Fly Leasing (FLY) $6.70

Fly Leasing is focused on owning the world’s most popular commercial aircraft. They have a fleet of 86 modern aircraft leased to 41 airline in 25 countries. Approximate value of the fleet is $2.7 billion US Dollars.

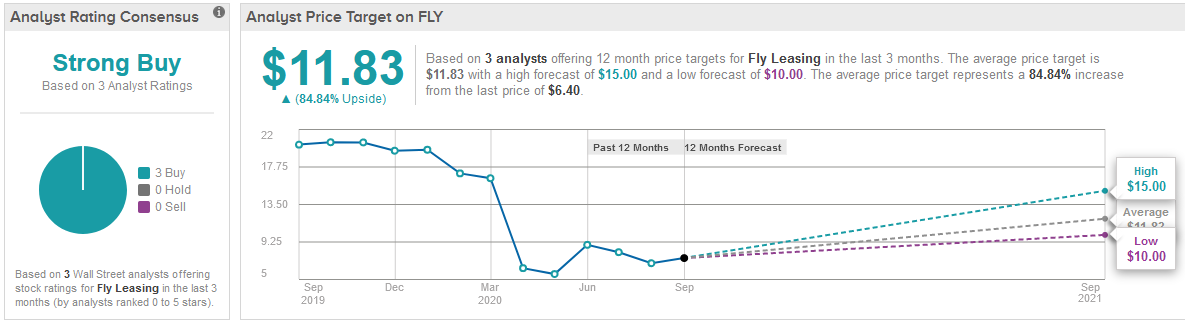

Analyst rating on FLY sourced from TIPRANKS:

The ratings above have all come in the past 60-days.

Quote from Jamie Baker, JP Morgan analyst with a $15, twelve-month target on FLY:

“[We] conservatively expect no deferral repayments in 2H20 vs. management’s expected $37m. Overall, our deferral and repayment assumptions are in line with the other lessors in our coverage. We are assuming no capex for the remainder of the year, consistent with management’s commentary for no capital commitments in 2020 […] Despite recent volatility seen in the space, we believe lessors’ earnings profiles are more robust relative to airlines,” Sourced

Aircraft have traditionally been an excellent holder of value in both inflationary times and deflationary times. There for we believe this position represents a hard asset investment purchased at a significant discount to book value. Company book value is $29.46 Vs stock price of $6.70.

Key Stats taken from Finviz

Market Cap: $204M Shares outstanding 30.48M Float: 26.54M

Percent Short 1.44% Cash Per Share $10.43 TTM Profit Margin 35.5%

Avg Trading Vol 286K Projected Frd P/E 3.18

Highlights Q2 announced Aug 13, 2020:

- Net income of $9.6 million, $0.32 per share

- Adjusted Net Income of $11.3 million, $0.37 per share

- $29.46 book value per share at quarter end, a 21% increase since June 30, 2019

- $289.0 million of unrestricted cash and cash equivalents

- $597.9 million net book value of unencumbered assets

- 2.1x net debt to equity

- On June 30, 2020, FLY’s total assets were $3.5 billion, including investment in flight equipment totaling $3.0 billion. Total cash on June 30, 2020 was $309.3 million, of which $289.0 million was unrestricted. The book value per share on June 30, 2020 was $29.46, a 21% increase since June 30, 2019. On June 30, 2020, FLY’s net debt to equity ratio was 2.1x, a decrease from 2.3x on December 31, 2019.

- Adjusted Net Income was $11.3 million for the second quarter of 2020, compared to $61.9 million for the same period in the previous year. On a per share basis, Adjusted Net Income was $0.37 in the second quarter of 2020, compared to $1.92 for the second quarter of 2019.

- For the six months ended June 30, 2020, Adjusted Net Income was $54.9 million, or $1.79 per share, compared to $109.0 million, or $3.37 per share, for the same period last year.

LOTM Summary: Q2 2020 earnings are down significantly from the year earlier period from $1.92 to $0.37. While a drastic decline, the company does not appear to be in trouble and the decline is due entirely to the global Covid-19 epidemic. We believe there is a rebound coming as the world adjusts to the new COVID-19 environment. We have expectation that a 50% to 60% efficacy vaccine will normalize global economy. We expect an antibody-based vaccine (J&J) in the next three months and a DNA based vaccine (INO) in the next nine months. There is risk of further deterioration related to Covid-19, but the company appears to be in good position to deal with negative developments and rebound with air traffic normalization.

Where Value meets Buy Signals

LOTM is a free newsletter. Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security. These Investments are bought and sold constantly.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()