- Goldman’s Jeffrey Currie, on Commodities as the only trade.

- Jamie Diamond, JP Morgan – Financial Hurricane Coming.

- Marko Kolanovic, JP Morgan, Torrid rally coming into year-end ’22.

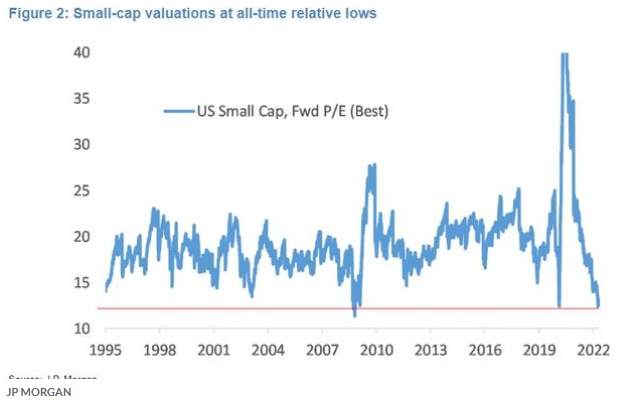

While I agree with Goldman’s Steven Currie (below), The commodity trade is not a new trade. In looking for stocks to double and triple in value from today’s price, we like we like the value proposition in Genomics, Payments, Emerging Markets and Small Caps. We (LOTM) are likely early, but one almost always is when value hunting. Look at some ETF’s in the areas mentioned above as a lower-risk way to play the “deep” Value and spend some time identifying individual companies within these groups to branch into as money flows return to the sectors mentioned above.

On Commodities – NOTE: Jeffrey Currie is head of the Commodity department for Goldman. He’s talking his book. Does anyone not know commodity prices (fuel) are high. Trend can continue, but not new news. Also note at the end of the quote below “for the next quarter” reference.

“As central bankers can drain liquidity faster than the economy can generate new production capacity, financial assets will continue to underperform physical assets like commodities,” said Currie. So convinced is Goldman, the bank’s portfolio strategy team is keeping overweight recommendations only on commodities and cash for the next quarter.

As Jamie Dimond warns about a financial hurricane ahead, one of his analysts, Marko Kolanovic see a ‘torrid’ rally back in the S&P 500 by year-end.

Kolanovic likes the value in Small Caps, Energy and biotech.

With “defensive” stocks already trading near record relative valuations to the rest of the market, Kolanovic sees the most opportunity in the comparatively unloved market segments, including Chinese ADRs (one popular ETF of these stocks is down more than 20% so far this year), small-caps (the Russell 2000 RUT, -0.49% is down more than 17% year to date), energy and biotech. All these segments are trading near all-time-low relative valuations.

No need to act fast. There is plenty of food for thought in the comments above. Start considering positioning for tomorrow’s market prices and don’t chase yesterday’s market news. As the Vietnamese often say, “the past is the past, we only look forward.”

Have a great day.

Tom

Written June 1, 2022, by Tom Linzmeier, editor, LivingoffTheMarket.com

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()