The global silver jewelry market was impacted by the pandemic in 2020, it is set to bounce back and is likely to see a recovery of 13% primarily due to the economic revival in 2021. Silver will also continue to serve as a safe haven asset in times of uncertainty. The ongoing revolution in green technologies, aided by exponential growth of new energy vehicles and investment in solar photovoltaic energy, will act as a major catalyst for the white metal going forward. Silver’s use in 5G-infrastructure and upcoming intelligent electronics is also likely to drive demand.

Meanwhile, absence of development of new projects, declining ore grades and depleting reserves remain headwinds. While demand remains strong, shortage in supply will drive silver prices in the days ahead.

Excerpt from Zacks Jan. 13, 2021 linked here

Listed below as some of our favorite Gold and Silver mining companies. We believe we are close to the end of an industry correction that started in the first week of August 2020.

Gatos Silver. Just came public. Close to being a large deposit, pure silver miner in Mexico. Trades at 10.7 Fwd P/E ratio.

Largest silver producer in western hemisphere, Pan American trades at 12 times Fwd P/E ratio and 4.97 times sales.

One of the best chart patterns in the industry at this time, Sibanye trades at 20, the Fwd P/E ratio and 1.72 times sales

About equal gold and silver production SSR Mining will have a leap forward in revenue and cash Flow from a merger of equals. Fwd P/E ratio is 7.52 – TTM Price to sales is 5.95

Great Panther is doing great and trades at an Fwd P/E ratio of 4.4 and a P/Sales of 1.1. cheap in the industry.

First Majestic – numbers mean less for this stock because it is managed for long-term performance Vs qtr-by-qtr, and management is recognized as one of the best in the business. Fwd P/E is 168.7 and P/S are 7.61. In this case, don’t place much value in AG’s numbers. Buy or trade on Technicals and Macro’s and accept the fact that management is excellent and working for shareholder’s interest.

Barrick Gold is one of the largest precious metal miners and one of the best managed. Class of the industry. Fwd P/E ratio is 15.84 and P/S is 3.45. Technically it looks like support is holding and waiting for the catalyst for higher prices.

AngloGold Ashanti is a large precious metals miner and very volitle – read that to mean a great trading stock. As Barrick tends to trade at a premium to the industry AU tends to trade at a discount to the industry. Fwd P/E ratio is 7.21 with a P/S of 2.59

Hecla is about 50% gold & 50% silver production. They carry a higher level of debt than most in the industry but at the current end product prices it is no problem. Forward P/E is 20.2 and P/Sales is 4.27. Debt will act as a positive lever for earnings and Profit margins in a rising physical metal pricing world.

Gold Resource is a debt free miner that had a tough year in 2020 related to CCP Corona Virus. They are expected to bounce back in 2021 but of course we have to see the impact of the Vaccines. Fwd P/E ratio is 265 and price to sales is 1.53. A solid recovery and this could rally two to three-fold in the next eighteen months.

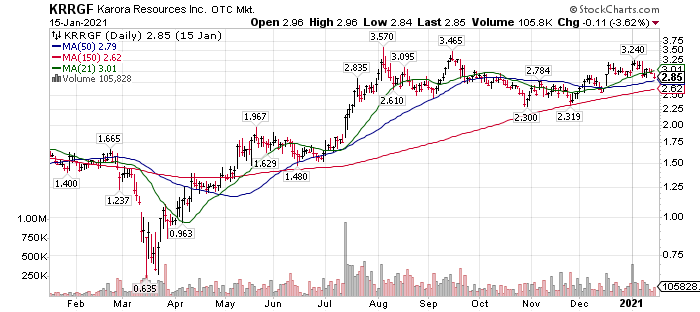

Karora Resources – solid with a strong monthly free cash flow of about $5 million. Trailing P/E ratio is about 9. Unknown except in the industry. At LOTM, we believe 2021 is the year KRRGF will be discovered outside the mining industry.

Below are two ETF’s. 1) Junior Silver Miners – SILJ, and 2) Junior Gold Miners – SGDJ. We like these, because the Majors in this industry are generating a lot of free cash flow and have underinvested in exploring for new prospects. There will be many mergers and acquisitions in this industry in coming months and years. It has been estimated, that if the price of Gold equivalents stays around $1,850, the top ten miners will generate $90 billion in cash between now and Jan 2025. The industry will consolidate through mergers and acquisitions (M&A).

Sprott Junior Gold ETF (above)

ETFMG Prime Junior Silver Miners ETF (above)

We suggest two different risk management tactics with the companies above.

- If you have the cash flow to dollar-cost-average into these companies over time, we suggest a two-year minimum hold and add to positions on weakness. This should work great as a way to build the position and lower your cost basis if your first purchases were at higher prices.

- The second is if you do not have cash flow to add funds for additional purchases over time. In this case you can take more of a trading approach and some or all or the position on spike rallies. Hold the cash looking for lower re-entry points to buy back into the shares. A combination of price and moving average crossovers is a useful buy / sell timing mechanism. We also recommend incorporating using the MACD indicator as well.

Happy profit hunting! We think there is a lot of cash to be “mined” from this industry over the next six months to six years.

Visit our website, www.LivingOffTheMarket.com and consider getting our LOTM Daily Notes or LOTM Weekly Summary sent to your email in-box.

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()