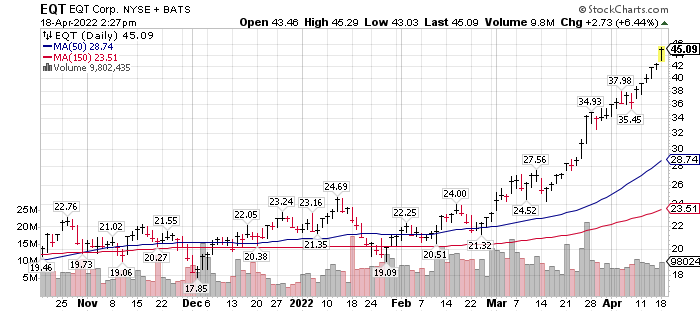

Pretty hot stuff, EQT*, like gas on fire.

Impossible to say where the price of EQT* will top out. Certainly, a big move, but still a behind the industry when comped to the larger stock price moves of other Nat Gas stocks that have been running since November 2020. EQT was a laggard as they purchased four Nat Gas companies and the loss through the purchase and integration period was not appreciated. Now those acquisitions are converting to cash flow and the market is excited about the story.

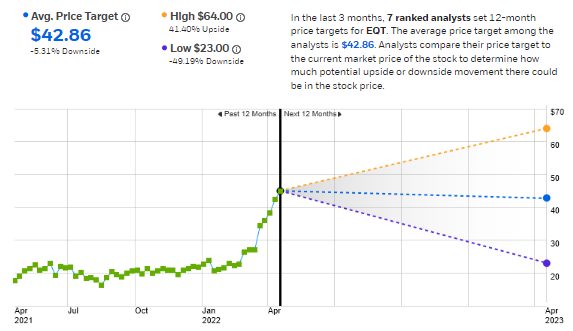

TipRanks is starting to raise price targets but please realize that analysts for the most part, are followers more than leaders when it comes to price targets.

One of our desired investment themes is to look for Bottlenecks between demand and supply. The Bottle neck in this case is the US Government. As long as the government has a Environment first People second the price of Nat gas will remain strong. The clear sell/exit for this energy sector will be when the US Government shifts to an increase production for lower energy prices policy.

EQT operates in the Marcellus area. As long as there are disincentives to produce oil and gas, EQT and companies like EQT are happy to sell their current supply at the higher prices, but they are unlikely to drill for more reserves thus producing higher prices. Under Capitalism the cure to higher prices is higher prices.

Bottlenecks mentioned in the article below are highlighted in red.

- From a “Let’s make money” perspective, bottlenecks are good things!

Investors can be looking for Bottlenecks as Investment Opportunities.

FROM SEEKING ALPHA

Natural gas +10% Monday, +100% YTD, as Marcellus production remains restricted

Apr. 18, 2022, 1:39 PM Seeking Alpha Staff and Link

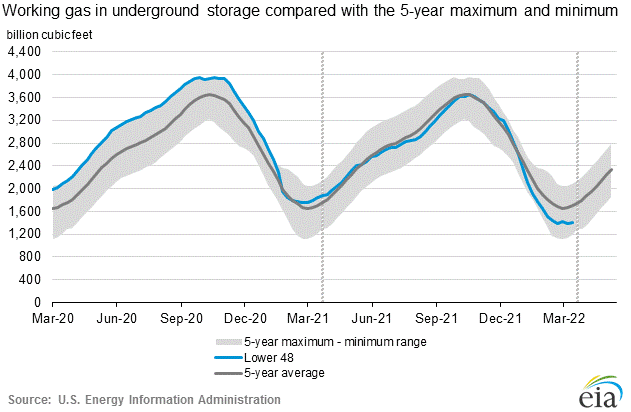

- Natural gas prices (NG1:COM) hit another 13-year high Monday, rallying 10%, as rising demand and restricted production continue to pressure inventory levels.

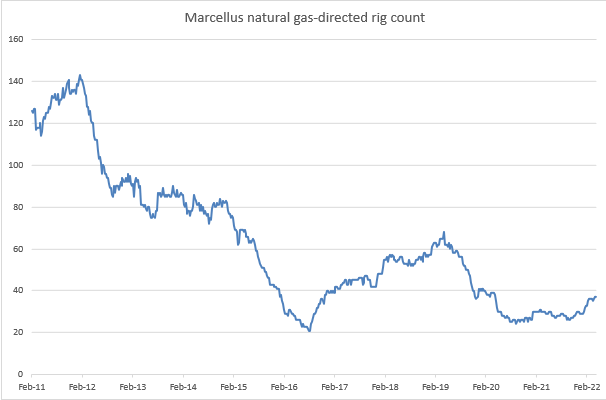

- Following Duke (DUK) and Dominion’s (D) cancelation of the Atlantic Coast pipeline in 2020, a pipeline planned to connect the world’s most prolific natural gas basin to new end-markets, RS Energy Group anticipated pipeline capacity would restrain Marcellus gas production by 2022.

Despite historically high prices, rig counts in the Marcellus have continued to languish:

- The Mountain Valley Pipeline is planned to increase Marcellus market access and is scheduled for completion this summer; however, Equitrans Midstream (ETRN) said in February that the project would likely miss its target in-service date, following a series of adverse court rulings.

There is nothing in the comments above that mentions, Russia or Ukraine for the higher gas price!

Therefore, it is a safe assumption that until our government encourages production, price will remain high.

That is not a political statement – that is a basic investing opportunity.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line

![]()