We have gone four-weeks with our sample-example of why one can buy into year -end tax selling as a regular practice. This is the last data point on this we will publish. Whatever your thoughts on the market, we feel we have shown that buying into tax loss selling periods is a repeatable annual event. Do your tax loss selling early in the season and have cash available for buying into tax loss selling. At LOTM we put this in the category of “Position Management” combined with “Tax Management” of positions and Trading Opportunities.

Purpose:

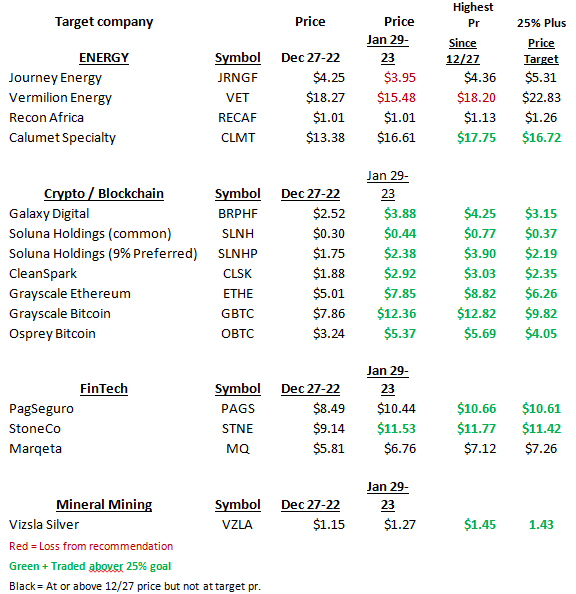

Demonstrate that buying when the majority are tax loss selling is an annual, profitable and repeatable event.

Goal:

Illustrate that 25% plus profit can be made in a 60-day selling target zone.

Trade a grouping of tax loss ideas rather choosing one or two stocks. It is the statical edge presented from tax-loss selling season that you are after, not a rife-shot on one or two names.

Summary:

Of 15 stocks all but two are at or above the starting price. Success rate of 86.7% to date as not losing money.

Of 15 stocks, eleven hit the 25% or higher appreciation level. 73.3% trading, hit the goal, success ratio.

We worked within the arena of our investment themes. Blockchain/Crypto – Energy – FinTech and Precious Metals. We did this to illustrate that we are not doing any “new name” stock selecting. We are working within the universe we worked all year. It is obvious that the industry with the most negative press at the end of 2022, Crypto, is the biggest rebounder in 2023.

Additional factual info that expands the “Hunting Season” for trading tax-loss dumped stocks:

Individual investors are working with December 31 year-end date for the end of Tax-loss selling period. Mutual Funds have an October 31 of each year, fiscal year-end date. Therefore, we have two periods where we can “go hunting” for tax-loss selling ideas.

Conclusions:

- A money management tactic might be to auto-sell 50% of a position, at the 25% profit mark and let the remaining amount ride. Stop out with a trailing stop-loss. Apply your own preferences.

- Buy into the opportunity from others selling in October, November or December and you do your own tax loss selling in January, February or March. It takes a bit more planning but can generate additional cash returns.

We hope you find this of practical interest. It is the same as shopping at a fire-sale or a clean-out house, summer garage sale. The more you understand your companies, the higher the probability of working this strategy. This also works with ETFs. Not as good as with Mutual funds as mutual funds sell and actually buy the higher price of the best performing stocks. This is called window dressing and is done so fund managers look better than they actually are. This is counter to being in your best interest.

Summary:

Buying Tax-loss stocks can be a annual, predictable and rewarding activity. Take advantage of what the market gives you.

Accounts related to LOTM holds positions in GBTC, ETHE, SLNH, SLNHP, CLMT VET, PAGS, STNE, VZLA, BRPHF.

For More Actionable stock ideas, consider a subscription to Tom’s LOTM Blog.

- Think of the Market as a Great White Shark and Emotion as the Blood in the Water – Garath Soloway

Written January 29, 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

Available for Training, Education or consulting.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()