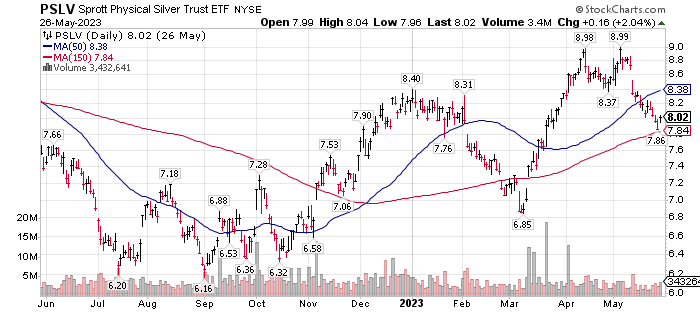

Blackrock buying PSLV is big news as Blackrock has their own iShares ETF that owns physical Silver, SLV $21.68

- Blackrock just bought 4.57% (20.6 million shares) of Sprott Silver ETF is PSLV $8.02. What does Blackstone, the largest asset manager in the world, know that they want to invest in another asset manager’s physical silver ETF – Sprott’s PSLV, in addition to their own ETF in Physical Silver? One conclusion is that they cannot buy enough silver on the open market in a timely manner to add to their own trust – so they bought into another silver stack.

Why are they buying so much? Why are they seemingly in a hurry to take this position?

Prices are very attractive and the long-term move up in gold and silver is in early stages. Fundamental news is excellent at select miners. It seems the best time to be accumulating share. The market is pricing in recessionary feeling while the only solution for the USA debt problem is printing more paper money. Our cheap valuation is for both exploration miners and production miners. Exploratory miners are probably the least expensive companies of all equities.

- Willem Middelkoop Interview on “Discovery Investing”, Released May 30, 2023

Lots of good info in this interview. The major theme in this interview is that this is the decade for investing in commodities. It is early days. It is way too early to give up on gold, silver, copper, uranium, nickel, vanadium even the traditional oil and gas. Dollar cost average into core positions, – look for new discovery ideas with exposure to large districts, – high grade core samples, – cost to produce from open-pit or underground tunnels and distance to roads, electricity and water. These are consideration in looking at a discovery mining operation.

Silver and Gold thoughts:

Karora Resources (KRRGF*) $3.35 – Now adding Lithium to it Nickel and Gold discoveries. Potential spinout in the future. News Flow linked here.

Vizsla Silver (VZLA*) $1.26 – high grade silver, large district claim. Good news on outsized Silver core samples doesn’t stop – news flow linked here. Anything over 1,000 grams per ton is considered “Bonanza grade.”

Discovery Silvery (DSVSF*) $0.69 – potentially one of the largest silver mines in the world that will also be mined open pit. Open pit is the lowest cost way to extract minerals. Market Cap of $245.3 million USD, Debt free, $37 million in cash. About three years from production.

EarthLink (SPOFF*) $0.17 turning into a royalty mining company. Trading at a discount to NAV. NAV is of $0.27 per share. The share price is not yet recognized as a royalty company. Cash flow to cover company expenses from chatroom and advertising. Tiny company, Three groups own the majority of the shares. Eric Sprott, Palisades Gold Corp, Private merchant bank focused on metals and mining. Website link

Gander Gold (GANDF*) Largest land claim holder in one of the hottest gold field area discoveries (Newfoundland) in the last three decades. To date, they have no blockbuster sized discoveries. 91.5 million shares outstanding with a Market Cap is $11.7 million.

Sassy Gold (SSYRF*) owner of 39% of Gander Gold. Total shares outstanding at Sassy, is 79 million shares. The market cap of Sassy is $6.3 million. The value of Gander share Sassy own at a 39% ownership is $4.63 million.

Blackrock Silver (BKRRF) $0.22 – big new discovery of gold in Nevada. Between two big produces on the same fault line. Headline linked here. It is very early but one to monitor for any additional positive core samples.

FEATURED Company – SilverCrest Metals (SILV) $6.32

Great first quarter March 30, 2023 – 95% of debt paid off in first nine months of production – Cash on hand at $45 million USD. First Qtr 2023 video conference call linked here.

N. Eric Fier, CEO, commented, “Marking another significant milestone for SilverCrest, Q1, 2023 was our first full quarter of production since Las Chispas was declared commercial in November 2022. We generated $19.3 million of net free cash flow allowing for accelerated debt prepayment of $25.0 million and a robust quarter end cash position of $45.8 million. As a testament to our strong financial position, execution and risk management, subsequent to Q1, 2023 we made an additional debt prepayment of $20 million and have now repaid 95% of our debt within six months of declaring commercial production. We remain focused on completion of the Updated Technical Report in late Q2, 2023 which will include updated costs, a new Life of Mine (“LOM”) plan and allow for the inclusion of data from our initial production period. This report will provide us with the details to support production and cost guidance.” LOTM: First quarter print news result linked here. If you own First Majestic – SILV is a good swap to a large silver producer with lots of positive news Vs First Majestic need for a catalyst.

Pan American Silver (PAAS*) $15.34 Largest holder of silver reserves on this planet.

First Majestic (AG) $5.77 – It is hard to get excited about AG even with the price pull back. First Majestic has some negative news related to suspending work at Jerritt Canyon. Certainly, AG can rise with an industry rebound but we need a catalyst of some kind to stimulate interest in AG.

Sprott ETF of Small Cap Gold Miners (SGDJ) $29.35 – Excellent generalists way to be exposed to the miners.

Aztec Minerals Corp. (AZZTF) $0.20 Exploration company with a Mkt Cap $19 million hits bonanza Grade.

- See the recently posted Substack subscriber article; “Four Timely Gold Producer Ideas”

There are so many undervalued – cheap – exploration companies in silver and gold that there are too many to list here. Production companies are cheap but not as cheap as exploration companies. This asset group could explode upwards tomorrow or take a couple of years to move higher. This is the conundrum of investing. One can see the opportunity but fitting the price move into a predictable time frame is nearly impossible.

Since we are in a correction mode for most of the market and we have not changed our perspective that Commodities to include Bitcoin, and especially Gold and Silver, are the best asset classes poised to out-perform on a long-term basis. We suggest dollar-cost-averaging into a large number of Gold, Silver, Uranium, Vanadium, Bitcoin and Nickel companies.

One might buy a package of equal weight names unless you have a clear reason to focus more tightly on fewer names. Ten to twenty names creates your own precious metal portfolio. In doing a package approach you minimize company risk yet allow for the lottery like returns when the industry gets hot. Sell enough to get your initial money out asap. That might be at the first price double. This is a volatile industry and prices pop fast and can retreat even faster.

LOTM is mining for gold and silver within the exploration and early production mining companies. Large Cap producers are very attractive, but the names are known and the returns less than that of the exploration and early producers. Large Cap names however are less volatile and more comfortable to own. What do you want from this exercise?

Tom

Consider a subscription for actionable investment ideas for LOTM through Substack

or Text to set up a conversation at +1 country cod – 651 area code – 245 city code – 6609 local code.

Referrals rewarded.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()