Five Actionable Gold and Silver Mining Stories

Chart above is Physical Gold sourced from Finviz.com

I: Silver One (SLVRF*) $0.18 – Exploratory stage

Silver One advances Candelaria & Phoenix Silver projects, eyes growth & new partnerships

Six Minute Update with the CEO of Silver One – dated March 3, 2025

Silver One is an exploratory mining business. We own the position due to its potential at an Arizona prospect near Globe, AZ. Extraordinary large “chunks” of near pure silver were discovered at surface about two years ago. Permits to drill were recently issued. Phoenix Silver prospect is in a highly successful copper vein trend with active copper mines on both side of Silver One’s Phoenix Silver claim.

II: Hot Chili Copper (HHLKF*) $0.48 – Exploratory stage

Major copper discovery for Hot Chili Copper

Mid-February 2025 – 20-minute update.

Hidden asset in a water desalination business that is anticipated to be sold in the next two years.

Aya Gold & Silver provides comps that the sale price would in the area of $350 to $400 million dollars. The current market cap of Hot Chili is about $70 million. The company’s long term debt is about $400 Thousand. The company has more than $1 billion of copper assets in the ground. It will be three more likely four years before copper is produced from this name. The Water Desalination plant is expected to be sold in eighteen to twenty-four months. Hot Chilli has already received interest in buying the Desalination plant. Hot Chilli is a very illiquid position – which we like. When news breaks on illiquid stocks the moves can be very Large and Violent. In order to build a large position, one must be careful and deliberate. Ability to hold the position should a market surprise happen is important. We like everything about this

Related secondary copper discovery announced about four weeks ago linked here. Video is a bit more than three minutes.

This is one largest copper positions when prior claims are added to the new discovery.

III: Aya Gold & Silver (AYASF*) $7.81 – Producing with rapid revenue growth

Now Is a Great Time to Invest in Silver – Interview with Benoit La Salle

Dated – Feb 24, 2025

Benoit La Salle is the President and CEO of Aya Gold & Silver.

SUMMARY: Revenue and new silver assets in the ground are projected to expand rapidly for two to three years into the future. Cost to discover new assets in the ground runs about $0.15 per ounce of silver found. AYA is currently a producing company – production is 100% silver. Producing and explored percent of the claim they control is about 2% of the claim. AYASF is now one of the top ten positions of companies owned in the LOTM / ZTA related account. This is a very exciting, healthy and in our mind cheap stock. La Salle is highly respected within the Silver and gold mining community.

The Video length is one hour & twenty minutes long.

IV: Endeavour Silver (EXK*) $3.98 – Producing with rapid revenue growth

April opening of its new mine, Terronera project, in the next two to three months. The Terronera project will increase silver production from about 9 million oz of silver per year to 15 million oz of silver per year. It will take about a year from start-up of Terronera, Endeavour’s third producing mine, to reach full capacity. Endeavour has a fourth developmental prospect, Pitarrilla.

Two minute intro to the company at the NYSE with Dan Dickson, CEO of Endeavour Silver linked here.

Pitarrilla is one of the largest undeveloped silver projects in the world. It’s an undeveloped silver, lead, and zinc project located 160 kilometres north of Durango City, in northern Mexico.

The Inferred Mineral Resource (open pit and underground) totals 35.4 million tonnes containing 99.4 million oz Ag grading of 87.2 gpt, 281 million lbs Pb grading 0.36%, 661 million lbs Zn grading 0.85% for a total of 151.2 million ounces AgEq grading 132.7 gpt.

The new mine at Terronera provides a stream of positive news releases for the next fifteen months, with an additional large development project following up as the Terronera mine reaching full capacity. LOTM sees this as a multi-year position with plenty of trading opportunities over a two to five year period.

V: Equinox Gold (EQX*) $6.65 – Producing with rapid revenue growth

EQX is about seven month ahead of the Endeavour story above. Equinox Gold opened up what is the largest and lowest cost mine of eight mines in operation. Greenstone was opened in June of 2024. They are still ramping up productions at Greenstone mine over the next nine to twelve-months. In February of this year, EQX announced the merger with Calibre Mining. Calibre is scheduled to open operations in late Q2 or Q3 2025. This will provide increasing and acceleration revenue and cash flow over the next one to two years.

Equinox Gold forms Canadian Gold Giant in “Merger of Equals” with Calibre Mining

28 minutes in length summarizing the combination of the two mines hosted by Crux Investor.

Equinox Gold & Calibre Mining Merge: A New Gold Giant is Born

Founder of Equinox Gold, Ross Beaty describes the deal.

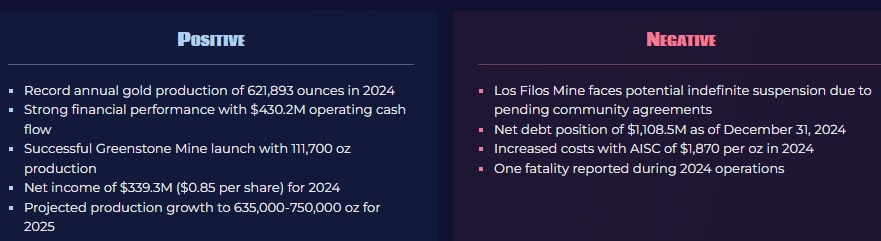

Positive features from recent earnings report

Full year Earnings and Cash Flow announced.

Equinox Gold Reports Record Results for 2024 with 623,579 Ounces of Gold Sold, Revenue of $1.5 Billion and Operating Cash Flow of $430 Million

When analyzing physical metal miners, it is better to look at cash flow than earnings. Mining stocks, like Oil & Gas and Real Estate, have non-cash deductions available to the industry. These non-cash deductions include depletion, depreciation and amortization.

![]()