There has been a change, though subtle, with money flowing into gold, silver and short-term treasuries. This is typically a defensive maneuver by Institutional Investors to lighten up on risk-on positions and move some funds to risk-off positions.

My coming to this conclusion isn’t universally accepted but LOTM has long had a Risk-off attitude with a 30% to 40% position in precious metals. It is where the value is in this market if you look at cash flows. Nat Gas is also a high cash flow risk off position in October / November 2020. It is still a high cash flow generating sector though not nearly as inexpensive as it was a year ago. We have risk-on positions in Blockchain and Crypto.

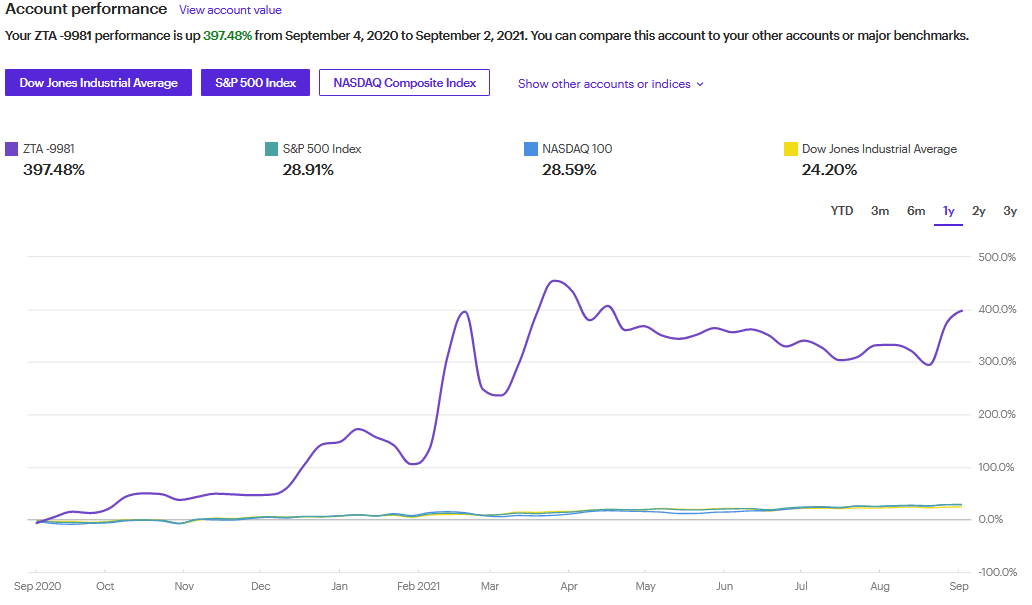

ZTA partnership is monrey I managed. You can see in the performance chart below, that our focused theme of Blockchain & Commodity only, has been successful.

Too successful perhaps. The thought has been running through my head: “How do I beat this?” Haha. We can only try.

We are staying with the Blockchain / Commodity theme because we still see the best values in Commodities and the fastest growth in Blockchain.

The shift we are seeing, for whatever the reason, into Gold and to short-term treasuries looks like this in charts below:

For gold we are using PHYS the Sprott Physical Gold Trust and for short term treasuries we are using IEI, the ETF for 3 to 7 Year treasuries.

You can see the lows of March April 2021 in Physical Gold and we now in an early rally phase. We believe this is related to Institutional Investors adding Gold as a risk-off trade from the market.

A near identical chart pattern can be seen in IEI, The Barclay’s 3-7 Year treasury Bond Fund.

One could assume, with 5 year treasuries’ rate at 0.78%, money isn’t flowing into this bond position for the interest rate. Lets say it is a parking place while the next few months tell us what is happening in the stock market.

Be careful with broad market exposure. Gold and Silver miners are having a great price performance week. Obviously Blockchain & Crypto is having a joyous party but that is not a risk-off trade.

Consider some inverse ETFs for a hedge. Insurance costs money. If you lose money on inverse ETFs, chances are you are making money on your long stock positions. The greatest benefit of owning Inverse ETFs is that at a market bottom you have something to sell that produces money for adding shares to your core holdings.

I am available to talk by appointment, if you would like to discuss strategy or tactics. I am not going to tell you what to do but rather provide or discuss various risk/reward paths open to you. It is better to talk now, rather than later if you get into a rehabbing your holdings situation.

Available for Coaching, Training or Mentorships

Contact LOTM For One-on-One consultations.

Rate: $150 per hour / Monthly Retainer, Lowers Rate

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()