Topics:

- What about a place to hid from the Markets?

- DeFi Technology (DEFTF*) $1.70 – ZACKS raises price target to $4.00.

- Technical comments are negative for Equities from a number of Technicians.

- FORBES: Harris hires anti-crypto team.

- Bank of America upgrades Origin Material (ORGN*) $1.23 from a hold to a buy.

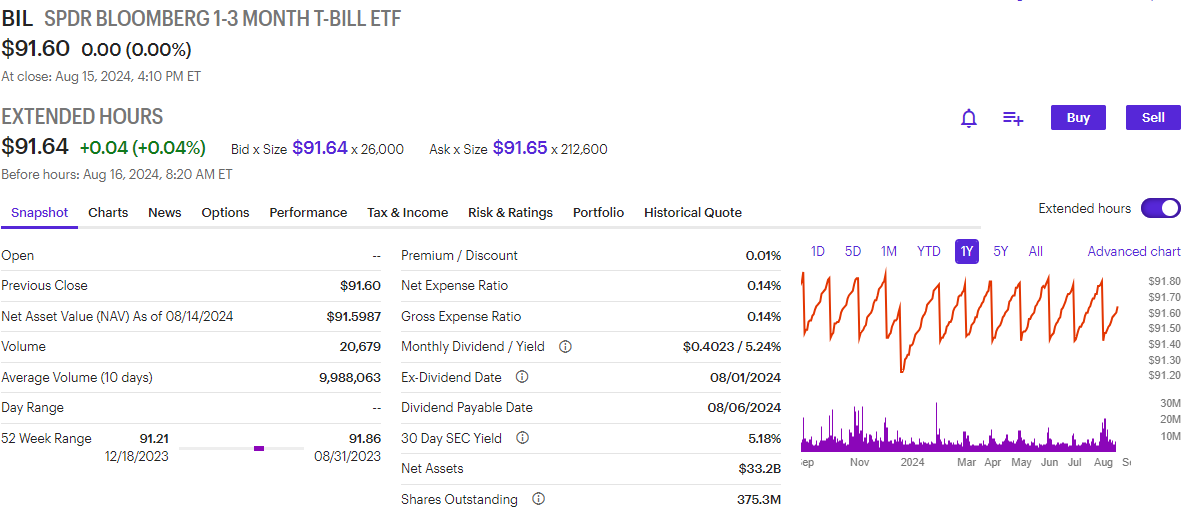

What about a place to hid from the Markets

SPDR Bloomberg 1 to 3 month T-Bill ETF (BIL $91.64

Offers liquid investment at an annual rate, paid monthly of 5.24%. The long term history of the stocks market is between 8% to 10%. BIL is is a good place to have cash or a place to have money and sleep well at night. Obviously when interest rates drop this yield will fall also. Never the less its better than money markets.

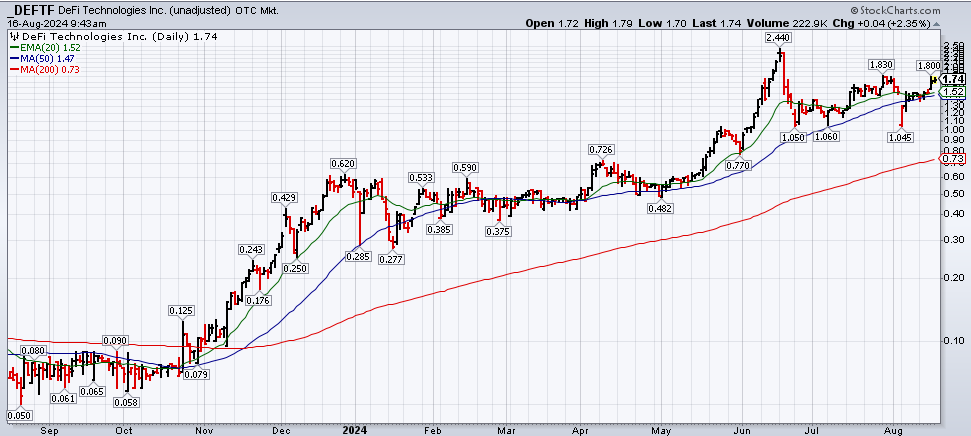

DeFi Technology (DEFTF*) $1.70 – ZACKS raises price target to $4.00.

2Q24 Earnings Review: Blowout Quarter Led by DeFi Alpha;

Raising 2024 EPS Estimate & Price Target to $4.00

After the market closed yesterday (8/14/24), DeFi Technologies (OTC:DEFTF) reported 2Q24 earnings results. On an IFRS basis, DEFTF reported 2Q24 EPS of $0.20, well ahead of our $0.03 estimate. Net income totaled of $66.0 million for the quarter versus our $12.7 million forecast. Relative to our model, the EPS beat was mostly a function of higher DeFi Alpha revenue and lower weighted-average diluted shares outstanding, partially offset by above-forecast operating expenses (mostly trading bonuses).

Our valuation work reinforces our bullishness on the stock. After incorporating a lower discount rate in our DCF model given DEFTF’s improving risk profile, we are raising our price target by $1.00 to $4.00, implying meaningful upside potential from current levels.

A more detailed analysis is presented in the actual press release. It seems to me ZACKS is being conservative in it forward guidance as to earnings. While acknowledging the blowout quarter, they are not predicting follow-up number that repeat. Never the less they have raised their price target. LOTM will give management benefit of the doubt and assume more good news is to come as the expand into new markets and double the number of ETP they offer. The price will react to the prices of crypto so assume a high level of volatility with this company. They do have a share buyback plan in operation as well as buying bitcoin as a treasury asset.

Technical comments are negative for Equities from a number of Technicians.

“Physical Gold is the highest probability investment at this time.” Chris Vermeulen of the TechnicalTraders interview linked here

Vermeulen – is a short term trader and says the market is too uncertain and volatile to trade for him. He is in cash and Physical gold. This is a good interview. While liking physical gold he does not like the gold or solver miners at this time. If the market crashes mining stocks will go down with the rest of the equity market. Following a crash, Vermeulen feel metal mining stocks and physical metals will soar. Overall the interview is concerning and raises our desire to raise cash. The easiest way is to scalp a percent (pick your comfort level number) from all positions. A second way is to sell your weakest positions and wait.

LOTM COMMENT: There are smarter people than me out there, and I respect what they are saying. My perspective is that so many people are in cash waiting for the crash that the market will have short-term up-side blow off to suck everyone in and then crash. Expect a Volatile market for the next two months, a strong year-end rally and rally into Jan Feb of 2025. Then a harder sell off. My hope is more of a controlled rotation into Industrial stock and commodities and a controlled exit from the High Tech sector of the market. A Trump win is bullish for the market. I do not believe the market will do well with a Harris win. The Market will forecast what its believes will happen from the election prior to the November elections.

FORBES: Harris hires anti-crypto team.

Leak Sparks Serious U.S. Crypto Crackdown Fears As The Bitcoin Price Bounces Back

Forbes reports a leaked document has Harris bring along the team that led the anti-crypto policy of Biden/Warren.

Brian Deese, former National Economic Council director, and former deputy director Bharat Ramamurti have also reportedly joined the Harris campaign as advisors.

“Deese and Ramamurti are two key architects of the Biden admin’s anti-crypto crusade, including chokepoint 2.0,” Thorn posted, referring to last year’s attempt by the Biden administration to “quietly” ban bitcoin, ethereum and other cryptocurrencies—a continuation of a 2013 government initiative that sought to cut off undesirable industries from banking services.

Bank of America upgrades Origin Material (ORGN*) $1.23 from a hold to a buy. 8.16.24

Good news for getting the press and sponsorship. That’s all I see at this time. It is important to note that BofA is involved in the raising of money for Origin Materials so while this upgrade is welcomed, BofA is also promoting BofA’s own interest in its Investment Banking department. It is how the system works.

![]()