- Luke Gromen: “US Economic Policies of Past 40 Years Intentionally Being ‘Trashed,’ Impact on Gold & BTC .

- Tokenization Transforms Asset Management: The Inevitable Shift to On-Chain Integration

- Real world example: U.S. Credit Unions Adopt Tokenization of Real World Assets

- GOLD to Hit $3,000, Only A Matter of Time | Mike McGlone with Soar Financially.

- LOTM Summation of multiple Analyst’s & Strategist’s view over the past ten days:

- Ray Dalio, founder of the largest global hedge fund, suggests transferring assets to jurisdictions outside the U.S., such as India, Singapore, Indonesia, Malaysia, Vietnam, and some Gulf states.

- A producing gold mining stock at an actionable price.

Luke Gromen: “US Economic Policies of Past 40 Years Intentionally Being ‘Trashed,’ Impact on Gold & BTC – Kitco News Interview, 71 minutes – Major events that has changed the financial world similar to decoupling the US Dollar from gold in 1971. Invest in hard assets – spend in fiat currency. This is additional support to Ray Dalio’s comment below, about transferring assets & currency into other country jurisdictions and out of USA. Linked here.

Gromen suggests gold can increase three to six fold going forward and still be under the historic relationship of GDP to gold levels.

This video might be difficult to follow in the first fifteen minutes but become clear and expressed in actionable process later in the video.

Tokenization Transforms Asset Management: The Inevitable Shift to On-Chain Integration: Linked here

A 2022 Boston Consulting Group report estimated that the market for tokenized assets could grow to $16 trillion by 2030, which would greatly enable DeFi protocols catering to these assets to develop entire new financial ecosystems across lending, liquidity pools, futures and derivatives, and other markets.

Trillions of dollars of new wealth has been created on-chain. This is a new investor demographic that expects to access and interact with financial products and services from their own wallets.

Real world example: U.S. Credit Unions Adopt Tokenization of Real World Assets – Linked here

The National Association of Federally Insured Credit Unions explained that loan participation occurs whenever the ownership interests in a loan are divided up and sold.

“Under section 701.22, federally insured credit unions (FICUs) can buy

participation interest in loans under certain conditions,” the blog states.

Hauptman pointed out that the current loan participation process can be complex. For example, he explained that if a credit union makes a loan and another credit union buys a 20% stake in it, it gets 20% of every loan payment.

Hauptman noted that the credit union that buys participation in the loan doesn’t know if the payment has actually been made, however. Additionally, that credit union is unsure if the selling credit union will pay the required 20%.

“This makes it difficult for the buying credit union to plan, and it creates unnecessary uncertainty,” said Hauptman.

Bottomline: Blockchain Tokenization solves this problem.

GOLD to Hit $3,000, Only A Matter of Time | Mike McGlone with Soar Financially. Linked here

McGlone is Senior Commodity Strategist at Bloomberg. Mike lays out his approach for the next six to eighteen months along with the macro view longer term. Highly recommend this for a realism check. McGlone is a believer in regression to the mean. He uses the example of Stock Market Cap to GDP is now 2 times. The previous high water mark for Stock Market Cap to GDP was 1.2 times in the 1930 period. McGlone talks about gold, silver, copper, bond markets globally and equity markets. He also spends time discussing China and India and believes the world is heading into a recession and deflationary period. This is showing in China and India at this time. McGlone believes what is happening in China and India will spread to te USA.

Ray Dalio, founder of the largest global hedge fund, suggests transferring assets to jurisdictions outside the U.S., such as India, Singapore, Indonesia, Malaysia, Vietnam, and some Gulf states. Link to MSN article.

Dalio suggests the United States has a one in three chance of a civil war. The period just before and after 2024 elections is a flash point for such an event. Inflation will stay high, and the US Dollar is going to fall Vs other currencies. It is the only way out of our national debt crisis. Dalio is thinking with a 360 degrees perspective and consider all possible outcomes.

LOTM Summation of multiple Analysts and Strategists view in the past ten days:

- Interest rates will stay high until the Stock market corrects. The question as always is, “how deep the correction?”

- Inflation will remain higher for longer to repay high national debt levels with devalued fiat currencies – globally.

- One must consider being in assets that grow with inflation or from shortages. This includes equities, gold, silver, copper, bitcoin, land and other hard assets.

- Risk is in the debt (bond) market and in “longer than three to five-year maturities.” Avoid long-term fixed income instruments.

- Gold is replacing US Treasuries as the Global Reserve “asset.” The US Dollar will remain the Global reserve “currency.” The are different. Bitcoin’s Market Cap is too low at this time to be a global reserve “asset.” Bitcoin will appreciate three times what gold appreciates. Having said that – Gold is projected to appreciate three to six fold over the next three to five years. Know your own risk and volatility tolerance.

- The stock market is overbought and will correct this summer. Bitcoin and gold will likely correct their prices as well. September and October will be a correction low for the year-end rally. This is an opinion heard from multiple soothsayers and pundits. Be prepared mentally, emotionally and financially should it come to pass.

- The stock market is the most over-valued since the 1929 – 1930 period. The current market is about 40% more overvalued, than the 1929 to 1930 period. Equity market cap is 2X US GDP.

- The next five to ten years will see hard assets and crypto out-perform traditional US Equities including the High Tech sector. See Larry McDonald’s view on this subject here. “Inflation, Why Trillions Are Currently Misallocated, And Where To Invest” Larry is the founder & Author of The Bear Traps Report.

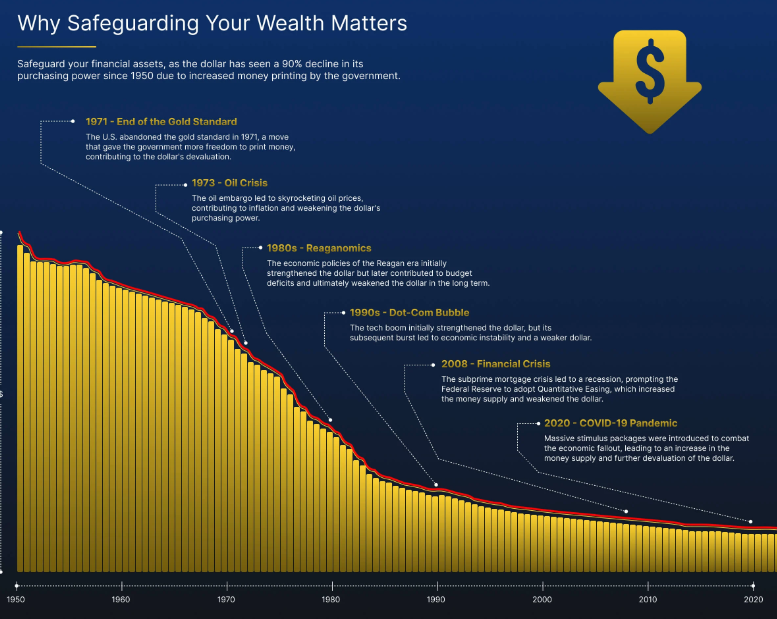

- There is no place to hide from risk. The best place might be three year-treasuries. The current return is 4.7%. The risk is loss of purchasing power when you get your money back in three years. The US Dollar has lost savers a substantial amount of purchasing power. US Consumer Price Index: Purchasing Power Of the Consumer Dollar. The index has dropped from 37.1 in April 2021 to 31.90 by Apr 2024. In percentage terms that is a drop of 14%. The return on three-year treasuries at best is keeping your purchasing power around breakeven. This is on official government numbers. You know as well as I real inflation is higher. You not gaining by saving at 5%. Source of the chart below can be seen more clearly at this link.

If you had $1 million dollars in 1950, how much would you need today, to have the same purchasing power?

The answer is $13 million – See Inflation Calculator at official inflation rates linked here.

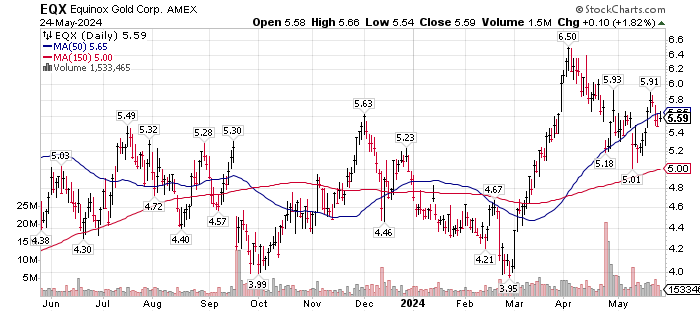

One Gold Stock Idea: One of our owned gold stocks, Equinox Gold (EQX*) made its first pour from its mine #8, Greenstone. Greenstone is expected to be one of the largest producing gold mines in Canada. In addition to Greenstone being one of the largest producing mines in Canada, it will be Equinox’s largest and highest grade with the lowest cost to mine of the eight producing mines Equinox owns. 50 second video of EQX’s first pour Linked Here.

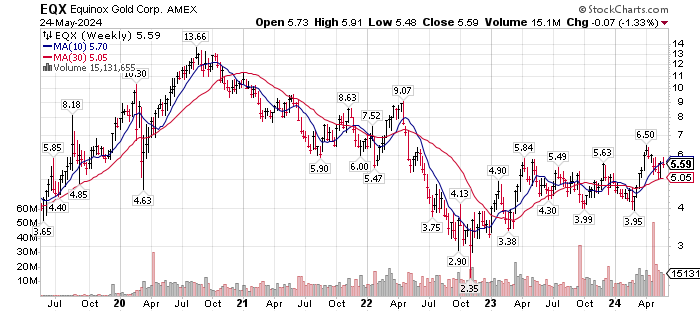

The price pull-back to former highs as support ($5.00 to $5.60) seems to be a near perfect area to buy the shares. If you are a trader & use stop losses, a 10% stop near the 150-day moving average ($5.00) would be appropriate. For investors, fundamental news at EQX is good and expected to improve, so from a dollar-cost-averaging perspective, $5.00 to $5.60 area is a good area for additional purchases. $5.00 as a stop loss or an additional buy, depends on your time-line and goal in being involved with the stock in the first place. Personally, I prefer long-term capital gains and as big a position as my money and risk tolerance allows. So, I am more of a Speculator then Investor or Trader. Know who you are and what tactics you will use. The macro view for gold and gold miners appears very favorable.

Five-year weekly chart EQX

Lots of great info here. It takes time to keep up to date with the market. LOTM is working to shorten your time spent hunting and pecking for actionable market knowledge.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()