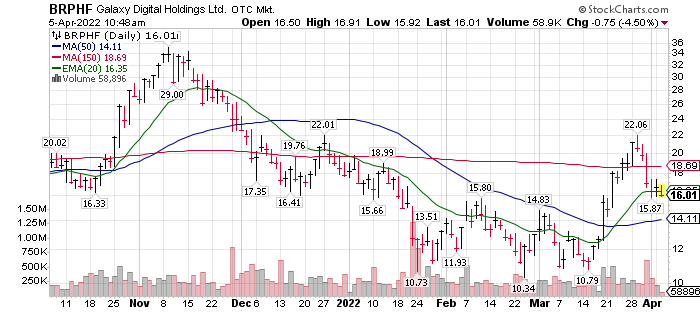

Looks Like a Cup & Handle Chart formation – Typically a bullish chart pattern

Galaxy “the company”, is doing amazing – and being a start-up in 2017. Consider these numbers:

Net Comprehensive income increased 345% to $1.7 billion versus prior year

That is income – not revenue!

The share price is inexpensive at a trailing earnings P/E ratio of 4.5

The reason the stock is not in play is that they are behind on getting listed in the USA. Originally scheduled for Q4 2021, pushed back to Q1, 2022 and now pushed back to between now and Year-end 2022. Listed in Canada, the transition to the USA listing is well behind schedule. This delayed listing is holding institutional buying in check. Many Institutions cannot buy Pink Sheet OTC stocks (current listing) or Foreign listed stocks. It is also holding back firms like Goldman Sachs, JP Morgan, Morgan Stanley and Citigroup from writing research on Galaxy. Why are these companies specifically mentioned in relationship to Galaxy? These are the four biggest clients of Galaxy’s 600 plus institutional clients. They know Galaxy very well. I have no doubt that after a listing in the USA, some or all of the mentioned brokers will write research on Galaxy. A good number of key employees at Galaxy are former Goldman Sachs partners. Galaxy is connected.

LOTM views Galaxy as “the” world leading Institutional Investment Banker for Blockchain Tech

So, what is holding up the listing in the USA? The short and sweet answer is the SEC and Accounting rules. Blockchain/Crypto is a new industry and technology. There is no adversarial relationship between Galaxy and the SEC. Rather, Galaxy and the SEC are working together to define the accounting framework to address this industry. This comment was expressed in the most recent conference call on Fiscal year-end 2021 results. It appears it is timing rather than SEC resistance to listing Galaxy in the USA.

The current trailing P/E is 4.5. With a listing in the USA, Galaxy could easily carry a 10 to 12 trailing P/E ratio with a USA stock listing. Multiple the current stock price by the higher P/E ratio and the stock moves from $16.50 to $40 to $50 area. Obviously, that is my prediction not assurance.

As investors in Galaxy, we are waiting the listing in the USA as the catalyst for higher price on Galaxy shares.

Press Release Headline:

Galaxy Digital Announces 2021 Financial Results

7:00 AM ET 3/31/22 | Dow Jones

Net comprehensive income increased 345% to $1.7 billion versus prior year

Partners’ Capital increased 226% to $2.6 billion versus prior year

Assets Under Management (“AUM”) increased 256% since Q4 2020

Galaxy remains committed to listing in the U.S. and closing the BitGo acquisition

NEW YORK, March 31, 2022 /CNW/ – Galaxy Digital Holdings Ltd. (TSX: GLXY) (“Galaxy Digital” the “Company” or “GDH Ltd.”) today released financial results for the year ended December 31, 2021 for both itself and Galaxy Digital Holdings LP (the “Partnership” or “GDH LP”).

“2021 was a transformational year for both Galaxy Digital and our industry. While providing shareholders a net comprehensive income of $1.7 billion for the full year 2021, we also grew headcount over 200% to support continued growth across all our businesses,” said Michael Novogratz, Founder and CEO of Galaxy Digital.

Full press release linked here

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()