Originally Published Sept 26,2020

Global Silver Demand Edged Higher in 2019, With Investment Demand Up 12%, While Silver Mine Supply Fell for the Fourth Consecutive Year

Silver Institute: April 22, 2020 linked here

Chart from Finviz.com

Technically, we see this chart as a correction in a bullish trend. Aside comment – the 33% drop in price from $18 to $12 in March, looks tiny Vs the move from $12 to near $30 in the next six months. We share this because this movement is “normal” for silver. The trend is up but expect surprise raids on the price.

Silver Demand

Global silver demand edged higher in 2019 to 991.8 Moz, up 0.4 percent, as higher net-physical investment was offset by lower jewelry and silverware demand. Industrial fabrication was nearly unchanged from 2018 at 510.9 Moz. Although the escalating trade war between China and the US weighed on industrial offtake last year, losses were broadly mitigated by favorable structural changes, such as vehicle electrification and a rebound in the key field of photovoltaics. Photovoltaic demand registered an impressive 7 percent increase in offtake, rising to its second highest annual level, while silver’s use in brazing alloys rose 1 percent. Jewelry posted a 1 percent decrease to 201.3 Moz, primarily due to soft demand in India and China. In contrast, Thailand achieved a 13 percent increase last year and growth was also registered in Indonesia, Japan and Italy. Silverware fell by 9 percent last year almost entirely due to lower demand from India.

- Favorable structural changes, such as vehicle electrification and a rebound in the key field of photovoltaics, fueled solid industrial demand.

Silver Supply

Global mine production fell for the fourth consecutive year in 2019 by 1.3 percent to 836.5 Moz. This was a result of declining grades at several large primary silver mines and disruption-related losses at some major silver producers. Primary silver production declined by 3.8 percent in 2019 to 240 Moz. On a country basis, the largest production declines were led by Peru, followed by Mexico and Indonesia, which were partially offset by gains in Argentina, Australia and the US. Globally, Mexico was the leading silver producer last year, followed by Peru, China, Australia and Russia. Total recycling edged higher in 2019 by 1.3 percent, chiefly due to an increase in industrial and jewelry and silverware recycling. (source – Silver Institute)

LOTM: Why do you want to own silver? Simple – supply and demand. In the global drive for alternative sources of energy (solar panels) and an increasingly electrified world (silver is the best conductor of electricity), demand will continue growing while sources are harder to find and lower quality.

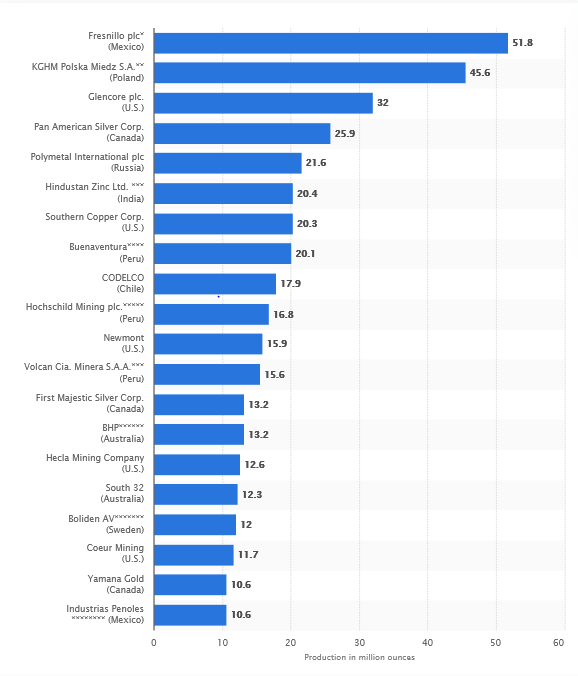

10 Biggest Silver Mining Companies – dated

This list at Investopedia is dated – there was no posting date on the data provided. It does give symbols to foreign companies that are not normally discussed in the USA markets.

Never-the-less, it is an excellent list of global leaders in silver production. There have been mergers that have moved PAAS up the list and certainly Sibanye (SBSW)* (not on the list) has a strong production position in Silver. SBSW is among the top Platinum/Palladium miners in the world. The companies are linked to charts at TradingView. TradingView has a technical indicator for each stock it covers (which is every stock in the world). So from a initiating position or adding to an existing position in Silver miners or a silver Trust (Sprott Physical) or a streamer (Wheaton) or a ETF as in Prime Junior Silver Miners, you can 1) accumulate slowly in this correction or 2) wait for the technical indicators to go on a buy or accumulate slowly and accelerate your buying when the technical buy signals say GO!. We also use StockTA.com for tracking buy or sell indicators. To each their own style.

Please Note: Our interest and approach to silver is as a two to five-year position. We believe we are in a long-term bull market for Silver. We will trade around a core position as is our style. Weakness is for buying until proven otherwise. Having said that; silver is a very volatile commodity – Speculative – so the swings are big – up and down. We do not recommend owning or trading silver on borrowed money (margin) – the price is that volatile. People within the industry believe the supply demand situation is tight enough, that $100 silver as a price goal in three to four years, is talked about with ease. Current spot price of silver is $23.00 on oz.

Don’t pick one name to buy – buy a basket of big companies, small companies and a physical trust. The will each perform differently at different times in the bull run. Trade the package, not individual stocks. EXAMPLE – add a 10% purchase to your “package” of stocks in silver – Sell 25% of your “package” of stocks. You don’t want to pick one stock and be right on the industry bull market, but not participate in the bull move because your stock pick has a company problem.

LARGEST SILVER MINERS FROM INVESTOPEDIA (a bit dated but worth seeing):

- #1 Industrias Penoles SAB de CV (IPOAF) $14.50

- #2 Polymetal International PLC (AUCOY) $21.16

- #3 Fresnillo PLC (FNLPF) $15.44

- #4 Pan American Silver Corp. (PAAS)* $31.24

- #5 Wheaton Precious Metals Corp. (WPM) $48.34

- #6 Coeur Mining Inc. (CDE) $7.17

- #7 Buenaventura Mining Co. Inc. (BVN) $12.11

- #8 Hecla Mining Co. (HL) $4.92

- #9 First Majestic (AG)* $9.52

- #10 Fortuna Silver Mines (FSM) $6.24

LOTM: Other stocks of Interest related to Silver Mining include:

- Sibanye Stillwater (SBSW)* $10.42

- Great Panther Silver (GPL)* $0.88

- Prime Junior Silver Miners ETF (SILJ) $13.50

- Sprott Physical Silver Trust (PSLV) $8.12

- SSR Mining (SSRM)* $18.38

Leading silver producers in 2019

Source: statista.com – Link in headline

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()