July 6,2020 Tom Linzmeier Editor

Mechanical Tech (MKTY) has created a new subsidiary called EcoChain. EcoChain will focus on Crypto Mining and Blockchain applications. They are invested in and consulted by a private company, Soluna.

So, who is Soluna?

Soluna has it all – All the buzz words –

Alternative Energy – 100% Data Center Cryptocurrency Blockchain

That is right. Soluna is the world’s first 100% alt-energy powered data center for mining cryptocurrency utilizing the power of blockchain. Forty (40) percent of the cost in Cryptocurrency mining and blockchain applications are the cost of electricity. Soluna’s data center has been created to be the low cost electricity provider for Crypto Mining and Blockchain app development and project work.

Soluna combines a utility-scale 900 MW renewable wind farm in Morocco, with its privately owned, co-located, high-density computing facilities to support and foster next-generation blockchain based technology in Crypto-mining – Artificial Intelligence – Video Rendering – Machine Learning. These technologies are energy gobbling vultures. The goal of Soluna is to be a magnet for attracting the newest technologies to their low energy cost data center for creating innovation solutions in blockchain applications and cryptocurrency mining.

Soluna is still a private company.

White Paper download about Soluna

Website: https://www.soluna.io/

Mechanical Technical (MKTY) $0.70

MKTY Website with news stories linked here.

The link between MKTY and Soluna is stronger than it appears with a casual glance of headlines.

- Starting in January 2020 Mechanical Technology formed a 100% owned subsidiary, EcoChain, for the purpose of cryptocurrency mining and developing cutting edge Blockchain applications. Soluna was retained as advisor to MKTY with compensation fee plus performance. MKTY made an investment of $500,000 in a preferred A shares of Soluna with and additional $250,000 Preferred share purchase if certain milestones were achieved.

- Of note, is that Brookstone Partners owns 37% of Mechanical Technology. Two partners at Brookstone are board members at MKTY: Michael Toporek and Mathew Lipman. Michael Toporek is on the board of Soluna – the Chairman of the Board. Matthew Lipman is also on the Board of Soluna. Soluna is a portfolio company of Brookston Partners as is Mechanical Tech. How much ownership of Soluna, Brookstone owns, is not disclosed.

- There is a YouTube, presentation concerning the recent MKTY activity at this link.

In the conference call, commitments were made that there will be future PR related announcements and perhaps events. This will give MKTY positive exposure to a new audience of investors. That is, investors interested in Blockchain and Crypto miners. New investors in a company with an 8.5 million share float are very welcomed! Supply and demand – limited supply of available shares as sellers dry up (assuming positive results of these actions) and an increase in demand for the shares. MKTY also committed to build a web site monitoring the creation of cryptocurrencies and MKTY’s sale. These are public announcements, specifically related to the new subsidiary EcoChain. MKTY mentioned selling the cryptocurrencies, was a way for MKTY to utilize their $50 million in tax loss carry forward. MKTY/EcoChain will not retain and collect cryptocurrency but sell as soon as they can to realize the profit from the mining (creation of the cryptocurrency).

- Also, of note is the unusual action of MKTY announcing they were going to apply to have their shares listed to trade on a more visible NASDAQ exchange. Unusual, because they requested about three years ago to be dropped from that same exchange and be traded on a less visible exchange, to save money. Prior to the closing of this relisting, in May 2020, MKTY withdrew the request. I assume it was because of market conditions – why spend the extra money / cost of the higher visibility exchange if market conditions were not in favor of getting the share price higher. They have misjudged the impact of coronavirus and its stock market reaction. The market has been good. It was a judgement call and time will tell if it was better to drop the action or to have moved forward with the shift to a higher exchange. I suspect the application to relist of a higher exchange will be presented again.

Bottom line, MKTY is doing things to grow the business. Management announced plans for a series of Public Relation (PR) events to get the story out.

- It is worthwhile to learn the story, look at the Soluna web site to see if this is an opportunity to invest in MKTY.

- Review the Soluna white paper attached also.

- Listen to the YouTube update on activity.

There are a number of possibilities for this new MKTY subsidiary, called EcoChain.

- MKTY and Soluna could merge as a way for Soluna to come public. Unlikely IMO, because Solara could have a hot enough story, they might be able to raise much more money in their own IPO.

- MKTY shares can get new investors (new growth story and/or new investors from the crypto and Bitcoin world that discover MKTY stock and move the stock higher. MKTY could do its own secondary to raise funds to increase crypto mining and invest deeper into Solara.

- There is a motive in MKTY doing new PR announcements in the future and applying to trade on a higher visibility stock exchange – both which raise corporate expenses. I do not know fully what that motive is, but it is positive for the share price. Probably to move the share price higher for a secondary offering to fund more crypto mining and blockchain app development. A secondary would be positive for MKTY for added visibility, more share outstanding for increased liquidity, added funds for crypto mining and blockchain app development.

Having said that – MKTY shares are very volatile and thinly traded. NEVER use Market orders when buying or selling. I do not know if the shares will dip and you can buy on lower limit orders or not. It is my opinion that the stock is cheap, but it is too early to know the benefits of the crypto mining / blockchain activity at this time.

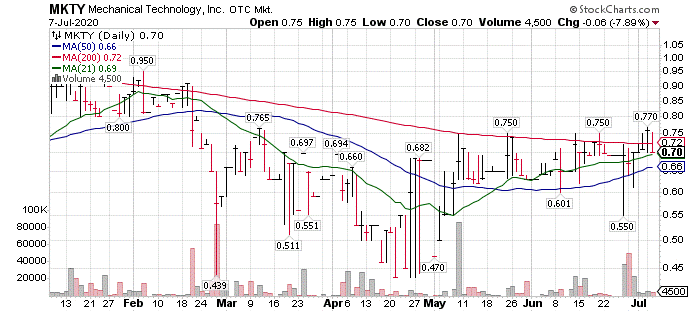

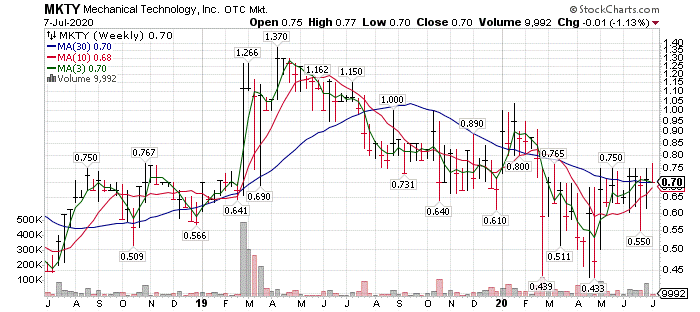

Six-month daily chart above and two-year weekly chart below.

- The rally in the share price in April of 2019 was due to a one-time cash dividend of $0.375 per share related to excessive cash accumulation. At the time it was announces in late February it was a 58% dividend on the $0.64 priced stock.

- MKTY remains debt free.

- MKTY received its biggest contract in history in March 2020 – the largest single order ever received by MTI Instruments, Inc. (“MTI Instruments”), the operating subsidiary of MTI engaged in the design, manufacture and sale of precision testing and measurement systems. This delivery order was made pursuant to the multi-year contract entered into by MTI Instruments and the United States Air Force in July 2016 and is composed of orders for 52 new PBS-4100+ vibration measurement and balancing systems, having a total purchase price value of approximately $3.3 million. MTI Instruments expects to fulfill and receive payment, with respect to this delivery order, by the end of 2020.

- Hint – 2020 is probably going to be a good year for a company. MKTY had 2019 revenue of $6.57 million and remained profitable. The contact above will be completed by year-end 2020 and is $3.3 million.

LOTM suggest buying slowly (exceptionally low liquidity) on weakness and be a nine-month to eighteen-month investor.

Tom Linzmeier is a former stockbroker, blogger & author, national workshop leader and currently, business development leader for Small, Medium Enterprises (SME) in Vietnam.

An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket

![]()