Blog Highlights:

- Falling inflation, Falling interest rates, rising GDP equals rising Bond and Stock markets.

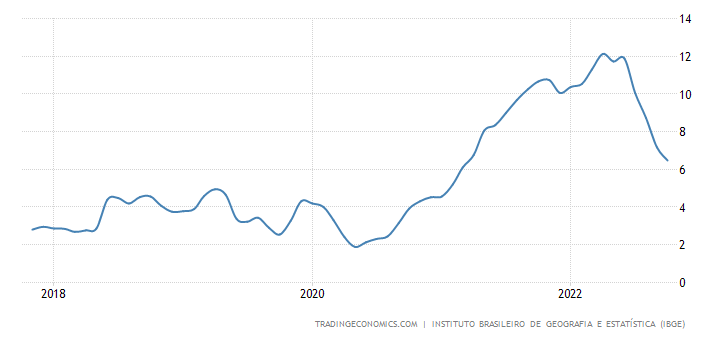

- Inflation Rate – Falling and half of its high water mark.

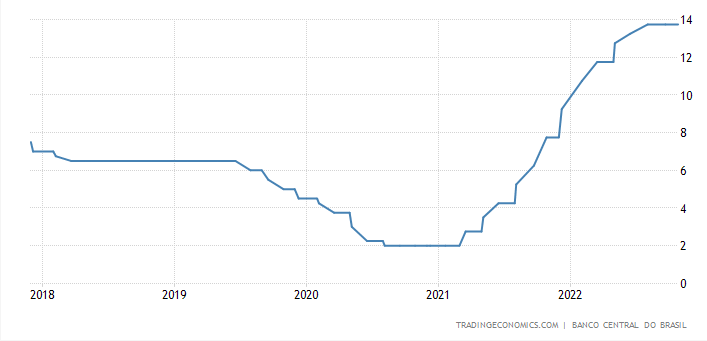

- Interest Rates – Still high but probably heading lower soon.

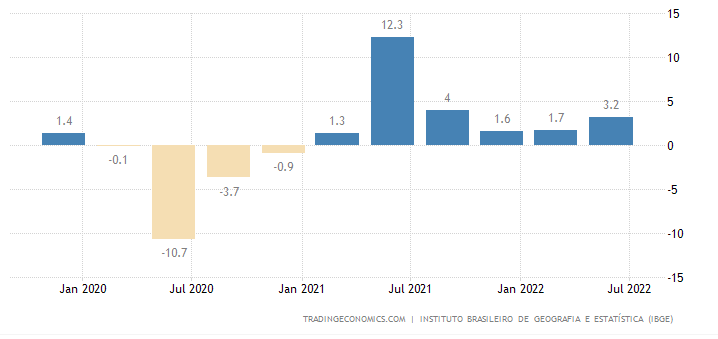

- GDP – Is Rising

Falling inflation, Falling interest rates, rising GDP equals rising Bond and Stock markets.

This is no secret. This formula is as old ad the markets themselves. The issue arises in that the general public is not taught in any classroom as we prepare to enter the working world. Few other than professionals look for the formula and it cause and effect relationship to play out.

Brazil is the best place at this time in history that the formula is playing out.

Brazil led the world in raising interest rates to address its inflation rate, so Brazil is in place to be the global leader in lowering inflation rate, its interest rates and having its GDP and its stock and bond market rise first.

Inflation – Falling to half of its high-water mark.

The annual inflation rate in Brazil eased to 6.47 percent in October of 2022 from 7.17 percent in the prior month, almost in line with market expectations. It was the lowest reading since March 2021, as prices continue to ease for transport (1.55 percent vs. 3.60 percent in August), food & non-alcoholic beverages (11.27 percent vs. 11.71 percent), and housing (1.14 percent vs. 1.84 percent).

Five-year Inflation chart Brazil from TradingEconomics, 11.13.22

Interest Rates: Still high but probably heading lower.

The Central Bank of Brazil decided to keep the Selic rate steady at 13.75% on October 26th, 2022, as widely expected. Brazil’s inflation eased further to 7.71% in September of 2022 from 8.73% in the prior month, marking the first time it fell from double digits in a year. Copom‘s inflation projections stand at 5.8% for 2022, 4.6% for 2023, and 2.8% for 2024. Regarding the Brazilian economy, policymakers noted that it remains resilient while the most recent indicators continued to indicate growth. source: Banco Central do Brazil

Five-year chart of Interest rates – Brazil 11.13.22

GDP – Rising

The Brazilian economy expanded 3.2% year-on-year in the second quarter of 2022, picking up from the 1.7% advance in the previous three-month period and surpassing market forecasts of a 2.8% rise. It was the sixth consecutive quarter of economic expansion, driven by a 5.3% rise in household consumption amid strong growth in real income and higher credit for Brazilian companies.

Three-year chart of GDP – Brazil 11.13.22

Two Brazil ETF’s and Two Brazil Stocks that trade actively in the USA

- StoneCo (STNE)* $11.05 – A leading Fintech company working in payments and lending to small and medium businesses in Brazil. Similar companies in the USA are PayPal (PYPL) and Block (SQ).

- PagSeguro (PAGS) $13.67 – The leading Fintech company working in payments and lending to small and medium businesses in Brazil. Similar companies in the USA are PayPal (PYPL) and Block (SQ).

- EWZ – Brazil iShares Large-cap ETF: $30.64

- EWZS – Brazil iShares Small-cap ETF: $12.80

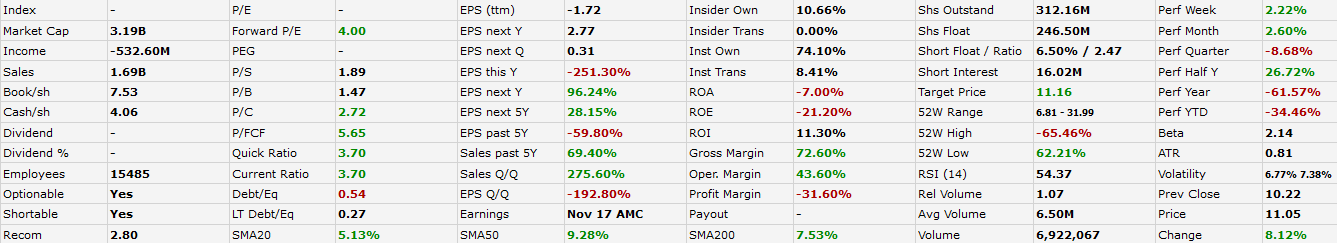

StoneCo (STNE)*

Note

Sales over past five years of 69.4%

Sales Q/Q of 275%

EPS Next year: 96.42% increase

EPS Next 5 years: 28.15% increase

Forward P/E: 4

One-year chart, StoneCo, 11.13.22

Long-term weekly chart, StoneCo 11.13.22

ZACKS, November 10, 2022, Buy Before Earnings: StoneCo provides financial technology solutions to merchants and integrated partners to conduct electronic commerce across in-store, online, and mobile channels in Brazil. STNE distributes its solutions, principally through proprietary Stone Hubs, which offer hyper-local sales and services; and technology and solutions to digital merchants through sales and technical personnel and software vendors, as well as sells solutions to brick-and-mortar and digital merchants through sales team.

STNE has an Earnings ESP of +45.45%. It has an expected earnings growth rate of 66.7% for the current year. STNE is set to release earnings results on Nov 17, after the closing bell.

StoneCo Ltd. (STNE) published October 13, 2022, by Insider Monkey

Price to Sales Ratio as of October 17, 2022: 2.15

Number of Hedge Fund Holders: 30

Industry Average P/S: 3.07

StoneCo Ltd. (STNE) is a financial software technology company that is headquartered in George Town, the Cayman Islands. The company’s services allow its customers to conduct electronic commerce sales.

Warren Buffett’s Berkshire Hathaway owned 10 million StoneCo Ltd. (STNE) shares that were worth $82 million by the end of this year’s second quarter. Insider Monkey’s Q2 2022 survey of 895 hedge funds outlined that 30 had also held a stake in the company.

StoneCo Ltd. (STNE) is Brazil’s largest merchant acquirer, and it is the only non-bank institution in the country that is licensed by the central bank to operate as a merchant payments acquirer. Its price to sales ratio of 2.15 is lower than the industry average of 3.07.

StoneCo Ltd. (STNE)’s largest investor after Mr. Buffett is Nitin Saigal and Dan Jacobs’s Kora Management which owns 4.6 million shares that are worth $35 million.

Artisan Partners mentioned the company in its Q2 2022 investor letter. Here is what the fund said:

StoneCo Ltd. (Stone) today is seen as a payment provider with lower margins than its peers in a structurally difficult environment in Brazil: strong competition, declining take rates, increasing funding costs. The last two quarterly updates indicated improvement in all business lines for Stone and management did forecast further margin increases throughout all of 2022. In contrast to the other payment providers, Stone also has a sizable software business. In addition, Stone is working towards becoming a full-fledged financial services provider. Both endeavors add costs to the P&L, but do not yet add meaningful profits, which is about to change. Particularly the lending business could become bigger and more profitable than the current bread-and-butter payments business. However, the lending business was suspended last year after experiencing issues that resemble those of the early PayPal from more than two decades ago (“X.com” was renamed “PayPal” in 2001)…” (Click here to see the full text)

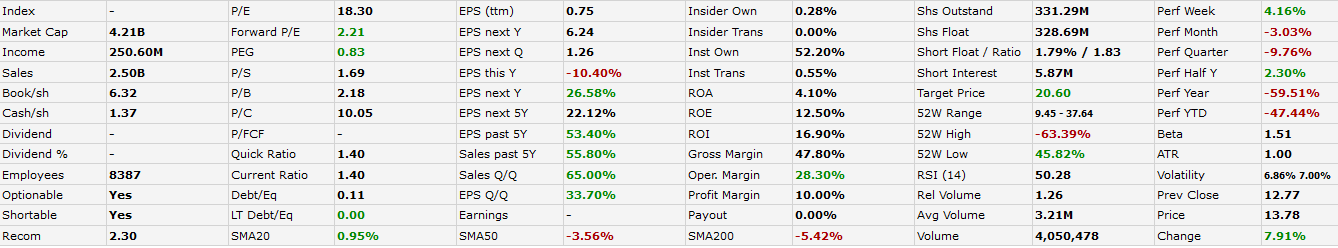

PagSeguro (PAGS)

Note

Sales over past five years of 55.8%

Sales Q/Q of 65%

EPS Next year: 26.58% increase

EPS Next 5 years: 22.12% increase

Forward P/E: 2.21

One-year Chart, PAGS 11.13.22

Five-year Chart, PAGS 11.13.22

EWZ – Brazil iShares Large-cap ETF: $30.64

EWZ and EWZS (links are to Fact Sheets) are our Macro plays in Brazil as an Emerging Market economy. When the US Dollar corrects from its strong rise, we anticipate money to flow out of the US Dollar and US Equities to countries that are commodity exporters. The Brazil Reais is one of two currencies that have outperformed the US Dollar on the dollars strong rise. The other country currency that out-performed the US Dollar is the Mexico peso. Mexico is also a country we are very interested in for investing. Two additional countries we have a strong interest in are Australia and Vietnam.

EWZS – Brazil iShares Small-cap ETF: $12.80

In Summary, we have selected Brazil as a country to invest in as its stats in successfully fighting inflation are more than a step ahead of the United States. As Brazil’s inflation rate continues to adjust downwards, their interest rates will follow inflation downward. StoneCo and PagSeguro are two of the leading growth companies that have corrected sharply over the past two years. They have survived and are far cheaper than their USA counterparties in the USA, PayPal and Block (formerly Square).

In selecting two ETF from Brazil, we present a generalist way to participate in the Brazil stock market recovery. In presenting StoneCo and PagSeguro to you, we have sharpen the investment spear and suggest considering two very rapid growth stocks that could offer a doubling, or more, in price over a two to three year holding period.

Thank you for reading Tom’s LOTM Blog. We welcome you to try subscribing to our free weekly blog or subscribe to our paid subscription for more macro perspective and targeted stock ideas within those macro trends.

Written November 13, 2022, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/. This writing Not yet published

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()