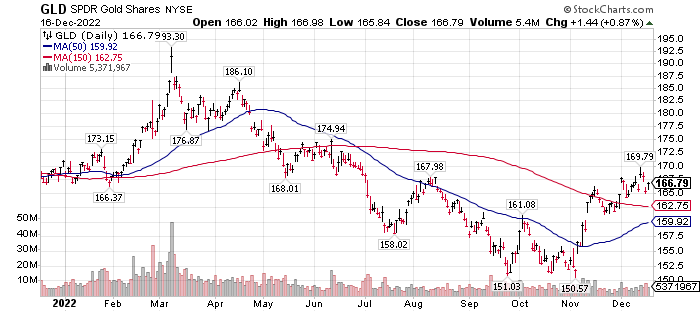

One-year GLD (Paper Gold Price): Double bottom marking the lows of stage one bottoming process. In early stage two chart pattern, the biggest appreciation stage of the four chart stages. Build positions on weakness in physical gold, Physical held in trust departments and Gold mining stock. We do not recommend buying Paper gold even though we display the charts. Paper gold (GLD) has no guarantee that gold is backed by physical gold and settlement by prospectus, can be in US fait dollars.

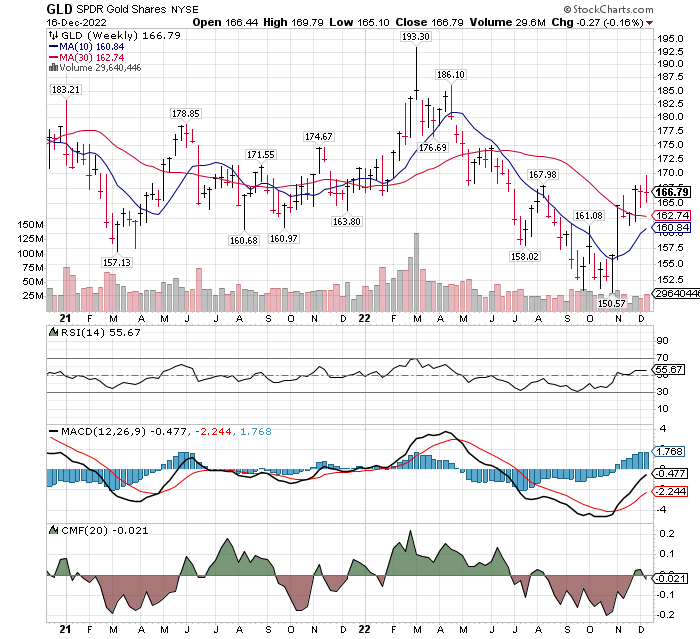

Two-year weekly chart of Paper Gold (GLD) with technical indicators.

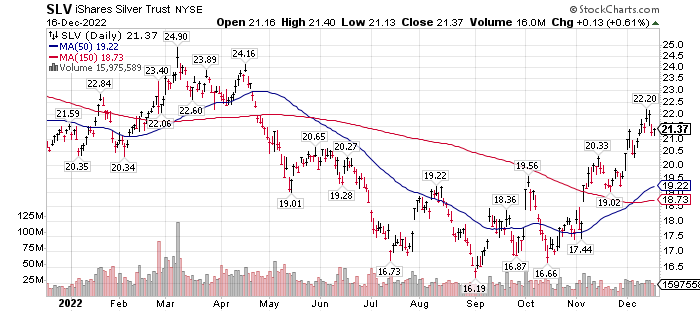

Two-year Physical silver chart below.

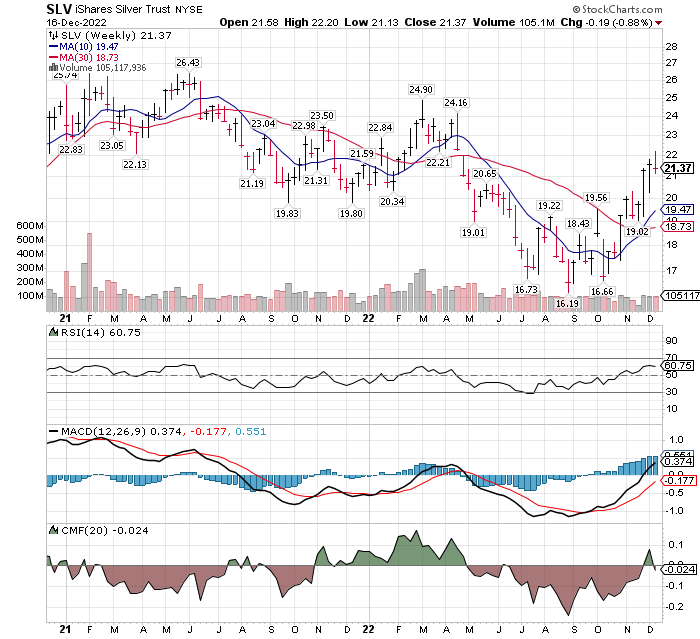

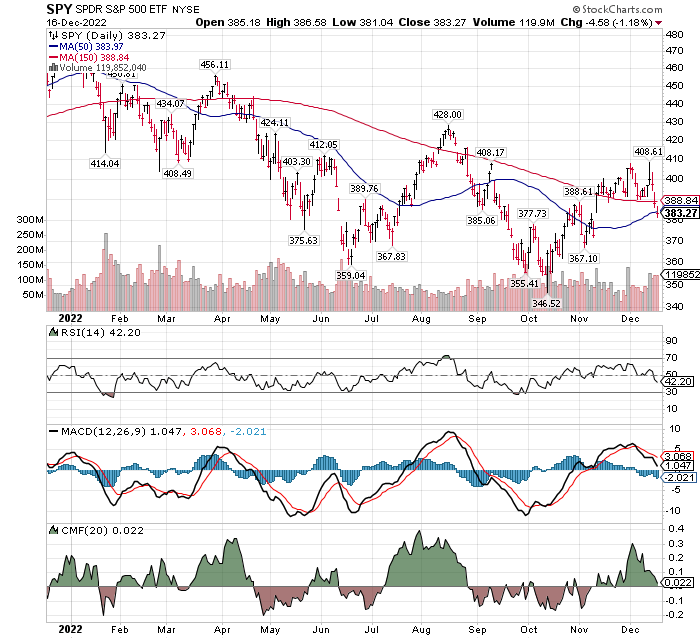

Notice the RSI (relative strength index) of silver, 60.75%, gold, 55.67% and rising when compared to the market (SPY chart below). Both are above the 50% line of equities and rising. This doesn’t mean we will not have a correction but at this time it suggests buying the dip within a rising trend. Have your risk management strategy determined and ready to use. DCA (dollar-cost-averaging) or Stop Loss are the two most common risk management tools.

Moving Averages: Gold and Silver are trading above their respective 50-day and 150-day moving averages while the SPY (chart below) has crossed below it respective, 50-day and 150-day moving average.

Below we share the chart of the S&P 500 (SPY). Notice that the SPY’s RSI signal is under the 50% line and declining. The SPY is a still operating within a declining chart pattern. A good number of analysts expect a Q1, 2023 sell off in the general market.

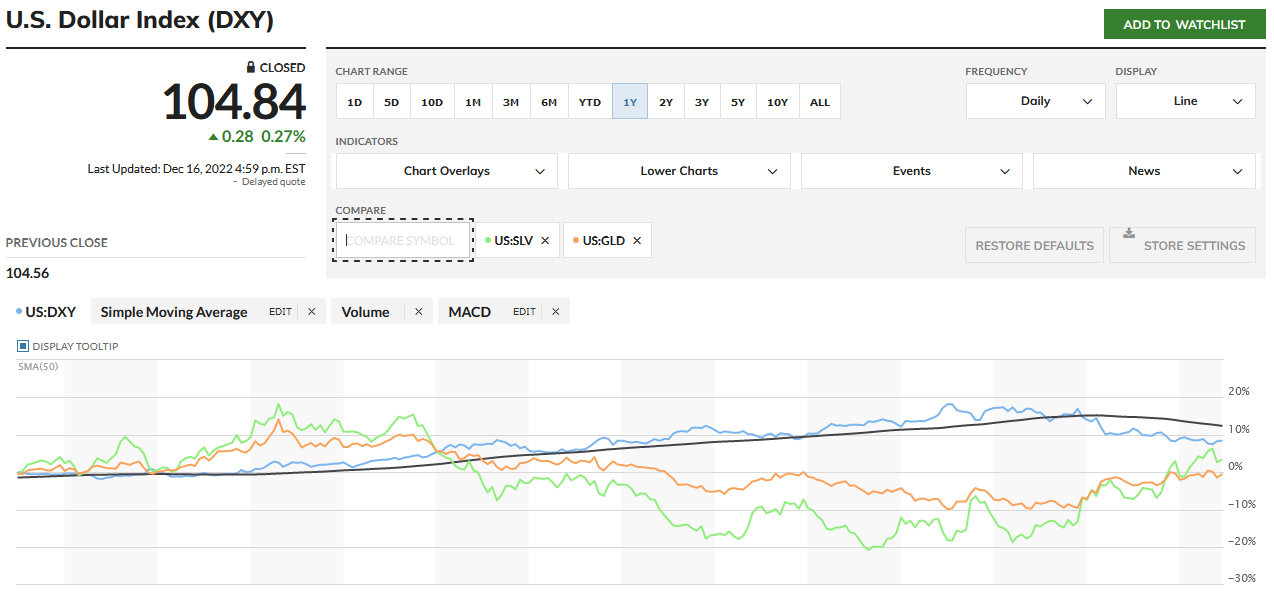

US Dollar and Precious Metals: At this time Precious metals trade the same as if it is a fait currency. The US Dollar goes up and precious metals go lower, and if the US Dollar falls, Gold and Silver go up. Silver is front running gold at this time.

MarketWatch US Dollar (DXY) Index with Gold and Silver.

Below is a link to twenty-five minute video by billionaire, Rick Rule on why he is very greedy in buying commodities and why he feels our global leaders are fools and frankly ignorant. Because of our global leader’s foolishness and ignorance, they are presenting a wonderful opportunity to make money from their stupidity. Warning: If you don’t like to hear reality based facts about where we are as a civilization, please to not view this video. If you do not want to make money from natural resources, please skip this video.

Consider being a subscriber to Tom’s LOTM Blog learn about our Ten Under Ten for the Double list for current and new ideas, many in the natural resource area, crypto and in bombed out growth stocks. The depth of a bear market is the best time to start building for the next bull run. The fastest gains come before most are aware the bull has started. This is a mental game as much as a logic based game.

The subscription price for LOTM will rise 15% ($274 annual rate) with the real rate of inflation, January 1, 2023. Current subscription price is $239 annually, with a renewal on December 31, 2022. Subscriptions at the current $239 rate, will not see a price hike until at least, December 31, 2025. A LOTM monthly rate, will be introduced at $24.00 per month that will auto renew but can be canceled before each month-end. This will be available starting January 1, 2023. We will announce an affiliation policy soon as well.

Written December 18, 2022, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()