It is a very brutal day today Monday May 9th.

Things that can help mentally:

- Did the news change at the company? Stock prices are real, but they are also a reflection of investors emotions. That is why the annual trading range for most stocks is 100% price change, low to high. Buy low / Sell high or higher. If you are buying companies Vs only watching price movement, adding to positions on lower prices is the smart thing to do.

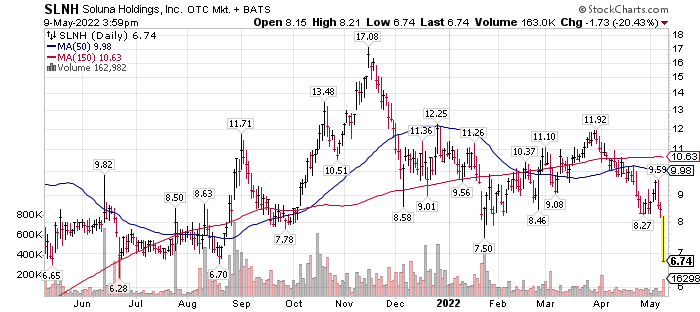

- Do some buying now for tax loss selling later. No need to sell a position and look for a new stock idea if you are in good companies. Soluna (SLNH)* as example. The 52 week low to high was $6.28 to $17.00. It is now $7. The company will have a blockbuster year in 2022. News of this will get stronger in the second half of 2022 and first quarter of 2023. Shares bought now at $7.00 and below will be a short term gain for 12 more months. You want to put in time holding them to get a long term gain. You may have bought some shares at a higher price in the second half of 2021 or earlier in 2022. Watch for the 12 month short-term expiration date. The shares bought now can be the replacement shares sold in the future from the higher priced lot, sold at a loss. Odds are very high SLNH will rally in the next twelve months. When I am position building and using tax loss selling, in a company, I like to buy first and sell for a loss second. Who knows -maybe they will get a buy-out offer between now and selling for a tax loss. That is not likely in the case of Soluna, but I want every chance to get lucky!

- Again, using Soluna as an example. If I buy now at $7.00, getting a double isn’t even getting back to its high price of the last 52 weeks of $17! Why do I need to find a new idea to get a double. Soluna’s revenue could be up ten fold in 2022 Vs 2021. Personally, my longer-term price goal is still above $30.00. Focus and concentrate on what might be – based on numbers. It might not happen, but based on numbers, $14 is not a dream. In my view it is highly probable. How many companies increase revenue 10 fold, one year to the next? Not very many is the answer if you are wondering.

Treasure Yields:

Watch 2 – 5 & ten year treasury rates for a decline. Odds favor a back off in interest rates will cause a positive reaction in stocks. A bit of who’s the fastest gunslinger event, but we are all looking for a signal for a better market.

Good Luck! Don’t let the market get to you! Day follows night and night follows day. Cycles are forever. Use them – don’t fear them. My disclaimer is only that length of the cycles is harder to forecast.

Favorite Blockchain/Crypto companies are pretty much the same:

Top Three:

- Soluna Holdings (SLNH)*

- Galaxy Digital (BRPHF)*

- Bakkt (BKKT)*

Emerging Market (Brazil) Payment companies that will be using Blockchain technology:

- StoneCo (STNE)*

- PagSeguro (PAGS)*

Have not changed my opinion. Building on positions when I can add shares.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()