180 Degree Capital

Summary:

- Anomaly in the chart pattern of 180 Degree Capital

- Significant discount to NAV

- Strong Insider buying

Anomaly in the chart pattern

There is an anomaly in the chart pattern of 180 Degree Capital that is worth note.

I have not heard of a term or label for this chart action so a long time ago I started calling it straight-lining. This is not normal market activity. This chart action does not happen unless there is big, usually institutional investor involvement. A majority of time this chart pattern breaks in an upwards direction. Occasionally the price drops hard. It seems like a big buyer is engaged in a strong buying/accumulation period. Eventually one of two things happen. One is that they end their buying/accumulation and there are still sellers in the shares and the stock price drops when the buyer is exhausted. The second and majority of time, other investors see what is happening (like this note) or hear the story behind the buying and join the buying party.

Discount to NAV:

The Net Asset Value (NAV) at the end of Q1, 2021 was $10.60 – this is a discount to the current share price ($8.13) of 23.3%. We think this is too large. Q2 will likely be a softer quarter in general than Q1. The market seems to have reached a high water mark in March April, however, interest rates are low, liquidity high, so we don’t much more than a 5% to 10% “market correction”., Certainly sectors of the market (blockchain and growth stocks) have had much steeper correction. The Market is doing ok because of the outperformance of energy that helped smooth the weak sectors. Another factor that “should” be considered in viewing the discount to NAV narrowing is the beautiful discipling of Management lead by Kevin Rendino in being activist investors in his public portfolio companies. This is now a five year’s track record. We should recognize this as repeatable cycle of 180 Degrees ability to create higher value in their portfolio holdings.

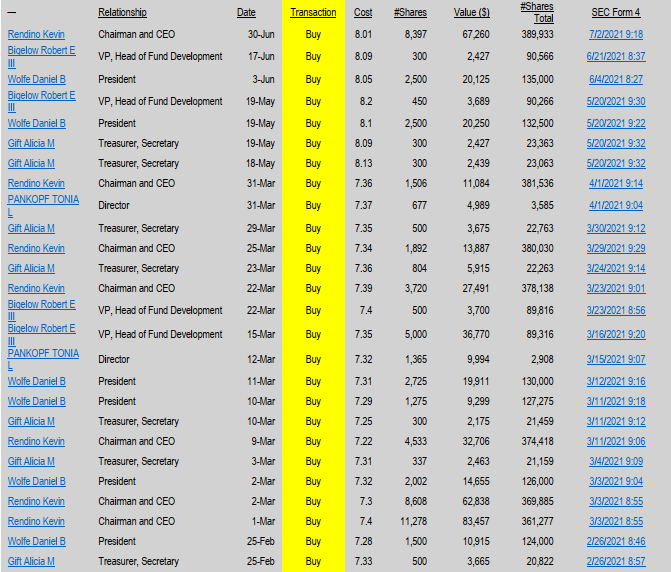

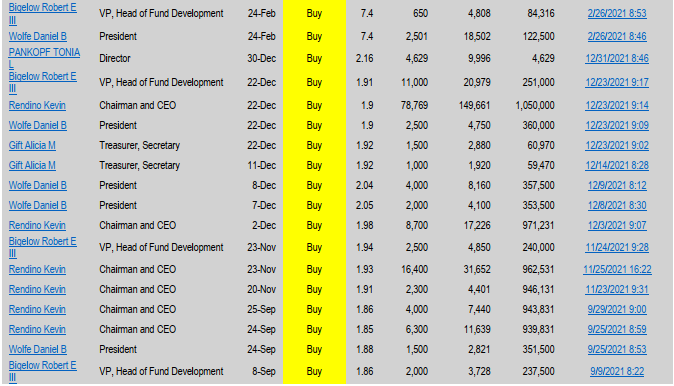

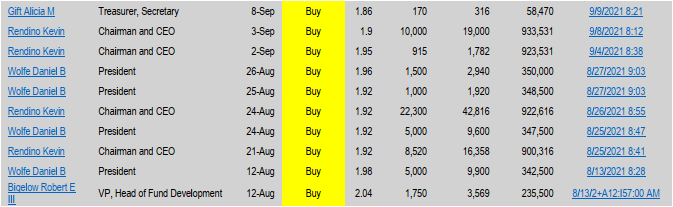

- Strong Insider Buying:

No reason for words. The visual below, speaks for itself. Noted error in the dates from source. They refer to 2020 as 2021 so adapt the timeline.

LOTM Opinion.

TURN is a strong multi-year ownership investment that is boring but performs. Share price weakness can be used to accumulates shares. With the seemingly big buyer involved in the shares at this time, we would also be buyers at this level. We have no price goal or time-line goal as this is a micro-cap investment fund. There is company diversification but asset sector (micro-cap) risk. We have no upside as management is dynamic in growing the NAV through new moneys coming to manage and an activist investor approach in portfolio companies. Certainly, there is market risk, however we see that weakness as opportunity to increase share position through purchasing shares on weakness. This could be a core position for many.

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()