- Account I – Single stock account. This simply means we might go down to one single stock position on our path to compounding to One Million$ value. Currently the account has four positions. The timeline goal is one double a year for the account.

- Account II – ZTA – Multi-position focused Portfolio Account

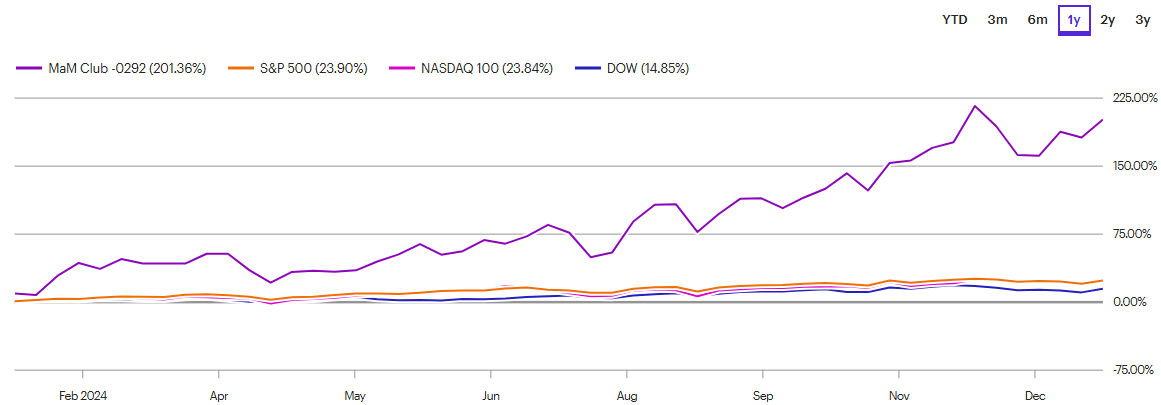

I: Make a Million$ Club (M&M Club)

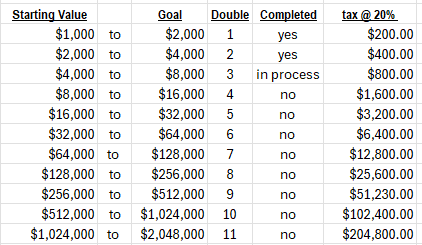

Goal: Achieve 11 doubles, at a rate of one per year to build the account above $1 million dollars after tax.

Starting Date: July 22, 2022

Starting Amount: $1,000 with no money added. For your personal account, contributions to the account will increase the rate of compounding. We are big fans of dollar-cost-averaging – even if trading. Catching a long-term trends is how we go about creating wealth.

Perspective: The mental perspective for this account, the money at risk is what you have contributed. The rest is score keeping in the Game of Doubling. Patrick Ben-David provides the game outline – LOTM provides the ideas for the double. Our LOTM goal is to profile for Companies/Stocks that are in position to double in price within a one year time-line. Getting you to trust the process is one of our goals. Many times we buy when the market has hate, fear or apathy towards our ideas. Ride the trend as long as you can is our by line.

Last 30-day Transactions: None

Performance Chart dated 01/20/24 – last 12-months:

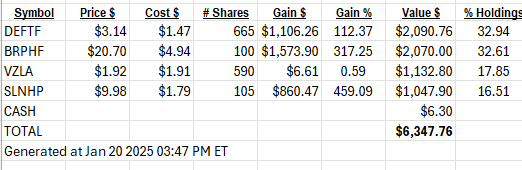

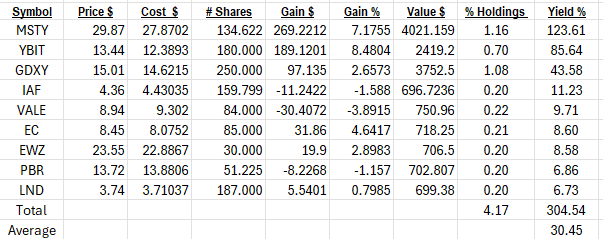

MaM Club Positions as of January 20th, 2025 from July 22, 2022 start-date with $1,000:

We are owed 28 months of back dividends by Soluna 9% Preferred (SLNHP*). This is accumulating at a rate of $0.1875 per share per month. Amount owed in total so far is $551.25. This would be considered an asset of the M&M Club and could be considered an addition to the $6,347.76 value above.

No money added other than original deposit

LOTM looks to catch trends — not short-term trades. Taxes are a cost of doing business.

Two Doubles Down – Nine to go

COMMENT: Piper Sandler selected Galaxy Digital (BRPHF*) as their #1 stock pick for performance in 2025. I believe DeFi Tech (DEFTF*) stock will out-perform Galaxy in 2025. Both have applied for up-lifting to higher level stock exchanges in the USA. DeFi is less well known than Galaxy but more consistent in its profits. This leaves room for discovery.

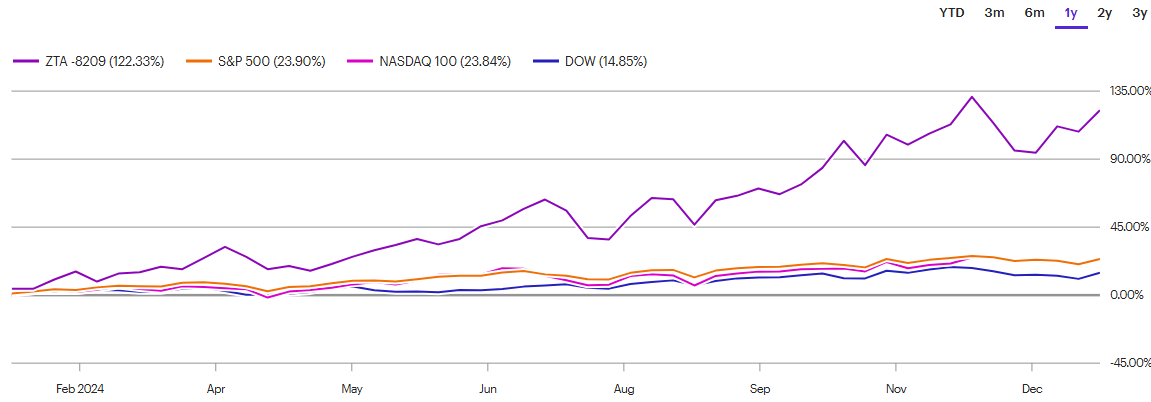

II: January 20th, 2025 ZTA-9981 Performance, Positions

Trailing 12 Month ZTA Performance:

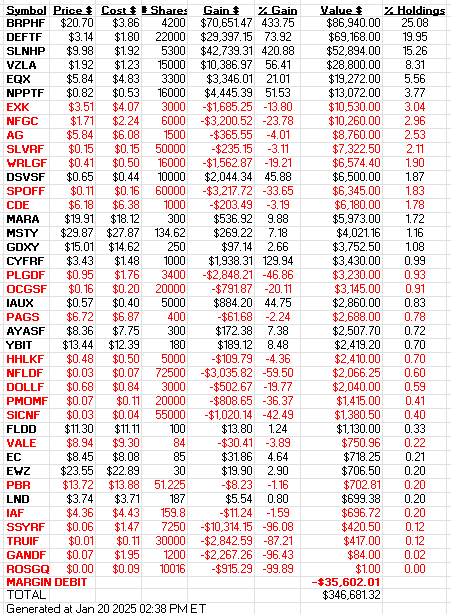

The ZTA portfolio has three themes at this time.

- Precious Metal Miners. This sector is totally out of favor at this time. The miners are trading at historic discounts to the price of the products they sell – Physical Gold, Silver and Copper. 2025 looks like a continued consolidation of the industry with larger companies replacing assets through mergers and acquisitions (M&A) of smaller miners and exploration companies. At some point in 2025, we anticipate the public will catch the awareness and excitement that the industry is too cheap and want to participate in the M&A activity happening within the industry.

- Crypto and blockchain as a transition away from Central Bank controlled Fait currencies for savings and holding value to De-centralized, Network Based, digital (crypto) assets for savings and holding value. Fait currencies will be used for transaction but for savings and asset building de-centralized digital currencies will be the vehicle of choice.

- We are slowly accumulating international position in countries that are trading at deep values and paying dividends that are often higher than the companies’ P/E ratios. To make the re-shoring of manufacturing back to the USA, the US Dollar must be re-valued lower. We believe the US government will take actions that lowers the value Purchasing value) of the US dollar to other currencies. The result will be investment money shifting to the buying of equities priced in other currencies that rise as the result of the US$ falling.

We are showing a lot of red (losses) in the portfolio. The majority are in the gold silver & copper mining sector. We are still very positive about this sector. To some degree, the metal miners are a risk off trade and crypto/blockchain is a risk on trade. These two areas tend to operate like a teeter totter to each other. When they both drop in value at the same time it is usually a liquidity squeeze in the total market and cash needs to be raised from wherever it can be sourced from. I think we’ll do very well with our gold, silver and copper ideas as a whole. We will clean up the smaller position once we are well into the next bull run.

We are continuing to build a dividend paying position in domestic and international positions that we feel are a good value for price. This is dollar cost averaging accumulation phase that will produce appreciation in the share prices in the second half of 2025 (IMO) and into 2026. In the mean time we will collect the dividend and have the dividends reinvested into the companies they came from.

Jan 20th 2025 – Here are the Volatility Harvesting & Falling USD Thematic focused Positions are at this date in the ZTA portfolio:

The first three symbols are our Volatility Harvesting dividend names while the remaining names are international companies based outside the USA. They have a low P/E and a good dividend profile. These later names “could/should” rally when the US$ falls. The US$ will have to fall if Trump is to complete his Make America Great Again program.

Soluna 9% Preferred (SLNHP*) $9.98 our non-paying but owed preferred dividend position.

Back-dividend owed in dollars per share for 28 months: $5.25

The total on 5,300 shares owned over 28 months: $27,825

The back-dividend accumulates at $0.1875 per share per month.

Soluna Preferred is an asset with a hidden value.

ZTA Positions January 20th 2025 Positions:

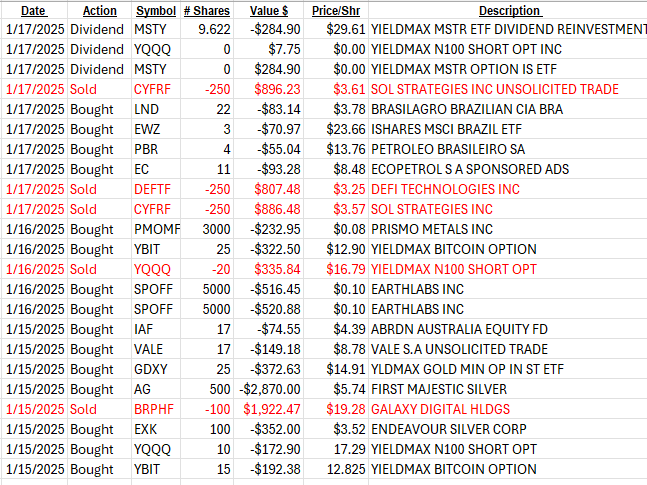

Transactions on Thursday and Friday of last week:

![]()