- Morgan Stanley is calling for a rally in a bear market for the S&P 500 – 3,400 ultimate target.

- Goldman Sachs down-side Target for S&P 500 3,600

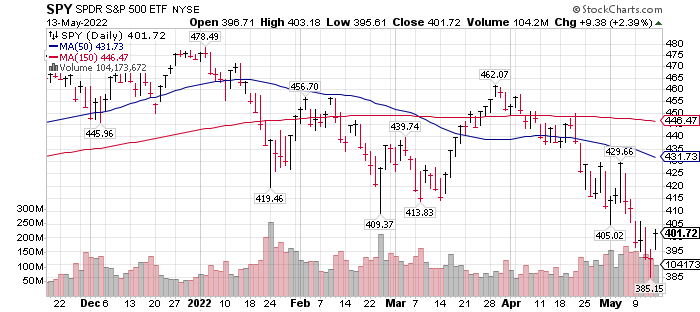

Five-month daily chart of SPY (1/10 S&P 500)

Text book trend-following – price is below the trigger indicating moving averages (MA) of 50-day and 150-day.

Rally in a Bear Market, 3,400 S&P downside target – Morgan Stanley? S&P down-side target 3,600 – Goldman Sachs?

It sounds like negative sentiment is in the market and we no longer have a buy the dip sentiment. That is a good sign. Over all I am not so positive on the market myself, but it is good when the headlines are negative, that we might be closer to a low than a high. Fear first comes before a bottom. Panic brings the bottom. We had some panic last week. Enough panic to set up the potential for a 5% to 8% rally. It is unlikely the SPY will get above it 50-day moving average without first a test of the lows last week.

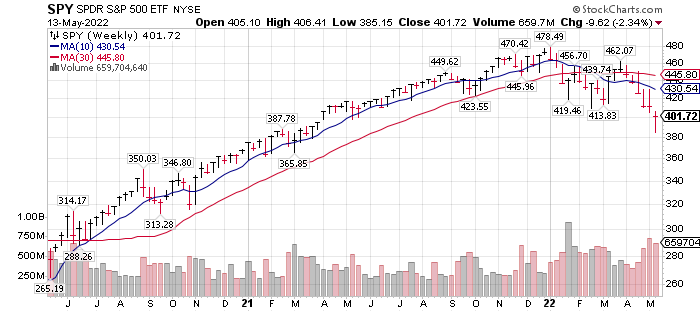

Let’s view the weekly of the two-year chart below. Close enough to the March 2020 lows to cover most of the rally off the lows and the peak of the rally and now the stage four decline.

Two-year weekly chart

Watch for a rally back to the 50-day moving average. Probable resistance at the 50-day MA or before it gets to the under-belly of the 50-day MA. It is normal to expect a correction of the lows near the 390 to 400 area (last week lows) of the SPY. Unknown if we will break to the levels mentioned and referenced above by Goldman and Morgan Stanley. Those are certainly real targets.

If it is the market low, near 390 / 400 on the SPY, we can expect some sectors to be in rally mode even as the market as measure by the SPY (1/10th the S&P 500) is testing the lows. They don’t make it easy, do they. Some market pundits are saying we have to wash out everything to reach the final lows. Right now, oil and gas are one of the best performing sectors.

Consider the process: we have to cause a recession bad enough to break the high prices of oil and gas in order to break the back of inflation. For all the pain this is going to cause with declining or crashing stock and bond markets, bad crypto market, small and medium sized business going under or struggling, employment layoffs and high mortgage rates, wouldn’t it be better to increase the supply of oil and gas (we have plenty) and reopen or complete the building of pipelines? Nothing the United States does is going to impact global climate change. And that is the science. Meditate on that.

Have a great week. Written Sunday, May 15, 2022, by Tom Linzmeier

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()