Originally Sent to LOTM paying subscribers September 16, 2024.

Marathon Digital – Now MARA Holdings (MARA*)

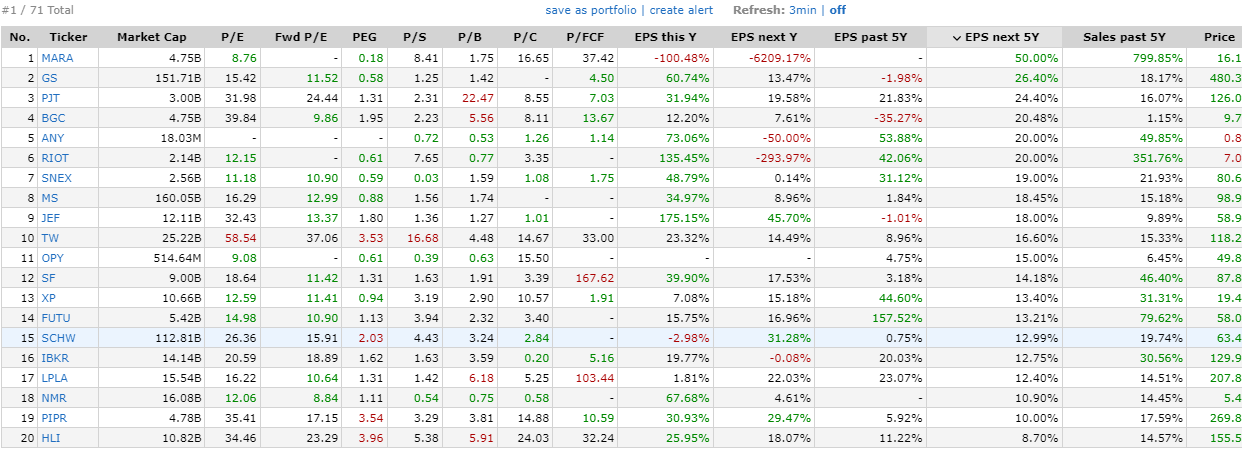

I am surprised to see that FINVIZ places Bitcoin Miners in the Capital Markets group as an asset sector. Included in this group are companies like Morgan Stanley (MS), Goldman Sachs (GS) and Charles Schwab (SCHW). Interesting, yes? One of the screens I like to look at is Future earnings predictions. To be specific, one-year out and five-years out. Checking what FINVIZ repots analysts see in their forward looking opinion of earnings is one source. I noticed that MARA is #1 out of 71 in Capital Market group for a five-year forward view in the column titled EPS Next 5Y.

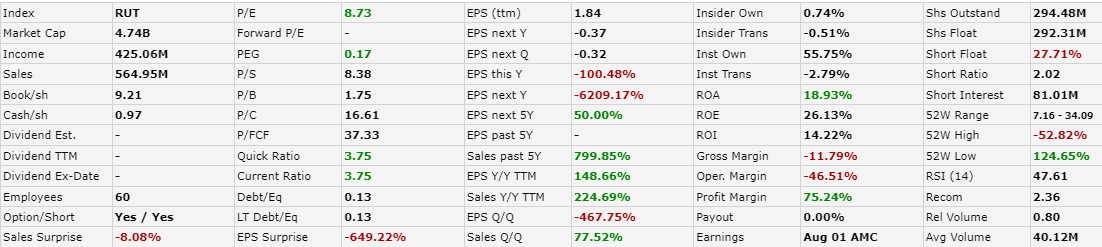

You will notice the Marathon Digital (MARA) has a P/E ratio of 8.76, looking backwards twelve-months. MARA’s forward (FWD) P/E is not posted. Yes, they will ran negative in earnings over the forward twelve-months. That’s because they are investing money in the expansion of alt-energy crypto mining operations and AI Data centers. They have adjusted their model to now include the selling of heat generated from computing operations related to their crypto mining and AI Data Centers. Proceeds from the sale of heat will be used to drop their cost of buying energy for computing. Excess cash from operations is being used to buy and accumulate Bitcoin as a treasury asset. Currently, MARA own $1.5 billion in Bitcoin assets. Therefore, in looking forward, the stock has sold down reflecting current operational financials but is discounted to what might be in a forward two to five-year period (if predictions hold). This perspective is part of the LOTM profiling for stocks whose price can double in one to two-years. When earnings and increasing cash flows become more visible after the capital buildout, the share price often “POPS” very quickly. This fast (in time and price) “pop” makes-up for the time spent buying & holding a good value purchase that might become a long-term capital gain. NOTE that once DeFi Technologies (DEFTF*) and Galaxy Digital (BRPHF*) become listed in the USA exchanges on more visible exchanges, they will also be included in this same Financial Capital Markets Group as MARA.

MARA – Company Stats from Finviz.com (linked)

Chart from StockCharts.com

The long-term weekly chart has formed a weekly cup and handle chart pattern after the decline from the company’s high stock price of $88.44 in late 2021. This is a highly probable chart pattern that more often than not, resolves itself in the upward direction.

We recently sent headlines that Russia and China have changed their regulations to accept Bitcoin and select other crypto currencies as legal within their borders. We believe Bitcoin has the potential to become a Central Bank reserve asset. Raoul Pal mentions this as a central part of his thesis for higher bitcoin prices. Fred Thiel of MARA also talks about this potential as well. Should a Trump admin include Bitcoin as a strategic reserve assets other central banks will follow shortly.

If you believe the price of crypto assets and Bitcoin specially, will rise over time, then crypto assets now in the MARA’s treasury will create an increase in the EPS each quarter they rise. Of course, when those same assets fall in value, it will be reported as an EPS loss. LOTM is a believer that the limited total issuance of Bitcoin (21 million shares) creates a scarcity factor that will drive the price of bitcoin higher with inflation in the same way demand any limited supply kind object increases in value.

Mark Moss in a recent interview, states that for each 10% increase in the supply of money (M-2), gold increases 14.5%. and Bitcoin increases 89.9%. Since the USA has no one to declare bankruptcy to, printing money is the only way out of our financial problem – no matter who is president.

Mark Moss 36 minute interview with Natalie Brunell linked here.

MARA with 27% of its float sold short is potentially a very exciting stock should 1) Bitcoin make a run into year-end 2024 and 2) the shorts panic and buy back their short positions. It could be a lot of fun!

An account related to LOTM has positions in Galaxy Digital (BRPHF*), Marathon Digital – Now MARA Holdings (MARA and DeFi Technologies (DEFTF*) – all mentioned in this article.

![]()