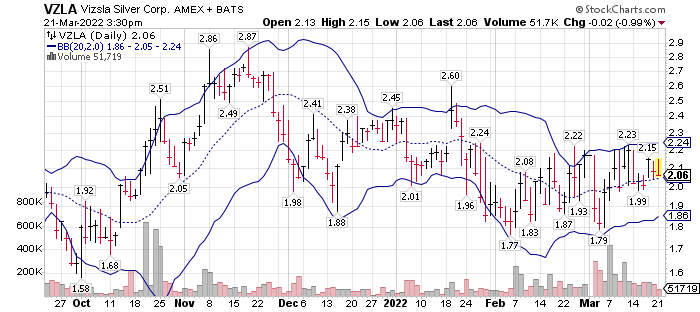

Accounts related to LOTM have owned Vizsla Silver $2.13 since the fourth quarter 2020. It is one ofour favorite silver exploriation companies. Our entry price in 2020 was $1.06. We gave added slowly but consistently since 2020. Exploriation results are proving up Vizsla as one of the biggest silver prospect districts in the world. The company is still exploring and developing the property. Meet Vizsla management interview with Influencer “I Love Prosperity” linked here. The team controling Vizsla is a global operation with a long history on multiple success. Very High grade for the management team.

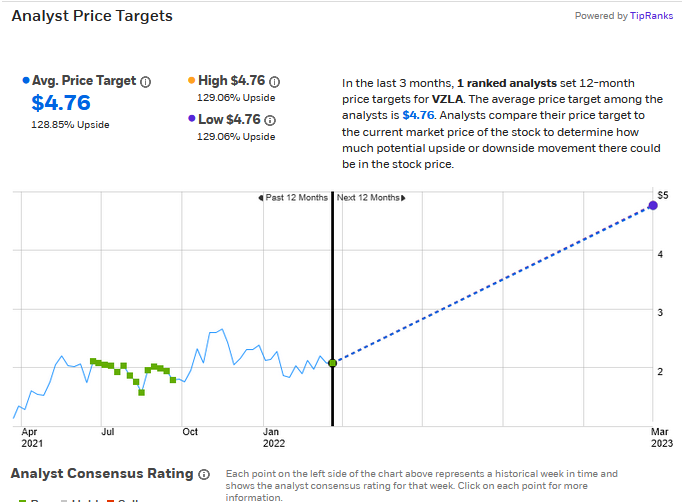

The price target mentioned in TipRanks below is from Canacord Genunity was Issued March 18, 2022. This might be in Canadian dollars I cannot confirm American or Canadian. Adjusted for an USD the price is $3.78.

High grade core samples have been consistent discovered over the past eighteen months. Estimated reserves, after a recent downward revision are 106 million silver equivalent ounces.

Comps: Multiple 106 million ounces times the $25 ounce price of silver and the number is $2.6 billion in reserves. Vizsla’s market cap is about $308 Million. Enterprise Value is about $250 million. That is a very good price on an asset that is also an inflation hedge and a high demand industrial metal.

From TipRanks:

From TipRanks:

The price target mentioned in TipRanks above is from Canadian based, Canacord Genunity, was Issued March 18, 2022. This might be in Canadian dollars I cannot confirm American or Canadian. Adjusted for an USD the target price is $3.78.

High grade core samples have been consistent discovered over the past eighteen months. Estimated reserves, after a recent downward revision are 106 million silver equivalent ounces.

Comps: Multiple 106 million ounces times the $25 ounce price of silver and the number is $2.6 billion in reserves. Vizsla’s market cap is about $308 Million. Enterprise Value is about $250 million.

Vizsla is considered a core holding. We’d certainly sell some shares into sharp rallies but be aggressive to buy back more than we sold on corrections.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()