Ten Under $10 for the Double

While adding names to the Ten under list we do expect to sell some names in the next one to three weeks to trim the portfolio positions and prepare for a potential correction. Technical Factors suggest we are already in a one-to-two-month correction even as major indices hit new highs. It is an age-old market trick – let a few big companies carry the market while sucking the value out of the majority of stocks in market. Our concern is not a short-term rotational correction but the potential for a bigger correction. You will see more technical work on this from LOTM. Try and be proactive in the markets. So far, we are ok. Just being concerned about what might be coming. Regular readers know of our concern about rising rates in the 20-year and 30-year treasury rates. Be careful. Reduce your margin loans or better yet get rid of it.

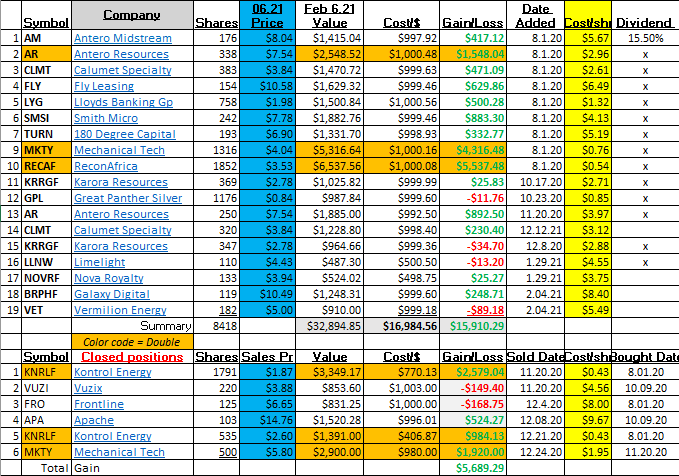

Additions to Ten Under $10 in the past two weeks:

*Limelight (LLNW)* $4.43 – Internet content delivery platform that is the video, state-of-the-art, service.

*Nova Royalty (NOVRF)* $3.94 – Copper & Nickel Royalty company

*Galaxy Digital (BRPHF)* $10.49 – Blockchain focused Investment Banker, financier, and crypto portfolio manager.

*Vermillion (VET) $5.00 – Traditional Oil & Gas company that we feel is undervalued and not well known.

- Galaxy Digital was discussed in a LOTM Feb 4, 2021 report linked here.

The remaining companies will be discuss in coming weeks. For now, we want them include in your awareness.

Nat Gas stocks – supply constraint and increasing demand. The Media is so caught up in the Go Green movement they are forgetting an important factor. That factor is – “It Takes Time”. Going Green is going to happen – it is just not going to happen as fast some “non-industry’’ knowledge politicians want it to happen. That is an investment opportunity!

- Last summer, did you see people rush out and buy new Electrified SUVs and RVS? No – you did not. But they did rush out and buy combustion engine SUVs and RV’s. A friend who is in the RV and Boat finance business, reported May and June were his best two months EVER (30 years in business) for financing in this sector. What people say, and what they do are often at odds.

- LNG demand is strong in South Asia (India) and SE Asia (China & Indochina Peninsula) that LNG prices are at premiums to the price of Natural Gas. Demand is high for Natural Gas in other areas of the world, higher than here in the USA.

Recovering demand for liquefied natural gas (LNG) and the strongest spot LNG prices in more than half a decade are set to encourage more U.S. exports of LNG this year.

The economics of U.S. LNG exports are looking attractive again, with the U.S. benchmark Henry Hub prices well below the spot prices in Asia, incentivizing additional exports out of the United States. Linked here

Our favorite Natural Gas companies remain Anteros Midstream (AM)* $8.04 – 15% annual dividend payer and gas pipeline company.

Picks from the top five US Nat Gas companies, #ed by size and listed in order of our favorites:

#3 Anteros Resources (AR)* $7.54 E&P company.

U.S. NGL production is projected to decline in 2021, driven by reduced drilling activity in shale oil basins, before recovering to 2019 levels in 2022

#2 Cabot Oil & Gas (COG) $16.59 E&P company

#1 EQT Corp (EQT) $16.75 E&P Company

We also like Apache Corp (APA) $16.22 and Bonanza Creek (BCEI) $23.64 among our top energy picks.

Fortune Names Apache Corporation (APA) One of the World’s Most Admired Companies

We almost forgot our wildcatter, ReconAfrica (RECAF)* $3.53. High risk – Very high reward. Literally a wildcatter in Namibia and Botswana. Holds 100% or 95% drilling rights to 28,000 sq kilometers of property.

VERMILION ENERGY:

LOTM has a new addition to the Ten Under $10 grouping in the Energy area. That company is an International Oil and Gas company, Vermilion Energy (VET) $5.00. We believe VET has potential to double – even triple in value from its current price. This is likely a slower double or triple as the company is using its free cash flow for debt reduction rather than expansion in developmental drilling. The company has extensive properties in North America, Australia, and Europe. There are disgruntled current or former shareholders who only owned VET for its generous monthly dividend. This was eliminated in March 2020 with the sudden crash in oil prices. The company has stated a goal to resume the dividend but would like to reduce debt first. It sounds like a workable plan to me. Because of the dividend cut and not being well known outside Canada, the stock has not rebounded like other O&G stocks. We believe it is a laggard in stock price, but otherwise healthy (with debt) company wanting to be conservative and reduce its debt level. Rising energy prices can be a big help in this area. Reinstatement of a monthly dividend will boost the price as well but that is in the future. We admit we are early on this but sense the chart’s base building period is ending with rising energy prices.

- Crypto related Companies, Mechanical Tech (MKTY)* / EcoChain $4.02 and Galaxy Digital (BRPHF)* $10.49 are our top choices in Crypto currency related companies. We will continue to hunt for reasonably valued opportunities involved in the build out of crypto infrastructure. MKTY/EcoChain is engaged in crypto mining and building alt-energy powered, micro data centers to provide low-cost energy and supporting services to blockchain app development tenants. Galaxy is an investment banking shop that focuses on finance and investment in Blockchain related businesses as well as a crypto miner and sub-advisor for third party crypto portfolio asset gathers like CI Financial (CIXX)* $14.00. CI Financial is an excellent company to consider. They are the first Canadian management company to offer a Bitcoin ETF to Canadians. They are ahead of the U.S. in that regard. We own it in related accounts. It is an asset management company, so they are vulnerable in a hard market selloff from “Market Conditions” but “Company” wise, appears solid and a rapid growth situation. They are expanding rapidly in the USA through the purchase of RIA Management companies as a way to build assets under management.

For actionable ideas as we make the decisions, consider subscribing to our Daily Notes. Send an email to Money@LivingOffTheMarket.com. Write “Subscribe Me to LOTM Daily Notes” in the Subject line. It is free.

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()

Hi just a quick question regarding BTBT. Should I be concerned over all the ambulance chasers coming forward?

I do not Like BTBT for the following reason. The bulk of their crypto mining is in China even though the company is headquartered in New York. Money earned in China has to remain in China. There is no way, legally, for profits in China to be returned to the USA. What good does that do BTBT Shareholders. BTBT to me is even more over-valued than RIOT or MARA because there is no access to the cash from China. I also think RIOT and MARA are over-valued. MKTY is interesting and I have a position in it and I like Galaxy Digital and own it. My thoughts on BTBT is – RUN! Not investment advice, just my personal opinion.