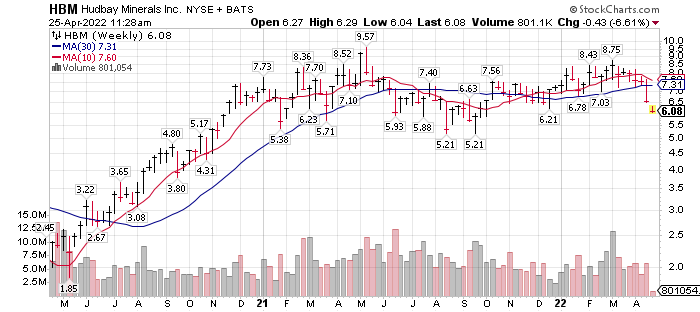

Two-year weekly chart:

Technically, the shares are oversold. Doesn’t mean it can’t go lower. Looking at the low of $1.85 in March of 2020 and the follow-up rally to the $8.50 area, the price has traded sideways in a consolidation pattern for more than a year.

Technically, the shares are oversold. Doesn’t mean it can’t go lower. Looking at the low of $1.85 in March of 2020 and the follow-up rally to the $8.50 area, the price has traded sideways in a consolidation pattern for more than a year.

The demand for minerals especially copper will accelerate in coming years as the trend to go electric in all things grows. We don’t have enough copper to go green but that has yet to be discovered by law-makers legislating the go green movement. Therefore, this is both a fundamental demand and priced at a technical support valuation to warrant purchasing.

Analysts:

Reported by TipRanks – In the last 3 months, 7 ranked analysts set 12-month price targets for HBM. The average price target among the analysts is $10.99. Analysts compare their price target to the current market price of the stock to determine how much potential upside or downside movement there could be in the stock price. A high target price of $12.95 and a low target price of $9.81 gives a upside goal of 61% to 130%, based on analysts estimation.

Stats:

Forward P/E ratio is 5.53

Shares outstanding are 261.6 million

Market Cap is $2.46 billion

TTM revenue is $1.89 billion

Book Value is $7.10 per share

Net Debt is $986 million

Total Assets are: $4.6 billion

Average daily trading volume is 1.3 million shares

Worth more dead than alive, but that is a marketing phrase old stockbrokers use. We don’t want them dead – they are too valuable alive. Never the less, there is some comfort in saying and thinking that.

Website: https://www.hudbayminerals.com/

Seeking Alpha headline from a year ago:

Hudbay Minerals’ Q4: Riding The Positive Copper Price Wave

Feb. 20, 2021

Summary

- Hudbay Minerals produced 60.1 million lb copper, 32,376 toz gold, 57 million lb zinc, 731,000 toz silver, and 734,000 lb molybdenum in Q4.

- The AISC declined to $2.16/lb copper.

- The copper, gold, silver, and molybdenum production should increase in 2021; however, the AISC will most probably remain high.

- The chart is looking good; further upside is possible if copper prices remain strong.

Copper price April 25, 2022:

Prices are down for commodities at the moment due to expanding covid lockdowns in China. This reason is fleeting. Fear of a recession in second half 2022 and into 2023 is being priced into the market as well. My suspicions are that “market” interest rates (ten year treasuries) are peaking or will soon and this will give us a stock market rally into the mid-term elections. Still some uncertainty but longer-term we will need lots of copper and silver for electricity and electric Vehicles.

Written by Tom Linzmeier, April 25, 2022.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()