Buy, Sell & Hold comments on positions above, are reserved for Paying members.

It’s been a tough market.

A couple of observations.

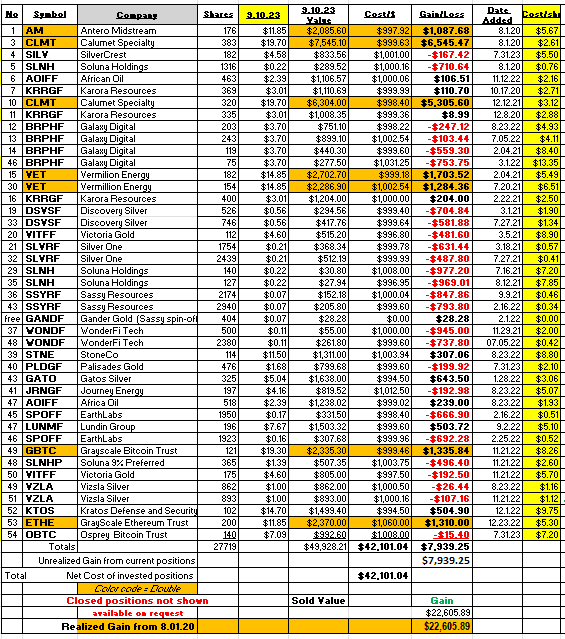

- Our starting date was August 2020.

- Over-all, we are profitable in our Realized and Unrealized activity. We are down a lot from our highwater marks, but profitable, never the less. More on that below in point number 4.

- We have a cluster of losses with our purchases between March 2021 and August 2022. This was the down draft (bear market) period. Since August 2022, we have been more selective in our buys. We even have a couple of doubles since August of 2022 and a 50% gainer. Lesson – be very selective whe buying in market down-trends.

- One stock, allowed to run, can make a difference in your return. Calumet, above, is that position for us. Vermilion is a second, better than average performer. This is the dirty secret of portfolio returns. Many times, a positive or outstanding return, is because of one or perhaps a few stocks. In the NASDAQ 100 and S&P 500, you have heard many times, the positive readings for these indices in recent years, are from seven stocks. Let your winners continue to win as much as you can.

- Our money management process is to not use stop losses. Many of our position are illiquid – on purpose. If we are right, we can find 2X to 10X ideas. Our max loss tolerance is 100% of investment. Therefore, we try very hard to buy companies that have some feature that make them worth more dead than alive. We are not always right. The point is this. Have a money management plan even though it might sound crazy to others. Our core money management process at work here, is to limit our over-all losses, even if that allows 100% in each position. In doing this, we fight to have some balance in the dollars or percentage held in each position. Ten to twenty position is best. Enough for balance but not so many that we cannot follow them. We are human, so we do take the freedom to over-weight some positions. If you allow 100% loss you must have a goal of allowing your winners to win. Minimum goal is 3X our cost for each position. Your winners must be allowed to gain 3X what you are willing to lose. In our case we are allowing 100% loss so we must find some 3X gainers of more to cover our losers.

We are over-weight in commodities, gold and silver especially. We love Oil & Gas at this time. We believe in Bitcoin, officially a commodity.

Sector concentration in precious metals is hurting us – today. We strongly believe in precious metals. The Junior minors are at historically low valuation when compared to the physical metals. Big miners are cheap as well.

There is good reason the juniors are cheap. Inflation is high so the cost of energy and labor is high. Juniors are always raising money because they have expenses and no revenue. Outside of the industry players, few want to be involved in junior miners, if there is no price momentum upwards. Hence, junior miners tend to be low on cash at this time, it is hard to raise money from retail investors and the explorers have no revenue. It has set up a feeling with in the industry of Death Warmed Over. LOTM happens to believe many junior mining companies are now worth more dead than alive. By this we mean the Value of the company is greater than the market cap retail investors are willing to pay.

There are criteria that larger miners look for when buying junior miners. Not all Junior miners will be bought out. Two important criteria are 1) large land packages with 2) higher than normal mineral concentrations. We like the Junior miners at this time. This is the area from which 5X to 20X winners will come from.

The industry has a history of exploding in price out of no-where. In a six-month period, the gains can easily be in the 3X to 6X range. Look to the December 2015 to June 2016 period as a real example of this price action. We feel we are in such a set up again. There are Juniors we have come to like better than some on this list.

Regular readers behind our pay wall, have heard our thoughts on some of these names.

Part of our over-all risk management policy is dollar-cost-averaging with the same amount of money as our original investment. Hence our use of $1,000 increments used above. We will average lower with the goal of selling enough of the higher cost losing shares once the stock price rebounds above our average cost. This allows us to sell at a profit to our position’s average cost, while taking a tax loss on our higher cost shares. This process of not actually losing money on our average cost, also drops our average cost even lower. The example in this portfolio is our activity with Gatos Silver. Our average cost was about $10. In two days, the price dropped to below $3.00 on a negative headline that was limited to just that, negative words. The “company” was in good to excellent shape, so we bought more in an equal dollar amount to what we originally bought. When the share price rallied above our average cost of $5.00, we sold the $10 cost share for the loss while getting a profit on our average over-all cost of the shares. We took an over all small profit but reported a tax loss. This dropped our average cost of the remaining, larger than the original share position, even lower, as seen above. . Check the chart to see a visual on this linked here.

A learning point from this:

Know your company. We dollar-cost averaged on the drop in January 2021 and sold the higher cost shares in April of 2022. If you know and understand your company, a bad situation can actually be a great opportunity. If you buy or sell without knowing your company, you could still make money, but it leans into being more of a gambling situation.

We have comments on many of the individual positions still held, but these comments reserved for Paying subscribers.

Consider a one month subscription as a “look see.” We will make additions with new Under $10 positions in the coming weeks. This is Tax loss selling season for institutions. Many “babies are thrown out with the bathwater” (sold) where the “Stock” price is down, but the “Company” is fine. As the fisherman’s saying goes, ninety percent to the water contains no fish, so fish where the fish are. If you want to find good to great values in the market, buy when the majority are selling. We are more a value buyer than momentum buyer so buying into other’s tax loss selling makes sense to us. It fits our personality.

A second learning point is this: Tax management and position management increases the probability of success and are more rewarding than buying and selling a position in and of itself.

Give LOTM a one month try. We are volatile and more a speculator than investor, but there is a system at play. You can stop at any time.

For Actionable Stock Ideas, consider a subscription to Tom’s LOTM Blog.

LOTM Style – We are more a controlled speculator, than diversified investor or short-term trader. We allow 100% loss/risk on some purchases. Often, we dollar-cost-average into losing positions. Volatility is our friend, not something to be feared. We let our winners win, as much as possible. We do not like paying taxes. We love value, yet watch charts. Our goal is to find value stocks that might double in one to three-years.

See our website for our doubling to a Million$ game. We were playing this game of doubles before Patrick Ben-David talked about it. Ideas in this blog are highly volatile and only for use by those who are comfortable with high-risk, high-reward investments.

Written April , 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()