Within the next 60 to 90-days, we expect:

- Ten-year Treasury Rates to pause and then fall.

- The US Dollar to fall.

- Risk Assets to rally – Growth stocks with cash flow, Bitcoin & Ethereum to rally.

- Money flows to shift towards Emerging Markets (EM) and away from U.S. Equities.

- Physical metals and commodities to rise in price.

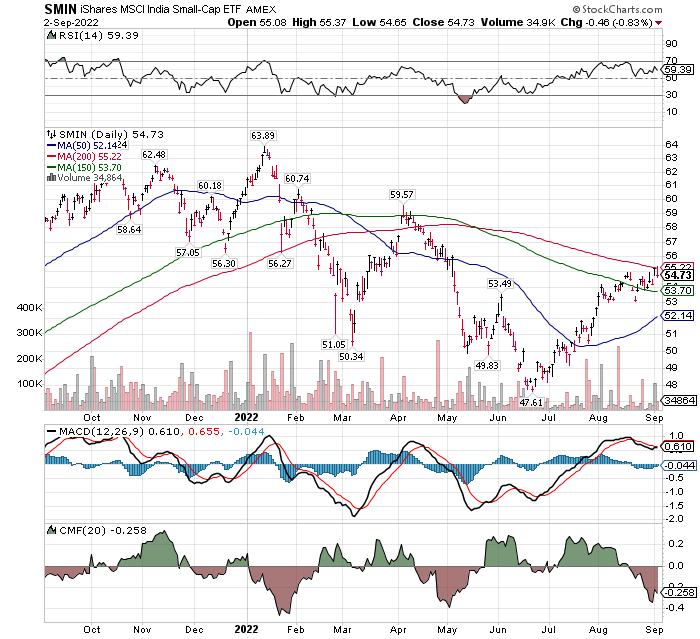

Above: Small Cap India ETF (SMIN). India will emerge as a dominant World Power over coming years. They will be the world’s most populous country. The median age is 28, among the youngest in the world. They are one of the most digitally connected populations in the world. They are an innovative country. Per capita income will rise quickly fueling a growing middle class.

Why will India be the next Superpower

We want to mention India at this time. Very short-term, it appears that the ETF – SMIN, will pull back in price. Maybe to support at $51.00 or at $53.00. Not much, but you might as well wait and see. Long-term, I am speaking a decade or more, India is a strong growth country. You can work the ETF’s price technically for many, many years. Buzz is building in the investment community about the country will expand and grow across many fronts. As usual I am early so consider this food for though and perhaps an small initial position.

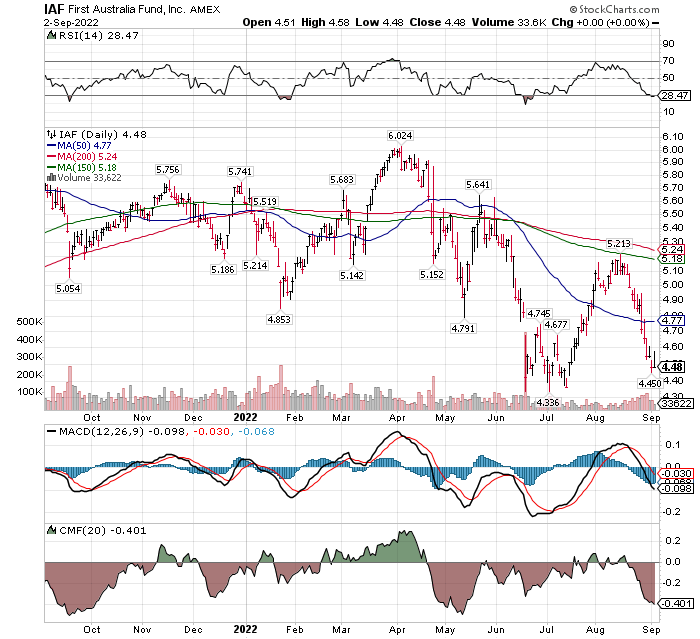

LOTM has mentioned IAF (Aberdeen Australian Fund) a number of times. It is one of our favorite Dividend plays but to be very candid, we trade the shares more than we sit on the shares. It is one of our Foreign market plays with an expected falling US Dollar. IAF pays a 11% dividend, and the fund is 24% in Australian Mining stocks and 26% in Australian Banks. Banks are healthy and Australia has a positive trade balance and a 6.1% inflation rate. We have been buying the dip post dividend X-date and selling the shares about 2 or 3 days before the coming X-date. We have been able to do better in the quarterly trade than what we would have received as a dividend. we can always sit on the stock if it does not trade up more than the 11% dividend.

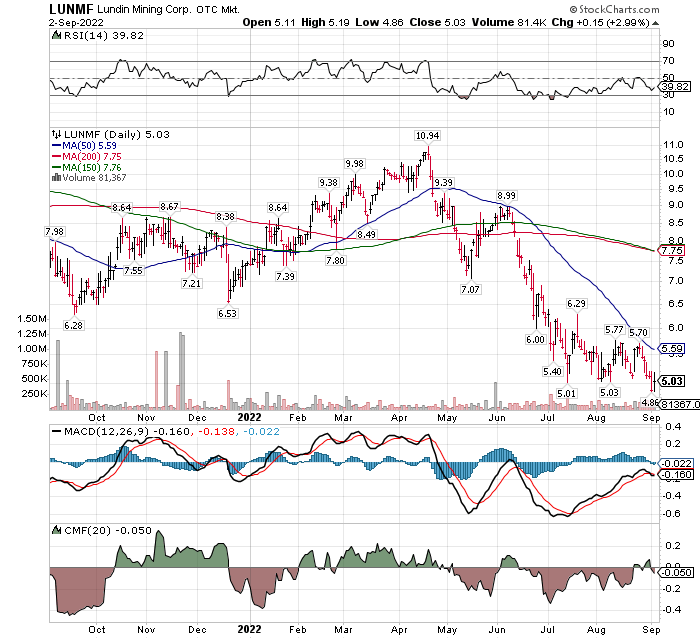

Lundin Mining is a dividend paying copper, gold and silver miner trading at bit above a 5 P/E ratio and pays abut 5.5% dividend. Sooner or latter we expect to get a double from this stock. Our feeling is it is a solid company, excellent management and too cheap. The 5.5% dividend makes it an easy wait for the double. Do the math on different holding periods. A two-year example to a double is 5% a year in dividend and 50% average appreciation per year. The world could end, and Lundin Mining would not go out of business.

Here is a recent 15 minute interview with Rick Rule, self-made Billionaire in Natural Resources. He is aggressively buying micro-cap mining companies, suggesting they are the cheapest they have been in his 48 years in the natural resource industry relative to the physical metal they mine. In our Ten Under $10 for the Double, we are focused on natural resource companies with a focus on miners.

Potential Catalyst in drawing interest back to precious metals is this Analysis from Casgains Academy. I have watched this groups’ presentations a number of years and find them to be a credible, disciplined and multi-dimensional thinking group. If this group is correct there will be reactionary events in multiple countries.

China’s Banks Just Went BANKRUPT ($3 Trillion Vanished) – released September 5th, Casgains Academy – 17 minutes.

Written By Tom Linzmeier, editor Tom’s Blog at www.LivingOffTheMarket.com

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()