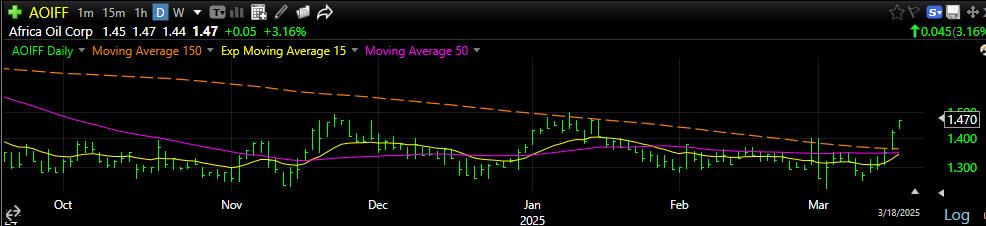

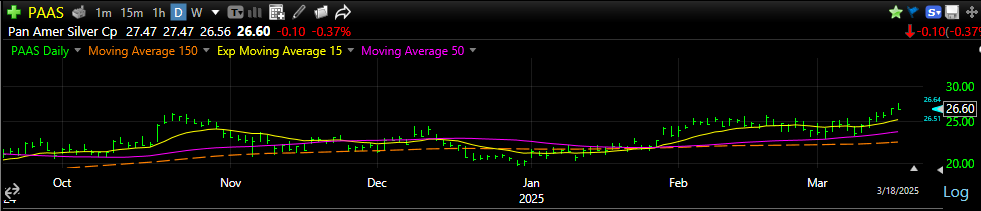

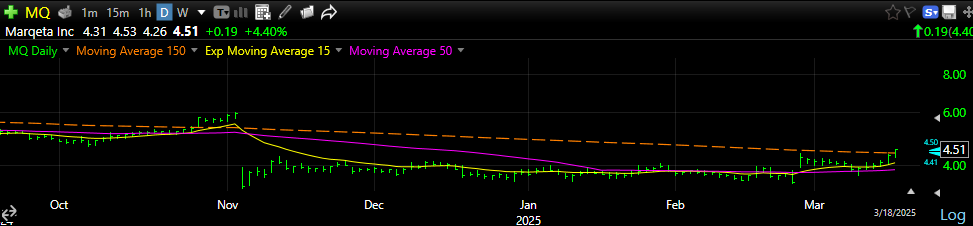

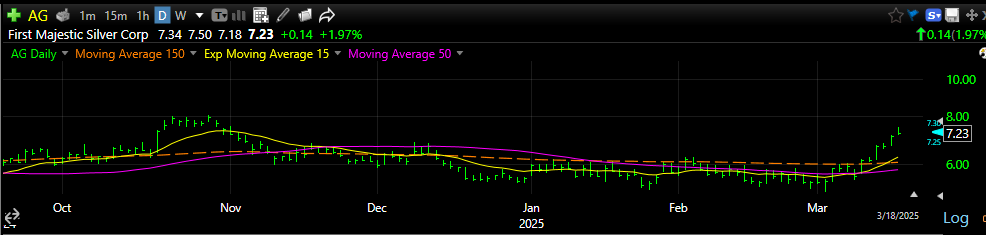

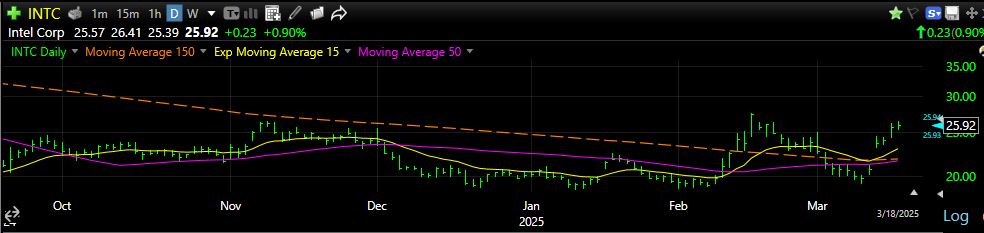

Seven Stocks with Breakouts Moves above Their 150-day MA

A cross section of companies LOTM tracks. Some we trace more closely than others. We have large caps like Intel and tiny higher risk illiquid companies like mining exploration companies – Hot Chili & Silver One.

I left for Vietnam to have some medical work done and just before leaving my computer crashed. I lost my email list until I return and recover the email addresses. If you would like to receive emails between now and April 15th, please send me an email to AccessVietnam.Tom @ gmail.com Close the spaces around the @ sign.

Between now and this October-ish we expect a very volatile stock and crypto market. LOTM is projecting a strong Q4 for 2024 and extending that strength into 2026. Metal Miners stocks are hot. They are also illiquid and not for buying and holding. Three-months to a year is all we project at a time for the “stock” of the miners. Fundamental reasons to buy can be longer term.

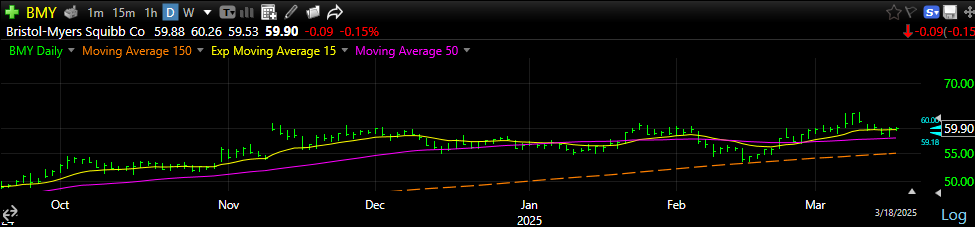

Pharmaceutical stocks look very attractive as deep value. We like Bristol-Meyer (BMY), Pfizer (PFE) and ORGANON & Co (OGN) as nice dividend payers, low P/E and cheap.

- Dollar-cost-average into the positions – no matter the holding period.

- Decide your holding period.

- Know your exit strategy and what your risk management plan is.

Gook Luck. I’ll post online until April 15th.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()