five year window needs to be assumed to get this to a ten bagger. An account related to LOTM added to an existing position earlier this week.

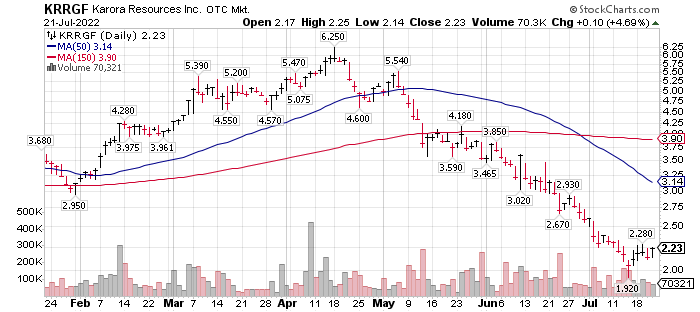

Karora Resources (KRRGF)* share price went from $6 to below $2 since the middle of April. The company is flush in cash, has an increasing grade of gold ore going for it, discovered high grade Nickel that can be proceed at no extra cost in their own mill and discover addition gold resources on property they already own. $6 to $2. News flow headline link. I wish I had more available cash. While not happy with the price drop, related accounts did take some money off the table (half of the position at between $3.50 to $5 area). We believe this is a great price area to reload the position or initiate new position.

Buy on fundamentals. Afterall, we own companies and trade their stock. Karora is cheap in my opinion. I can sleep at night with that. Still thinking $10 number in two to three years depending on the markets emotional attitude towards precious metals and battery metals.

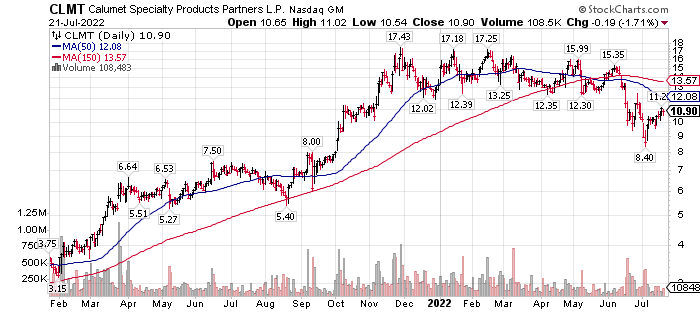

Calumet Specialty Products (CLMT)*

They are not making refineries any more. True statement for the USA. Current refineries cannot keep up with demand to the point the US government sell oil to China from our Strategic Reserve. Ever get stabbed in the back by your own government. 😊 Just my humor.

Linked here is an excellent video on Refiners from one of our favorite investigative reporting channels – Al Jazeera. It is long, but the initial part is helpful in exposure to those willing to invest in refineries. Calumet is one of the best in my opinion. We believe Calumet presents a growing monthly dividend opportunity, will do debt reduction and give you a opportunity to double or more on your money over a two to three year period.

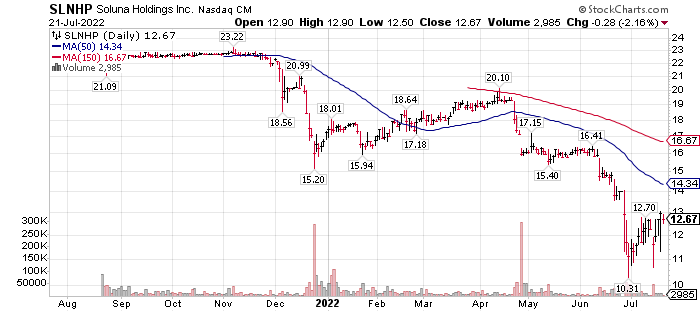

Soluna Holdings Preferred shares (SLNHP)*

Soluna Preferred is down in price and some what of a concern because products that pay a 17% interest rate must have something wrong with them, right? In this case I believe liquidity is the problem combined with the deep concern, without homework about Blockchain related investments, is the culprit. Management at Soluna is a very sharp crew. I believe they have put some structural safe guards into this preferred (and company) that will not harm the company yet protect the owner of the preferred, should the company have a cash flow issue. First of all, there is no maturity date on the preferred to act as a hard stop trigger to force a financial problem. Second, the dividend is cumulative, meaning should Soluna not be able to pay the dividend, the dividend accrues as an IOU to the preferred owner. Third, management is a 30% owner of the company so they think of things that would bother a shareholder – because they are the largest shareholder. I don’t know the management team personally, but I like their discipline and how they think. IMO, Soluna is a very interesting monthly payout holding, with an above average yield of 17.34%, paid monthly, at a distribution rate of $0.1875 per share. IMO, it is safer than it looks. Just one person’s opinion.

There is no assurance the company will act on this, but they have the “right,” but not the “obligation,” to buy back the preferred after Aug 2026 at $25 per share. From the current price, should the company buy back the preferred, it is potential appreciation of $12.33 per share.

The stocks above are suggested as Too Cheap from a Fundamental perspective, however their technical charts are not in a buy signal situation. Our Too cheap comment is meant as a over-sold and too cheap comment because we are buying the company longer-term and not trading the stock within a two four month period. We are looking for three to ten times on out investment.

The four stocks below are meant strictly as a technical trade with two to four month visibility. If you are not buying “the company” and strictly trading, then use a stop loss, 1/3 of your expect trade sell goal. If you are buying “the company” dollar-cost-averaging is an time tested risk management tool for longer-term holders. Know what you want, plan accordingly and execute with extreme prejudice.

TRADE IDEAS:

The following names are at a point in time of price crossing above 50-day moving average – high probability signal of the start of a two to four month rally. The four companies might be trade ideas (price cross-over their 50-day MA) in bigger companies and higher priced stocks (for trading liquidity) but still in an industry sector we like. The companies are linked to their Finviz charts:

- PayPal (PYPL) $82.85

- Alliance Bernstein (AB) $42.20 paying a dividend rate of 9.5%

- Sprott Inc (SII) $35.84 paying a 3.6% dividend.

- StoneCo (STNE)* $9.50

Use a stop if your intent is a trade.

Note: A stop loss on 1/3 of your expect trade sell goal, means if you do three trades and lose of two but win on one, you make money. If you have not seen or heard that before, consider the benefits of being a disciplined trader, who can lose 66% of the time but end up making money. It is a math game.

Written July 21, 2022, by Tom Linzmeier, editor LivingOffthemarket.com

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()