Are you up for the Double your Money Challenge?

It is that time of the year to be looking into the crystal ball for next year. Well, maybe a bit early, but we have an election coming in six weeks and a lot can change from November 3rd forward. We’ll take on that task with the picks below and why we think they will be winners no matter who wins the Presidency.

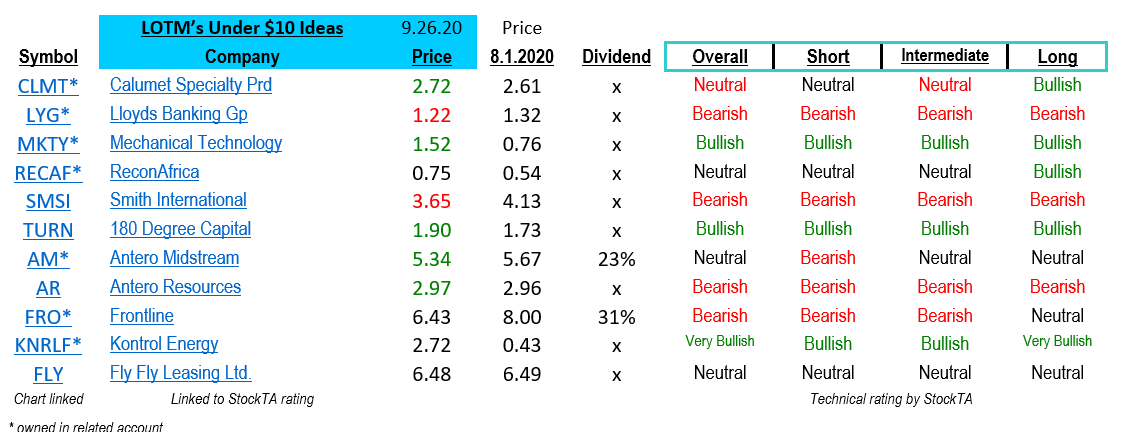

- Here they are:

Download PDF

This is a head start to our Week update. Each day we will post on LivingOffTheMarket.com web site, two summary comments on the companies above.

Summary comments will include:

- a brief description of the opportunity each company offers, longer-term

- Why we think they are a good fundamental value

- Catalysts as to why we think these are timely on a calendar basis

- Technically how we would approach accumulating the shares,

- What risk management approach we will use in situation.

Keep in mind there could be a major shift in Government policy that starts in 2021. We believe the uncertainty of a which party, Democrat or Republican, will be built into the price as we approach November 3rd elections. Therefore, “knowing” who is running the show will bring a rally, no matter who the Show Runner is. We include fossil fuel-based companies in that statement as well. We recognize the shift in incentives and restrictions that could happen, whatever that reality, it takes time. The transition from fossil fuels to all green will require time. That time period is measured in decades, not in presidential cycles. Also remember this is not “about us/U.S.”, since the world’s energy needs are based in fossil fuels. If the shift to alt / green happens too fast, there will be Yellow Vest protests that slow things down.

- The grid above links the Company Name to StockTA.com, a web site that updates daily the technical opinion of each stock. You might consider saving this grid with it links or referring back to our LOTM web site to track the technical opinion of each stock.

- Risk Management policy: We recommend no stop loss prices except / accept 100% of each individual position. In other words, the company goes bankrupt and to zero value. We don’t think that will happen but if you invest equal funds in each name you have 10% exposure to each company. If one or two were to go to zero by Dec 31, 2021 so be it. We accept that. Mainly because it is unlikely. On the other hand, do not sell your winners either. Let them run free. From this list of ten there will be some doubles or more that make up for any that go to zero. Should we see a foreseeable negative situation at an individual company we will adjust. If a stock rallies to much, too fast we will also adjust.

- Timeline: This “project”, should you accept the challenge of participating, is a fifteen-month project starting from today and ending December 31, 2021.

- The goal is to earn 100% on the overall portfolio holdings, in that timeline.

- We suggest you initiate positions with no more that 30% of intended capital for this project, equally divided between each holding. Decide now what amount you will commit to this program. Your personal adjustments to dollar amounts and which positions if not all are your choice if course. We are sharing our baseline and suggested risk management policy.

Some company stocks are very illiquid. Companies like MKTY, RECAF, SMSI, TURN and KNRLF are especially illiquid. Buy slowly on weakness to build your position. ALWAYS use limit orders when buying.

You can work this with small amounts of money ($50.00 per position works) or more significant dollars. If you work this with say, more than $20,000 think about the Liquidity factor. ALWAYS use limit orders when buying.

Of note for this program, we don’t care about what the market does. A sell off in the market is an opportunity to accumulate more shares at lower prices. This is not a trading program but limited time period investment approach. We believe there are catalysts present in each company that will play out in the next fifteen months to justify a position.

CORE Strategy.

15-month Goal is to double the value of the portfolio

Dollar cost average into the portfolio with at least three different purchases for each company, especially on weakness. Think investment, not a trade with a stop loss cut price.

Equal money in each position

No stop loss except 100% of each company investment – should they go out of business!

We will rebalance the portfolio once or twice during the 15-month holding period. More likely in the first six months than the final nine months. Probable dates are in early January and early April.

Wrapping up the Program: November & December 2021. At year-end, we will evaluate and recommend a new group for 2022.

Are you up for the Double your Money Challenge? Welcome aboard if you are!

The Challenge? – Pick Ten stocks and challenge Our Ten for best return by December 31, 2021. Ready… Set… Go!

The first two company summaries will be posted on LivingOffTheMarket.com prior to the market opening Monday. The ten company summaries will be in no particular order but all ten will be completed by Friday October 2, 2020.

Where Value meets Buy Signals

LOTM is a free newsletter. Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security. These Investments are bought and sold constantly.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()