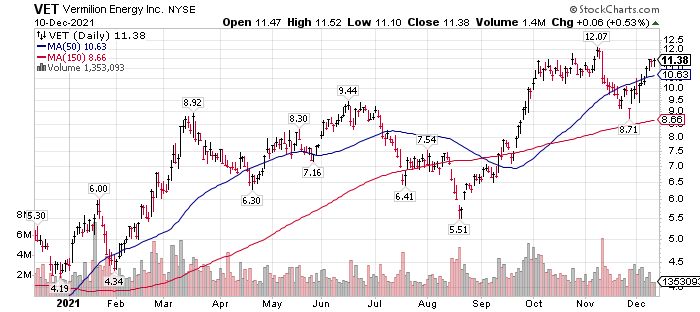

A LOTM: Ten Under $10 for the Double position.

- Cost on addition to Ten Under $10 was $5.49 – Feb 4, 2021

Vermilion Energy comment from Raymond James

VET $11.25

- Vermilion Energy’s greater stake in the Corrib gas field off of Ireland signals the start of a new era for the energy company, according to Raymond James.

- Vermilion agreed to acquire Equinor Energy Ireland for $434M, increasing its stake in the Corrib to around 56.5%. It will add around 23M barrels of oil equivalent of 2P reserves, and is expected to produce around 7,700 barrels of oil a day in 2022.

- “Not only is the transaction greatly accretive to free cash flow and leverage, but it allows the company to restart its dividend plan and ultimately, improve perception with investors as a company that is playing offense vs. defense,” the investment bank says.

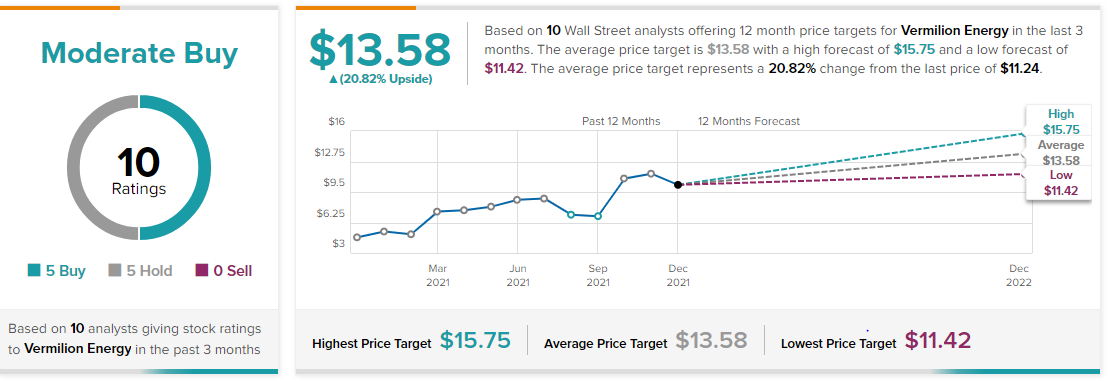

Sourced from TipRanks:

Based on today’s Raymond James news + the reinstatement of a dividend in Q1 2022, LOTM has the opinion that this volatile stock (52 week low was $4.17) is an excellent value (3 times trailing earnings) that will get upgrades from analysts as the 2022 numbers come into reality.

Watch for weakness to accumulate however we have no issue with initiating a new position at the current price as long as your risk reward system is dollar cost averaging. While I do not believe the stick has much downside risk it is an uncertain world we are dealing with. Anything can and does happen. We consider Vet a core holding, hence our willingness to dollar cost average.

The dividend is C$0.06 quarterly. The company has stated that they will consider share buy-backs and a special year-end cash dividend if cash flow allow.

VET is suitable for investors and modest dividend owners. Traders would have an interest to buy on sharp price drops, but would likely get bored by the modest upward trend if purchased at the current price. Speculators can initiate a position and add larger purchases should the share price fall. This is a quality, well-run company, but not well known on Wall Street. It is, however, well known on Bay Street.

From Q3 2021 report linked here

Message to Shareholders

Global commodity prices continued to strengthen during the third quarter which we were able to take advantage of through our internationally diversified asset base. Compared to the previous quarter, global oil prices increased approximately 7%, Canadian natural gas prices increased by 24%, United States natural gas prices increased by 42%, while European natural gas prices (TTF) increased over 90%. Vermilion’s exposure to global commodity prices is what sets us apart from our North American peers. Not only does this global commodity exposure enhance our revenue and cash flow during strong market cycles, but it also serves to reduce cash flow volatility over the long-term.

As a result of the strong commodity prices, we generated $263 million of FFO in Q3 2021, representing a 52% increase over the prior quarter. We invested $66 million in E&D capital expenditures during the quarter, resulting in $196 million of FCF(1) with the majority of that FCF used to reduce debt and the remainder allocated to an acquisition in the United States as well as reclamation and abandonment expenditures.

Based on the forward commodity strip, we expect to generate in excess of $500 million, or over $3.00 per share, of free cash flow in 2021 and exit 2021 with net debt forecast to be in the range of $1.65 billion. Based on these projections, this would imply a net debt to trailing FFO ratio of approximately 1.8 times which is well ahead of the original net debt target that we had at the beginning of the year as stronger commodity prices have enabled us to accelerate our debt reduction.

We now have a clear line of sight to achieving our targeted debt to trailing FFO ratio of 1.5 times or less in 2022, and with that we plan to reinstate a dividend in Q1 2022. Although it is still subject to board approval, our intention is to reinstate a fixed quarterly dividend (5-10% of FFO stress-tested at lower prices including US$55/bbl WTI) while continuing to focus on debt reduction. As further debt targets are achieved, we will consider augmenting our return of capital through fixed dividend increases, share buybacks and/or special dividends. We will provide more details on our return of capital framework with our formal 2022 budget release in early December.

You can Read, you can watch Videos, but nothing beats Personal Interaction for accelerated learning.

This game has levels of understanding that could take a lifetime of Trial and Error to learn.

Available for Coaching, Training or Mentorships

Contact Tom through the LOTM website or by email

Rate: $150 per hour / Monthly Retainer, Lowers Rate

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()