About ARGO:

Headquartered in London with operations in North America, ARGO is a debt free Crypto Miner. Unlike Mechanical Tech (MKTY), who will create and sell crypto currencies shortly after production, ARGO will retain ownership of its crypto currencies for investment appreciation. This is a good way to acquire crypto currencies – make them yourself. We like both ideas of creating and selling as well as creating and owning. MKTY brings the added business plan feature of building alt-energy Data Centers, while ARGO takes a different path and is starting to accumulate Intellectual Property in Blockchain Applications as well as creating, owning and buying different crypto currencies.

Potential Catalyst:

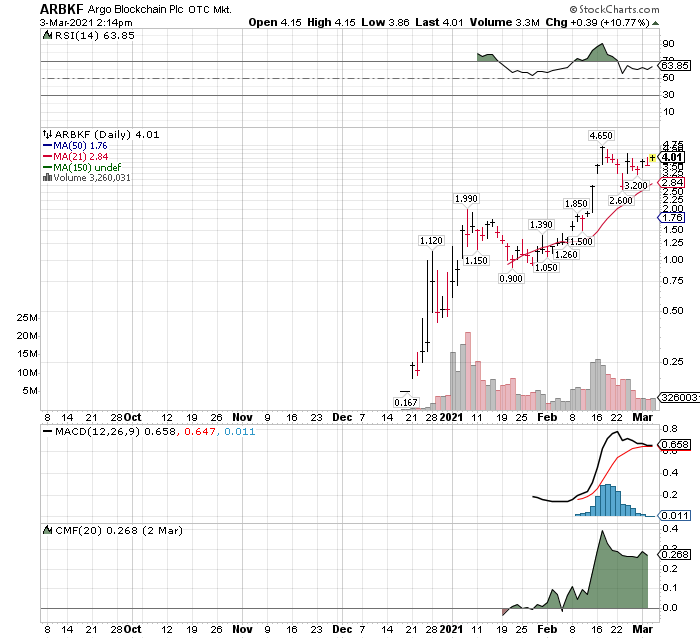

ARGO Blockchain was up listed to the U.S. OTC trading exchange Feb 24, 2021. We don’t want to get too excited about this as the shares have risen significantly in 2021. It does help in allowing more institutional investors the ability to buy and sell shares.

Open Market Purchase of Crypto:

Like a number of companies, ARGO also bought Bitcoin in the open market. In early January, with Bitcoin trading between $30,000 and $36,500, ARGO bought 175 Bitcoins.

Total coins held at January month-end were 501 Bitcoins. ARGO mined 93 Bitcoins in the month of January. In addition to Mining crypto, you will need to add “trading” to the activities of ARGO. They are not actively trading but they are positioning alt coins along with Bitcoins. We don’t know if they are actually trading or holding as treasury currency. Either way the swings are beneficial or harmful to ARGO depending on price direction.

Shares outstanding are 365 million which gives ARGO a Market Cap of $1.46 billion dollars U.S.

Edited version from LOTM Daily Notes, sent email, March 1st:

- Bitcoin rallied after a volatile weekend session, riding a broad resurgence in risk assets and a bullish report from Citigroup Inc. The bank’s strategists laid out a case for the digital asset to play a bigger role in the global financial system, saying the cryptocurrency could become “the currency of choice for international trade” in the years ahead. Bloomberg March 1, 2021 Link

LOTM is changing how we view the Blockchain / Crypto world. We are more interested in owning the companies around Bitcoin & crypto currencies, than in the appreciation of crypto currencies for growth. Bitcoin is still the preferred “digital gold” asset, but we will view crypto currencies as demand & supply driven. We view the companies building DeFi and the infrastructure and supporting systems around Crypto currencies as dynamic and organic growth vehicles. Along this theme Galaxy Digital (BRPHF) is our #1 choice.

We find the following companies as having attractive business plans, rapid growth while still being somewhat reasonably valued.

Voyager Digital (VYGVF) $17.12

Galaxy Digital (BRPHF) $14.62

Mechanical Technology – EcoChain subsidiary (MKTY) $8.70

HIVE Blockchain (HVBTF) $4.26

ARGO BLOCKCHAIN PLC (ARBKF) $3.70

We like these but suggest small initial position if you do not have a position and buy on weakness to build your position. There will be many “sell on strength” opportunities if you wish to sell some or all as these are early days of a ten to fifteen years growth spurt in Blockchain development. Think Internet 1995-99…. Perspective…

Money Management:

It is important to understand our money management process when reading our newsletter. In rising markets, we might own ten companies (example) within our investment theme. If / when a correction happens in the general market, we will never go to all cash as we really don’t have that clear a crystal ball as to what is happening. Our style is to know at all times who our core stocks are. These are companies where the survival of the company is never in question and the valuation or reason/catalyst for owning the company is intact. In the market decline we will sell the non-core or higher risk positions. We will fight hard to not buy too soon, but rather let the core stocks fall, build a chart base or experience a climax selloff. At that time, we will begin spending the money from the sale of the non-core positions and dollar-cost-average into the core stocks. Our core stocks could number as few as three positions down from ten. Mentally, you need to know or believe the core positions are bullet proof as to their survival. This is our coiled spring method of managing risk. By buying more of our core positions and compressed prices, we own a bigger position than any of the individual ten stocks we started with. When the market rebounds our expectation and goal is that we have a large position in undervalued companies that double or triple from the bottom. In doing so, the value of the account rebounds to a high level than before the sell off and in a relatively short time frame. Certainly, shorter than if we hold all ten stocks through the selloff. This is how we manage (bend) time and space in the market. My biggest $$$ winners have come from this strategy. Of course, when buying a company specifically as a non-trading position, they are considered a core-position. Over time, core companies become non-core positions due to many reasons. Company disappointment, our theme changes, there is a better company in the same industry. Adapt and adjust but in a measured and controlled manner. We actually incorporate a hard sell off into our money making strategy.

Have a good day! Tom

Training, Coaching & Mentoring available

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()

Very Informative

Whats you view on

BITK

https://blockchaink2.com/

&

PIRI.L – Pires Investments Plc

https://www.voxmarkets.co.uk/articles/pires-investments-increases-stake-in-pluto-digital-assets–2b76233