Dorsey Wright Short ETF (DWSH)* $8.77

There is enough technical evidence to suggest we should be preparing for a bear market. Even if we are wrong, consider inverse ETFs as a partial insurance policy to have money if a bear market unfolds more than it has.

At this time market weakness is showing up in the smaller companies as in the Russell 2000 and in the NASDAQ. I have linked the advance / decline (A/D) line for different market sectors for you to see, linked here.

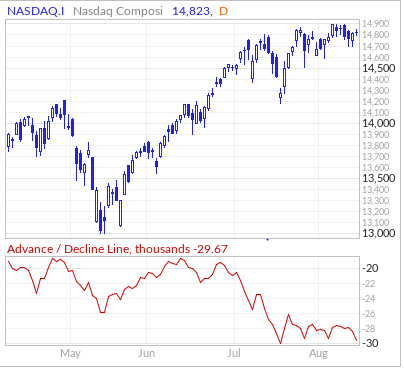

As an example, the index and A/D line for the NASDAQ is below:

The NASDAQ (chart above) is showing a topping pattern, but the A/D line is already well into a decline. Valuations decline from the bottom first. The leaders often follow the majority in bear markets.

We suggest buying Dorsey Wright (already added to the LOTM: Ten Under $10 for the Double list) because it is not an index. It is an actively managed Inverse ETF, selecting stocks the managers think are vulnerable to a decline in price. Therefore, we are not basing our suggestion on market timing but rather weak companies or stocks that could make us money in good times or bad. There is less risk that doing this, than trading based on Market Timing.

- Hedging Investment Tool – DWSH can be implemented as part of a long/short strategy to provide an investor with a “buy and hold” alternative to hedge their long domestically-traded equity exposure.

- Alpha-Seeking Exposure – DWSH’s systematic and selective approach offers the potential opportunity to add alpha to an investment portfolio, especially during a bear market. At certain technical levels during severe market downturns, the strategy can allocate its short exposure more broadly to the domestic equity market – by shorting individual ETFs or futures contracts – seeking to enhance its total return.

- For Manager Diversification – Through an established portfolio manager, spreading your investment risk among equities not correlated to the broader market can help diversify and mitigate your overall portfolio risk. DWSH differs considerably from inverse ETF investment strategies, which are subject to daily resets and blindly sell short the top companies within a market-cap weighted index such as the S&P 500.

- For Strategy Diversification – The systematic portfolio management process seeks to limit unnecessary risk and maximize exposure to the momentum factor. If a security becomes too large as a percentage of the portfolio it is trimmed to bring it back in line with the other security weights. The process also seeks to similarly spread out allocations within its stock model. The objective sell discipline represents an important component of the portfolio construction process.

LOTM is still optimistic on the commodity assets group. Our focus withing the commodity world are Precious Metals, Uranium and Nickel miners and physicals. We are very positive on Blockchain and Crypto related holding. We prefer the platform companies like Galaxy Digital (BRPHF)*, Voyager Digital (VYGVF)* and Mechanical Technology (MKTY)* above the individual crypto coin. We do personally own crypto coins but have a much larger allocation to the platform stocks above.

This is not a notice to sell everything and go short the market notice. This is a buy something that can appreciate in a downward trending market and look in a focused way at might appreciate in a downward drifting market.

We believe we are in a Stagflation environment where growth will become harder to find. We believe Blockchain can buck slowing growth trend. We believe Commodities for be on the receiving end of money flows as money leaves over valued sectors of the market.

Food for thought. I am available on a consulting basis for choices in Strategy, Tactics, Education Coaching or Training. I not going to tell you what to do or buy but will inform you of choices available to meet your goals.

Available for Coaching, Training or Mentorships

Contact LOTM For One-on-One consultations.

Rates are $125 per hour / less for retainer

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()