April 19 price action for many of the Biotech and Genomic names in our watch list was strong. We are early in sharing this but want to get you acclimated to a potential opportunity.

LOTM has been watching this group for some time. They fell from a greatly over-valued price for the entire group in February 2021. Now we are about twenty-seven months later. The stocks have been through the stage four chart pattern. They are now in a stage one chart pattern.

We will use Cathie Wood’s ARK Genomic ETF as a measuring stick for the industry below. One reason we targeted the Genomic industry is that they are literally changing the healthcare world. They move great distances in price, up and down. They appear to have been washed out from their drop in price from early 2021. This drop has created our opportunity for the future.

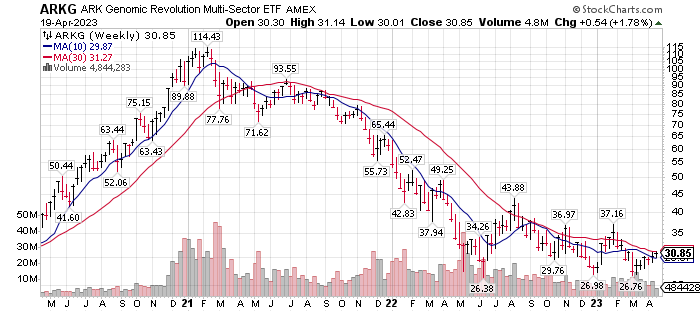

Below is a three-year weekly chart of ARKG, Cathie Wood’s ETF.

It looks like a triple bottom with the three dips below $27. Many would suggest the price to close three to five days above $35, as the break-out from the saucer chart patter to be the start in entering stage two price pattern. I know you like to plan and stalk your target like the hunting cat you are, so I’m sharing this with you a bit early.

If you purchase the ETF now and in increments might be early. Your risk is low in doing this, as you are buying in to a basket of 40 to 50 biotech and genomic companies. Virtually no company risk. Dollar-cost-average monthly or quarterly as funds become available. Study some of the individual companies and their charts for ones you might want to be in as the trend develops. This will give you more volatility and company risk but also the potential for bigger gains. Your knowledge will build of the industry as you watch and do research.

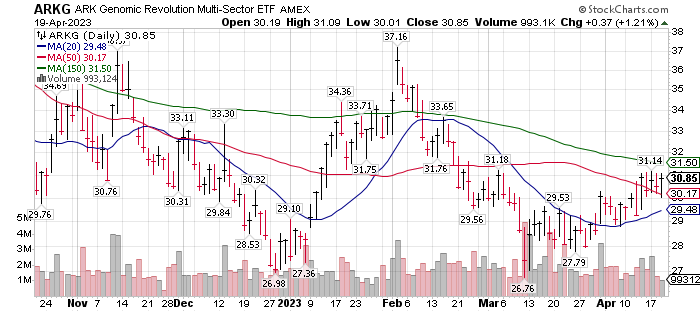

Here is the six-month chart for ARKG:

The share price is above the 20-day and the 50-day moving averages but still chopping in a trading box. In this chart we have a double bottom in place. Incrementally positive steps are the 20-day MA crossing above the 50-day MA and a goal for both shorter-term MA’s crossing above the 150-day MA. Certainly, price holding above the 20-day MA and 50-day MA is important. Price crossing above the 150-day MA is also important in turning an intermediate term rally into a longer term rally.

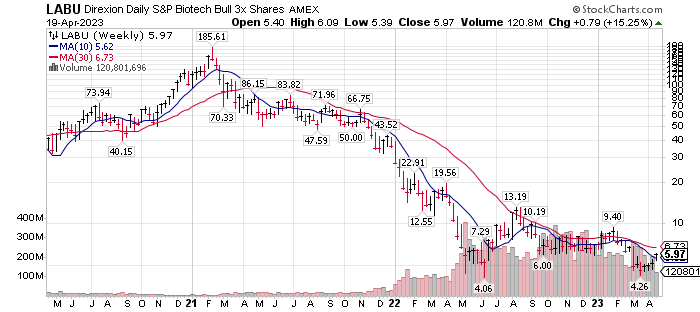

If you are more trader than investor, you might consider LABU in the list above. LABU is a 3X levered trading vehicle. LABU is the Bullish Direxion Daily S&P Biotech ETF.

NOTE!!! This is for nimble traders only. It is volatile and leveraged three fold. A six dollar price can go to one or two very fast.

Three year chart of LABU:

LABU was built for short term trading so be careful. The water is filled with professional sharks looking to separate non-traders from their money.

For Actionable Stock Ideas, consider a subscription to Tom’s LOTM Blog.

LOTM Style – We are more a controlled speculator, than diversified investor or short-term trader. We allow 100% loss/risk on some purchases. Often, we dollar-cost-average into losing positions. Volatility is our friend, not something to be feared. We let our winners win, as much as possible. We do not like paying taxes. We love value, yet watch charts. Our goal is to find value stocks that might double in one to three-years.

See our website for our doubling to a Million$ game. We were playing this game of doubles before Patrick Ben-David talked about it. Ideas in this blog are highly volatile and only for use by those who are comfortable with high-risk, high-reward investments.

Written April , 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()