October 04, 2024

Over the past three years, our LOTM approach has migrated to a barbell approach as our investment theme. Precious metals on one end of the barbell with Crypto and Blockchain technology companies on the other end of the block chain. 2022 was a difficult year as gold and silver came down from their 2021 highs and Crypto/Blockchain related positions collapsed in a very hard bear market. Both sectors based in early 2023 and by the end of 2023, both sectors moved strongly higher. This shows up strongly in our ZTA partnership account performance history. Three time-line charts below of ZTA Performance –

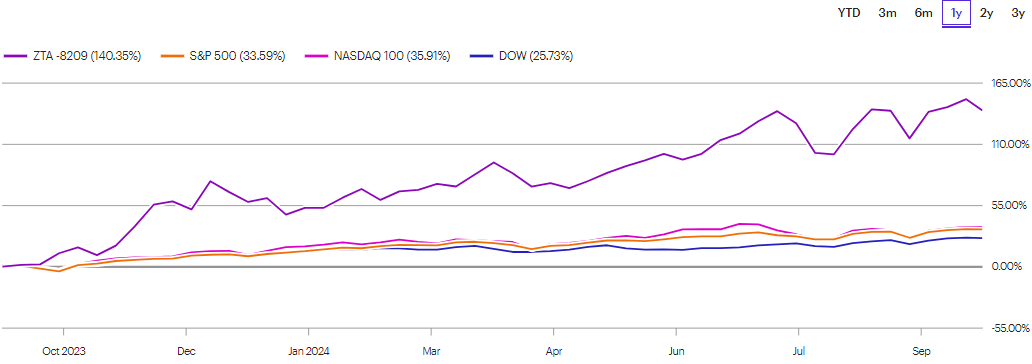

One-year performance below:

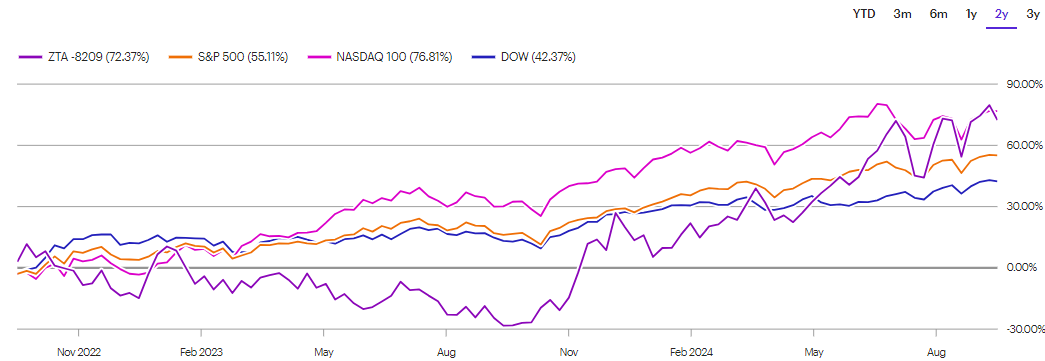

Two-year performance below:

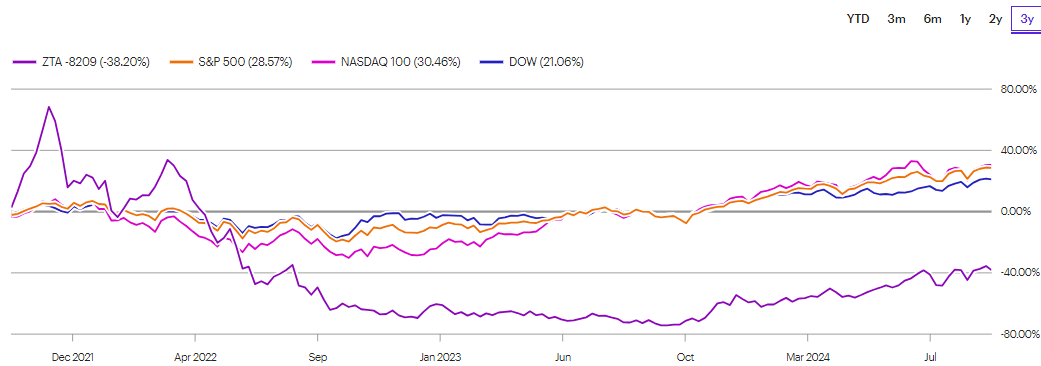

Three year performance below:

“If” our performance in the ZTA account stays equal to the performance of the broader markets (or better) over the next six-months, we will catch up or beat the other bench marks on a three-year basis as well. This is because we are dropping off our high out-performing comps to the three-year market indices from 2021 to early 2022 period. This is referring to the three-year chart. We are volatile in our money management process because of our concentration of about ten positions in two industries and our three to five year time-line focus. We are working to reduce downside volatility while maintaining our upside volatility. If following our process, you can put a stop-loss on your account and step aside at any time to reduce the downside volatility in your personal accounts. This would be similar to putting a stoploss on an ETF or managed money account that is customized to your personal risk management requirements.

JP Morgan just released a report that speaks directly to our current LOTM barbell approach.

Gold and Bitcoin will benefit from a “debasement trade” – JP Morgan analyst

Posted by editors at Seeking Alpha October 3, 2024

Recent geopolitical conflict has shifted attention to alternative asset classes or hedges, such as gold (XAUUSD:CUR) and Bitcoin (BTC-USD), said Nikolaos Panigirtzoglou, strategist at J.P. Morgan, in a note.

What analysts call the “debasement trade” is a combination of gold demand factors that reflect higher geopolitical uncertainty in clients and their trade. Those include longer-term inflation backdrop, government deficits, and the diversification away from the dollar, among other things. Full release is linked in the headline of this article.

Linked below is an excellent thought process and commentary on the Interest Rates, Currencies, Precious Metals, the Nuclear industry and Crypto/Blockchain sectors.

This is an audio interview with Luke Gromen, a macro economist. Hosts are Erik Townsend & Patrick Ceresna from MacroVoices:

“MacroVoices #448 Luke Gromen: Why the Gold Recycling Trade is Accelerating”

It is an easy to understand but in depth interview that is best listened to rather than summarized. Bottom line is more inflation ahead in mid-2025, with Gold and Bitcoin as hedges to for a few more years. The big However, is that we should expect a few 20 to 30 percent pullbacks along the way. All three are very bullish on Nuclear long-term as the only solution to base load energy shortages. They do go into the, Why we will have electricity shortages and only nuclear can solve the problem.

Viewed from outside the USA; Simon Hunt is an Englishman who has lived much of his life outside of England. Currently, Simon is running his own consulting service. He is now based and living in Dubi. His life focus has been as a copper and copper mining industry expert. As an international product and multi-country sourced product (Copper), Simon has had to incorporated Geo-political opinions into his copper analysis. Our interviewer is Kai Hoffman, a native born German who is still living and based in Germany.

“GOLD: This Meeting Can Change EVERYTHING | Simon Hunt”

The meeting referenced in the title is the October 22, 2024 meeting of the BRICS countries. In this interview, Simon Hunt discusses the upcoming BRICS summit, potential shifts in global currencies, the escalating conflicts involving NATO, Russia, and the Middle East, and China’s economic strategies. Get insights into how these geopolitical tensions could reshape financial markets and influence global stability.

Next is an interview with market technician, Chris Vermeulen. Chris specifically discusses the technical outlook for Gold, Silver and Uranium.

Is The Gold Price About To CRASH? / Chris Vermeulen”

Chris is long the markets as the trend is still up. He believes the equity markets are in a late stage 3 topping process. While still looking for higher prices, Chris suggests we are close in time and price to a 20% to 30% correction in precious metals and a deeper correction in Equities. As to time-line for the rally to continue, Chris suggests, metals could rally for two to three-months that could extend into the next six to nine-months. Timing tops and bottoms is not easy.

IN NEWS TODAY:

SILVERCREST (SILV*) Bought-out by Coeur Mining CDE).

While my thinking was Gatos Silver being a single location mine that was acquired by First Majestic (AG*) there might be other single location miners that would be buy-out targets as well. I had no inkling that SilverCrest (SILV*) would be bought-out today when I suggested it and added it to the ZTA Partnership.

DJ SilverCrest Metals Shares Rise on $1.7 BLN Acquisition by Coeur Mining

9:45 AM ET 10/4/24 | Dow Jones, By Adriano Marchese

SilverCrest Metals shares jumped Friday morning after agreeing to be acquired by Coeur Mining in a $1.7 billion deal.

Shares traded in 5.3% higher in Toronto at 13.26 Canadian dollars, the equivalent of $9.78.

The two companies said on Friday that, through a subsidiary, Coeur will offer 1.6022 of its shares for each SilverCrest common share, implying a consideration of $11.34 apiece.

The offer represents a premium of 18% over the 20-day volume-weighted average prices of both companies as at Thursday’s closing levels, and a 22% premium to SilverCrest’s closing price on that day on the NYSE American.

Once the transaction is complete, SilverCrest shareholders will own about 37% of the combined company, and Coeur shareholders will hold the other 63%.

Like First Majestics’ (AG*) $6.54 purchase of Gatos Silver (GATO) $16.36, the addition of SilverCrest (SILV*) $10.20 is a positive for Coeur Mining (CDE) $6.47.

Current ZTA Ltd Partnership positions and October transactions are reserved for regular subscribers of LOTM. ZTA Ltd Partnership is a related account to LOTM where our activity is shared.

Good fortune to us all!

![]()