There’s a lot going on in the market.

New trends beginning,

Current trends topping,

Asset rotation,

Bitcoin: A New Asset Class being funded.

Heightened Risks, New opportunities. Today I’d like to share things to watch out for positive and negative outcomes.

Outline: The LOTM approach is as a Position Trader. We tend to build core positions and trade around those core positions. As such we look at the company and value first – not always but for the most part. While we work on timing through technical analysis and stage analysis, we tend to be early. Most of the time we get it right, but we do enter stock positions at what we think are points of a trade that reflect good value in the company.

Please note that we make a difference between Company and stock. They are different. So, Company first and stock second.

Theme: You cannot make a plan less you have a theme.

Here is what we think is going on.

We are transiting towards a commodity super cycle. The world has underinvested in discovery and production of minerals over the last ten years. Demand for minerals to go electric is exceeding supply. Supply will take four to six years to come on-stream in a claim that already has been discovered and mapped. The process of getting to production extends from discover, permitting, building the infrastructure to opening the mine. This easily could take ten to fifteen years. To go electric, we have to re-build the grid system. This Takes time, money and minerals. Iron ore, copper, lithium, silver, nickel & zinc. We are under producing Vs demand right now.

Add to this is the fact that we are in a global war “mode.” Granted it is in the proxy war stage, but wars consume natural resources. I am opposed to all war. I have been in the Vietnam American conflict in the 1970-‘72 period. I have lived in Vietnam for long-periods between 2007 and 2020. War is horrible. War is Inflationary.

- Inflation will remain high and companies that do not grow revenue faster than inflation will struggle. Expanding profit margins matter since financing will be expensive and companies need access to cash. Self-financing through Cashflows and Profits are the best way to grow a company and invest. Miners and Oil & Gas operations generate cash flows. Prices for gold and silver, Oil and gas will rise. Oil & Gas is in an oversupply at the moment, but by 2026 they will be in short-supply – the exception is if oil supply routes are blocked through conflict. Then Oil will double in price very quickly.

Reshoring and near-shoring from China. Building new manufacturing plants in North America require minerals, energy, labor and electricity. It is inflationary. Here are five countries to consider.

Mexico is flourishing. Brazil, Indonesia, Viet Nam and India are new growth centers with young populations and lower cost labor. Get some property or equity invested outside the USA if you can. There is ample opportunity overseas.

- Industries to consider that are deflationary, increase productivity and growing faster than inflation.

These Industries are “emerging,” are rapid growth but that will rise and fall in stock price cycles. Some like Genomics/Biotech are attractive far off their 2021 highs but still weak. Look for cycle lows Stage 1 chart patterns to buy.

- Robotics

- Artificial Intelligence (AI)

- Genomics & Biotech

- 3-D Printing

- Fintech / Crypto / Blockchain / NFT’s is a favorite area for me as I understand finance better than I understand Genetics and Bio and the others.

Timing and Technicals:

This is tough because each of us have emotion and financial requirements different from So that is “a” major Theme to build around. Theme is the long-term framework to work backwards from. Risk management on a long-term time frame might be dollar-cost-averaging (DCA).

Decide a core position sell some on rallies for profit and add back more on weakness. DCA. Some of us are wired for all in or all out. Build your trading model. To match your strengths and how you operate. The beauty of the market is knowing yourself and creating a business model that is unique to you. If it doesn’t work, refine adapt and change until it does work. This might be where a coach or mentor comes into your world. Computerized trading is best for very short term trading. Swing Trading is three to five day trades. Other time-lines trades might be two to four months or six to nine months or nine to eighteen months. Decide if you want long-term gains or are you using a tax deferred account and shorter trades are not taxed? Uncle Sam (or Joe) is always your partner.

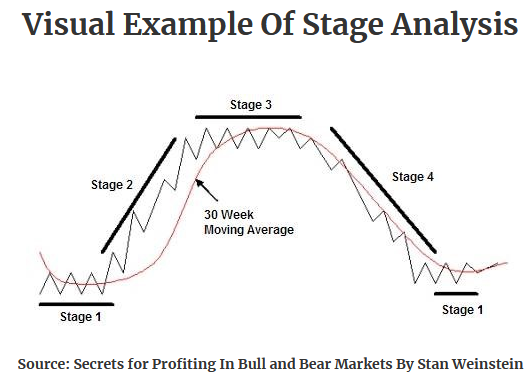

Topping Industries on a six month to eighteen month time-line might be AI, Semi-conductors, Uranium, Magnificent Seven. Stage three topping chart pattern and some like Apple (APPL) and Tesla (TSLA) are in stage four declines.

Purchasing power of the US Dollar is in a stage four decline. Hence the move to physical gold by Central Banks around the world. This is also a result of reshoring back to North America, Money printing policies of the USA (and many governments,) lack to trust in the US Government as a result of tariffs and asset confiscation related to the Ukraine War, and the never ending war policy of the US government.

New stage two chart pattern industry and rising rapidly is crypto and blockchain. Perhaps another twelve months to run is suggested. Pull-backs will be sharp and sudden. One can focus on the Bitcoin spot ETFs or direct investment in crypto or companies that are engaged with crypto and blockchain in some way. Two of our favorites are Galaxy Digital (BRPHF*) and Marathon (MARA).

Stage one basing chart patterns can be found in Physical gold and silver. True physical Gold is breaking out to new all-time high prices, but this is after a consolidation period from August 2020 until December 2023. Gold and silver miners are lagging Physical gold and silver and are at historic discounts to the physical metal they get for profits. Crazy right? The product thy mine and sell is high so profit margins will expand yet the companies them selves are cheap historically. Any one see an opportunity here?

Also, in stage one or early stage two charts are Country finds. Stock markets that are cheaper on a valuation basis in over-seas markets are attracting money that is exiting the USA. Chief among countries as “receiving destinations,” are Japan, Brazil, India, Vietnam and Indonesia.

Work your Timing strategy or pick your core DCA positions. It is going to be a volatile, exhilarating, stomach wrenching to hopefully profitable next few years. I am excited!

Some thoughts & comments I have found around the web of interest:

Dr. Charles Nenner One of the best for market timing with cycle studies and trading. Totally factual and non-emotional in his comments based on his studies, beliefs and actions. One of the best.

- We are in War mode – The West May Not Survive – Cycle studies suggest the market is topping, – Gold and silver will lead the way out of the next decline. Video Link – 24 minutes

Michael Oliver Momentum based technical Commodity analyst. Practical, not a gold bug as he covers all commodities. Gold Stocks Bottoming, Uranium Looks Like NVDA, Lithium Won’t Explode | Video linked here. An hour long but very informative.

Chris Vermeulen, The Technical Trader.com, web site link.

- Short-term technical chart opinion on Market, Gold & Silver 24 minutes Video linked here.

Mark Cuban on why he would choose Bitcoin over Gold every day of the week. 14 minutes video linked here.

Mark Yusko excerpt recorded by Everyday Finance.

- Fair value of Bitcoin is $52,000 but will double because of the Bitcoin Halving – Mark Yusko. Yusko is looking forward one year and feels Bitcoin can triple by April 2025.

Bitcoin’s biggest run coming, and no one is talking about it – 14 minutes video linked here.

Many of us own Galaxy Digital (BRPHF*) $9.87.

- I am a cheerleader for Galaxy Digital, so assume it for what it is. Mike Novogratz discusses his view on Bitcoin, Ethereum and what he feel is the next big catalyst for crypto. This is more a presentation of Mike Novogratz as CEO founder of Galaxy and meet the management of Galaxy more than a promotion of Bitcoin. It is Novogratz pitch for Bitcoin never the less. Video Linked here 12.30 minutes. Personal Disclosure: Galaxy Digital is how I personally have chosen to participate the strongest in the Crypto/.Blockchain eco-system.

Written March 10, by Tom Linzmeier

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog LivingOffTheMarket.com

![]()