- Three of the four largest bank failures ever happened in in 2023.

- Should you care?

- What is the fallout?

- What to do? The Bottom-line

- What’s the real rate of inflation if we use the calculations from 1980?

Should you care that three of the four largest bank failures happened in 2023. Certainly. Yet the government projects that all is well. It is not. All banks that hold US Treasuries as a reserve currency are in similar positions. It is only how they report holding the assets that determines the price at which they are held that determines the liquidity pricing of te treasury bond. If they are classified as long term assets, Banks can carry them on their books at the maturity value. As soon as the banks have a need to sell the bonds, as in a run on the bank the bonds are then re-rated to their “market price of call a marked to market price. These now prices at 50% less than their maturity value as in the case of 20 plus years and longer bonds. Snap your fingers and now the banks are insolvent. Many more banks are insolvent as soon as they need to Mark to Market.

A report by the Hoover Institution calculates that more than 2,315 US banks are currently sitting on assets worth less than their liabilities, with the market values of their loan portfolios worth about USD 2.2 trillion less than the stated book values. May 2023

Something is going to break: Andrew Brenner on today’s bond selloff – October 3, 2023

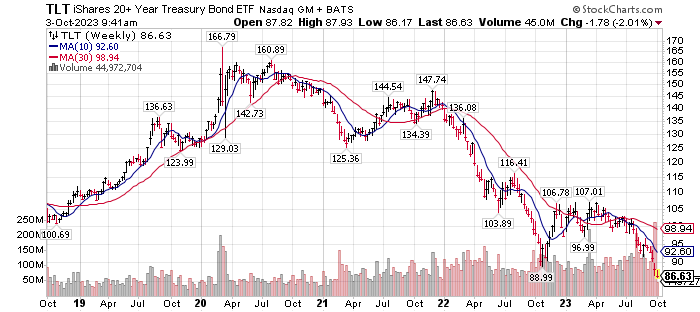

The Fall out is happening now as Central banks around the world are selling US Treasuries. They are selling falling prices as in the TLT chart below, to buy oil and staples for their populations or just selling a declining asset, US Treasuries. They are buying gold for any number of reasons the US government has provided them reasons to do so. Loss of trust in US Policy, Falling values of Treasuries, Desire to support their own currencies and Create a new trade settlement system away from the USA SWIFT System, are all reasons they are selling T-Bonds.

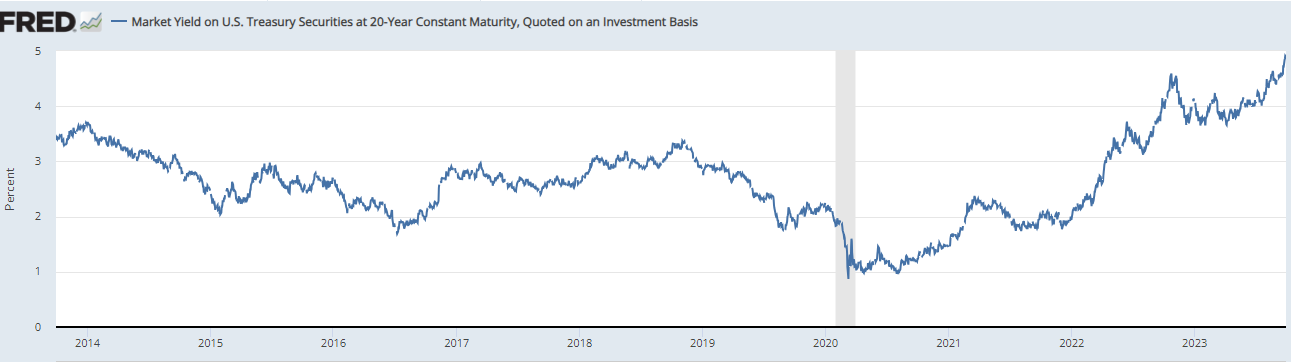

Ten-year history interest rate for 20 plus year Treasury Bonds.

TLT (below) is the ETF for 20 plus year Treasury Bond prices. The index has lost just shy of 50% of it value since the Federal reserve started raising interest rates. This was the reason for the three largest banks ever going out of business in 2023. Once the banks needed to account for the market value of the treasuries held as reserve assets, they were bankrupt. Most backs are in this position. A shift to market price pricing of treasuries would bankrupt the banking industry in the United States.

Two excellent discussions on the reality of currency, interest rates, gold and debt levels in the United States.

“Currency Is ALWAYS Sacrificed When Crisis Hits, Without Exception” Matt Piepenburg

“Central Banks are Stacking Gold and Dumping Treasuries” – Matt Piepenburg

“Bond Market Sell-Off Will Continue If U.S. Dollar And Oil Stays High” Luke Groman

“The US needs to refinance $5 trillion of debt in the next two years and they can’t at today’s rates” – Luke Groman

How the US Government calculates the official inflation rate over-time has changed. ShadowStats.com charts what the inflation rate would be if calculated in the same ways as it was in 1980 and again in 1990. .

The Bottom-line:

The best assets to own are Risk-off assets – Short-term (six month or less) Treasures, Property, Timber, Oil & Gas, precious & industrial metals and Bitcoin. Stated another way, Hard Assets are a good place to be.

Other assets to own are companies that improve productivity – New Technologies that improve productivity and deflates costs. Blockchain, Genetics, Software for Medical industry, Robotics, Artificial Intelligence, and Three-D printing are examples of industries that improve productivity. These have volatile prices so the price at which you buy them is important.

Of course, if you just want some price stability, one to six month treasuries would be a good place to hang out.

The good news is that Bonds appear to be in the process of a market selling climax. Volume is spiking in T-bonds and precious metal prices are crashing. It will not be long now until we see more problems involving someone or thing breaks. It should not be long now. Usually, precious metals are the first group to rally that is why we are not very concerned about pricing of Precious Metals and Bitcoin in the very short-term. Long-term, Oil & Gas companies with dividends seems to be a good place to be.

Once interest rates begin to fall (along with the US Dollar), risk-on growth companies that increase productivity will rally strongly as well.

We are close to a climax in the bond sell-off, but no one can say what the final damage will be. It is a good time to be a buyer in Precious Metals, Bitcoin and the stocks that are healthy and increase productivity as mentioned above. Very short-term treasuries are a good place to be if you just want to rest and preserve what you have short-term.

Written October 3, 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()