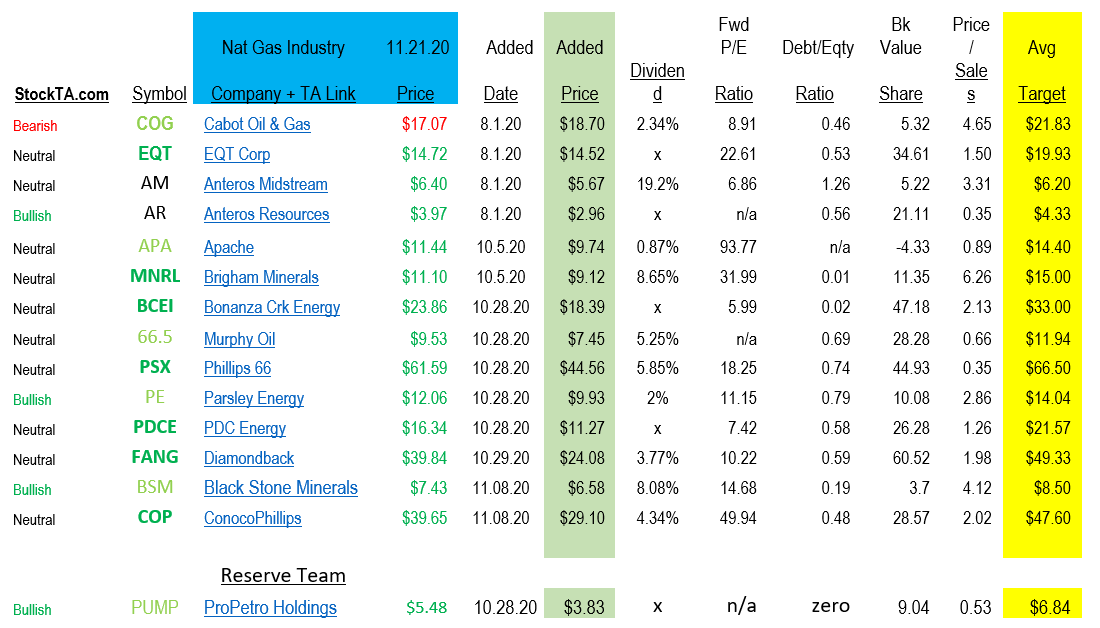

- Top Picks Appreciation at this time: APA – AM – AR – BCEI

- Top Two picks for Dividends: AM 19.2% & MNRL 8.65%

- 2021 Average Oil price: Goldman Sachs: WTI $51.38 – Brent $55.63

Goldman Sachs remains bullish on Oil and gas citing rising demand led by China and followed by increased activity later in 2021 from the vaccines for Covid-19. Story linked above.

Brent oil is targeted at $55.63 and WTI at $51.38 Current Brent price is $45.24 and WTI is at $42.47

Appreciation: we like Anteros Resources (AR), Anteros Midstream (AM), Apache (APA) and Bonanza Creek (BCEI). One can certainly use the “buy the dips and sell the rallies” approach, however we believe this is the beginning to a two year rally in Oil & Gas stocks and suggest you will make more money, dollar cost averaging – especially on price weakness.

Dividends: We like the cash flows at Anteros Midstream (AM) and believe you will benefit from a high dividend payout and a dividend “normalization” to 12% – thus giving you a price target of $9.90.

MNRL (Brigham Minerals) is debt free and has the cash flow to pas a dividend however we believe the rising oil and gas prices will allow them to raise the dividend as prices rise. They are a royalty company so their corporate purpose to distribute as much of the dividend after expenses and sustaining reserve life.

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()