“Hard times create strong men. Strong men create good times. Good times create weak men, and, weak men create hard times.”

― G. Michael Hopf, “Those Who Remain”

Cynical:

1. Believing that people are motivated purely by self-interest; distrustful of human sincerity or integrity.

2. Concerned only with one’s own interests and typically disregarding accepted or appropriate standards in order to achieve them.

Inconvenient Truths:

Are you a diversified investor when you own the S&P 500?

- Apple (AAPL) and Microsoft (MSFT) are 14% of the price movement out of 500 stocks in the index. So goes Apple and Microsoft, so goes the S&P 500.

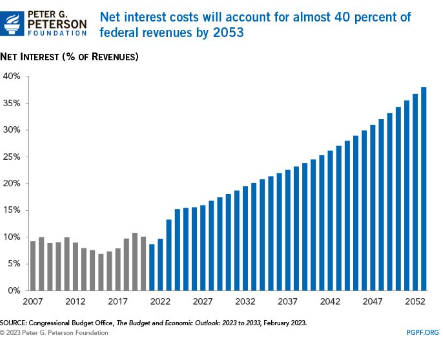

INTEREST COSTS WILL CONTINUE RISING THROUGHOUT THE NEXT DECADE

CBO projects that annual interest costs will rise to a staggering $1.4 trillion in 2033. To contextualize that rapid growth, consider that the federal government spent about $1.3 billion per day on interest payments in 2022; by 2033, the nation will spend about $3.9 billion per day. Relative to the size of the economy, such costs would nearly double from 1.9 percent of GDP in 2023 to 3.6 percent in 2033.

Crony Capitalism – an economic system in which businesses thrive not as a result of free enterprise, but rather as a return on money amassed through collusion between a business class and the political class. This is often achieved by the manipulation of relationships with state power by business interests rather than unfettered competition in obtaining permits, government grants, tax breaks, or other forms of state intervention over resources where business interests exercise undue influence over the state’s deployment of public goods, for example, mining concessions for primary commodities or contracts for public works. Money is then made not merely by making a profit in the market, but through profiteering by rent seeking using this monopoly or oligopoly. Entrepreneurship and innovative practices which seek to reward risk are stifled since the value-added is little by crony businesses, as hardly anything of significant value is created by them, with transactions taking the form of trading.

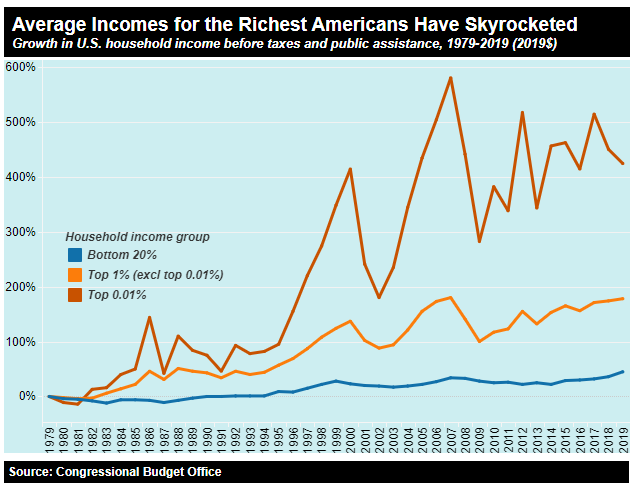

Income Inequality

America – Land of the Free and Home of the Brave – but not it comes to wealth accumulation.

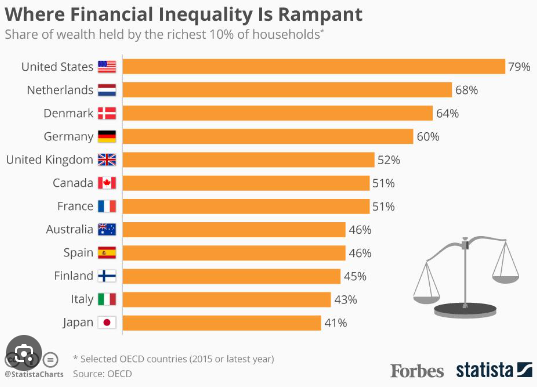

Federal Reserve data indicates that as of Q4 2021, the top 1% of households in the United States held 32.3% of the country’s wealth, while the bottom 50% held 2.6%. From 1989 to 2019, wealth became increasingly concentrated in the top 1% and top 10% due in large part to corporate stock ownership concentration in those segments of the population; the bottom 50% own little if any corporate stock. From an international perspective, the difference in US median and mean wealth per adult is over 600%. A 2011 study found that US citizens across the political spectrum dramatically underestimate the current level of wealth inequality in the US, and would prefer a far more egalitarian distribution of wealth. During the COVID-19 pandemic, the wealth held by billionaires in the U.S. increased by 70%, with 2020 marking the steepest increase in billionaires’ share of wealth on record. Source Link

A reason to own Precious Metals, Oil reserves and Bitcoin:

”The FDIC insures $9 TRILLION of bank deposits with only $125 billion worth of assets. In other words, only 1.3% of its holdings are in reserve.

It can’t possibly insure everybody, especially in a crisis when many people want to withdraw their money all at once. Therefore, Federal Reserve-orchestrated bail-outs – and thus more inflation – are inevitable should a market crash come to pass” From the story Linked Below and Linked Here.

Must Watch: FDIC Bankers Discuss ‘Bail-Ins’ To Deal With Impending Market Collapse

Jan 1, 2023 – By Jamie White

November 2022 meeting shows financial regulators plot how to hide alarming market signals from depositors to prevent a bank-run panic.

“The bankers don’t trust the banks,” notes financial commentator Wall Street Silver.

Federal Deposit Insurance Corporation (FDIC) officials recently discussed (November 9, 2022) how to deal with the next approaching market collapse and hide alarming data from depositors to prevent bank runs, video of a meeting shows. YouTube Link to actual three hour FDIC Meeting from which this story originated.

The FDIC’s Systemic Resolution Advisory Committee (SRAC) held a meeting in November to discuss how the next market crash would occur and what steps would need to be taken to ensure not everybody tries pulling their money out of the financial system at the same time.

“You’ve got to think of the unintended consequences of taking a public that has more full faith and confidence in the banking system than maybe the people in this room do,” one FDIC member noted.

“We want them to have the full faith and confidence in the banking system. They know FDIC insurance is there. They know what works. They put their money in, they’re going to get their money out.”

He claimed that although institutions will soon be able to figure out the dire implications of what’s being discussed at the meeting, the general public should not, because that would lead to “unintended consequences.”

“I would be careful about the unintended consequences of starting to blast too much of this out in the general public,” he said. Link to full story linked here.

Conclusion: Financial knowledge is power but also necessary for financial survival, in these uncertain times. Trust but verify. Challenge and test every belief system you have been taught. Diversify in multiple ways. Other than owning a home, most people are underinvested in physical assets like crypto, precious metals and commodities. We strongly believe that the 40-year deflationary period, with constantly falling interest rates, from 1980 to 2020, has ended. We are now in a rising interest rate and rising inflationary period that will be decades long. We also suggest having your wealth diversified geographically in other country jurisdictions for protection from confiscation as well as a loss of purchasing power of the US Dollar. Geographical financial diversification sounds drastic, but I assure you, the top 5% of US wealth holders are diversified by international geography.

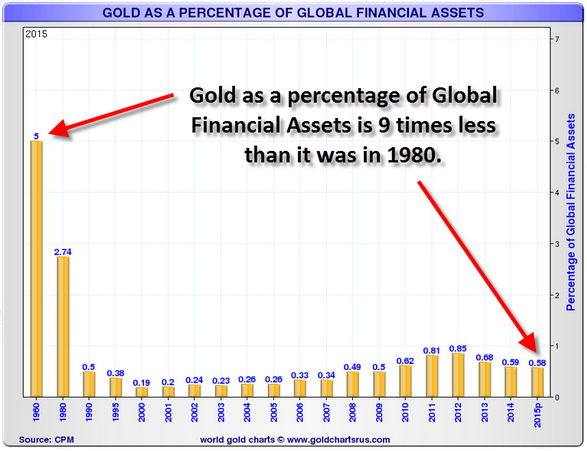

Historically, prior to 1980, retail and institutional investors held a much higher percent of investment portfolio in gold than today. That percent today that is about 0.58%. Central banks have been and are still increasing ownership in gold and decreasing ownership in their US Treasuries.

Basal 3 has raised physical gold as the same as cash (Tier-1) in its recent rulings.

Previously, banks could hold gold on their balance sheets in the form of unallocated paper gold contracts without holding physical gold in tangible form. These paper contracts were considered as “good as gold” when it came to determining how much capital a bank needed to maintain on its balance sheet. Under the old rules, there was little incentive to hold physical gold, as it was only valued at 50% for reserve purposes. Basel III rules move physical gold from being considered a Tier-3 asset to being considered Tier-1, which allows physical gold in bullion form to be counted at 100% value for reserve purposes. Gold in unallocated paper contracts will no longer be considered an equal asset. For this reason, banks using paper forms of gold to help meet reserve requirements will have to convert those positions to physical metal, or risk becoming too undercapitalized to continue to function. Source link

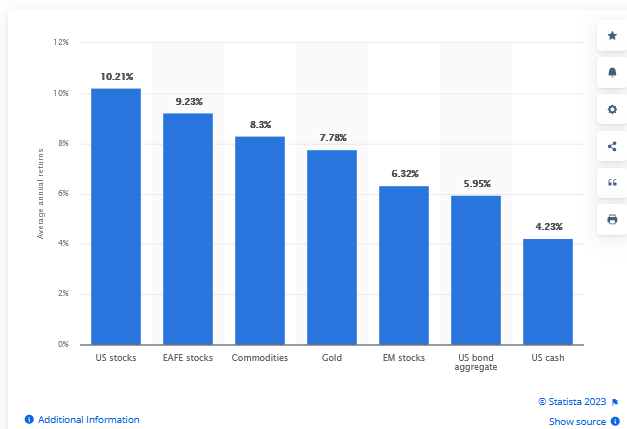

Equities have out-performed Commodities and Gold from 1980 to 2022, the 42 year deflationary period, (below graphic). We believe commodities and gold will be the big winners in this next inflationary period. Government’s need to repay debt with cheaper fait money. They can default or inflate the debt. Inflation is a less violent reaction by the general population. Therefore, inflation is the preferable path for governments in relieving their debt burden. We believe Cash will be a negative return (loss of purchasing power) when inflation is added to the calculation. Expect bouts of deflation, possible during the summer of 2023, but the overarching trend is for higher inflation rate over a multi-decade timeline. Deflationary periods are opportunities to buy or add to commodity positions. Passive equity investing returns could very well be flat or declining returns for the next five to ten years. Gold, Commodities and Crypto are ways to preserve purchasing power in inflationary times.

Average annual return of gold and other assets worldwide from 1971 to 2022 – Statista link

Contact Tom at Money @ LivingOffTheMarket.com with questions, concerns or subscriptions.

For Actionable Stock Ideas, consider a subscription to Tom’s LOTM Blog.

LOTM Style – We are more a controlled speculator, than diversified investor or short-term trader. We will allow 100% loss/risk on some purchases. Some of our biiggest winners have come from our biggest losers. Often, we dollar-cost-average into losing positions. Volatility is our friend, not something to be feared. We let our winners win, as much as possible. We do not like paying taxes. We love value, yet watch charts. Our goal is to find value stocks that might double in one to three-years.

See our website for our doubling to a Million$ game. We were playing this game of doubles before Patrick Ben-David talked about it. Ideas in this blog are highly volatile and only for use by those who are comfortable with high-risk, high-reward investments.

Written April , 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()