The market is under intense selling pressure as witnessed by the 1,100 point drop in the Dow Jones average on Wednesday.

A logical and systematic approach to the lower stock prices would be to dollar-cost-average (DCA) when “the market” is in a correction phase for prices – if you believe the companies will survive and prosper in the future. Bear markets are opportunities to downsize the number of positions and add to the smaller number of held positions that are healthy enough to be the survivors of the bear and leaders in the next bull market. This is a foundational opportunity to set the stage for the next big advance. The key – “Know Your Company” so you can judge the risk/reward they present.

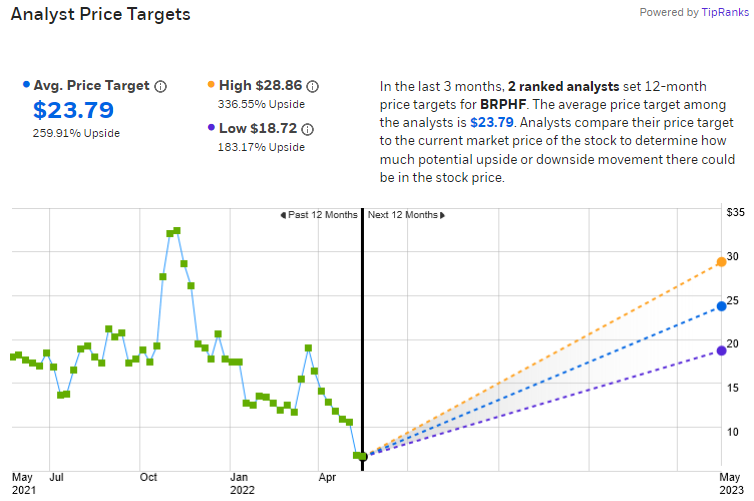

Galaxy Digital (BRPHF)* $6.61

I have not seen analysts lower price targets in spite of the sharp price decline. Galaxy is a company that LOTM has chosen to own regardless of the price decline due to a bar market. LOTM has always said we are committed to Galaxy as a company no matter how low the stock price. If you believe blockchain and crypto is the face of the next technology wave, Galaxy is the leading institutional investment bank engaged in blockchain and crypto. From TipRanks May 17

TopNewsGuide: 5 Fintech Plays for “Undervalued” by Mark McKelvie, TopNewsGuide

Wells Fargo ‘s Jeff Cantwell says the time to buy fintech stocks is now – Cantwell sees a $1.5 trillion growth market for fintech. Fintech, which boomed during the pandemic, but slid with the recovery. This is why Cantwell believes the sector is undervalued and says, “this discount won’t last forever, investors should grab them (fintech stocks) now.”

- Complete article is in linked in the headline.

LOTM: The headline story is about five Fintech Ideas by Jeff Cantwell of Wells Fargo. StoneCo (STNE)* was one of the five ideas. There are a number of FinTech ideas LOTM is considering adding to our holdings, however at this time, we are focused on PAGS and STNE as having depressed in prices but doing well.

Others we are considering but don’t want to dilute our concentration of positions on at this time include GreenBox (GBOX), 2.45, Bakkt (BKKT)* $2.66, Marqeta (MQ) $9.29.

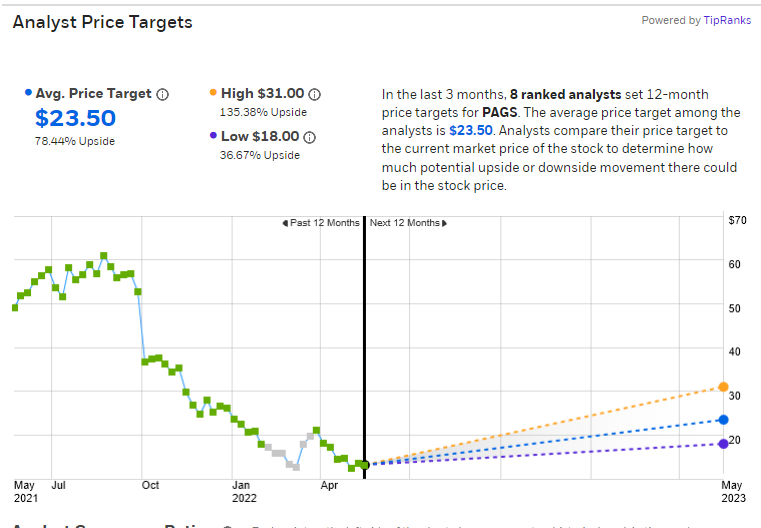

PagSeguro (PAGS)*

The same is true for PAGS as Galaxy above. PAGS is a different industry but similar story. The “company does not seem to be in danger of going away. Business though going through a lumpy period, is solid and better valued than its US comrades, Block (SQ) $86.92 and PayPal (PYPL)* $79.48. Technically speaking, I am of the opinion, PAGS and StoneCo, below, have seen their lows of this bear cycle and their test of the lows for this cycle. Just an opinion. DCA your way methodically through the mine field.

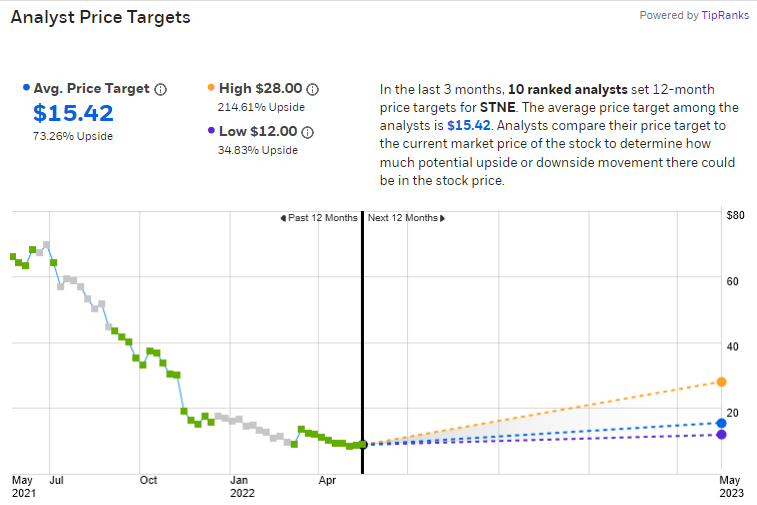

StoneCo (STNE)*

Same comment as PAGS and Galaxy. Company seems more than fine. Company pre-announced Q1 ’22 revenue and earnings will be up more than 100% Vs the prior year’s, Q1 results.

From Wells Fargo, Analyst Jeff Cantwell: StoneCo Ltd (NASDAQ:STNE) – There are now plenty of fintech companies that investors could consider looking into as the sector continues to grow and one of those is StoneCo Ltd stock. The company is involved in providing software solutions and financial services for merchants who operate in Brazil.

There has not been any news about the company this month so far but back on April 26 it had announced that it had made more changes to its board. StoneCo noted that the changes had been made in order to ensure that the next phase of growth went smoothly for the company.

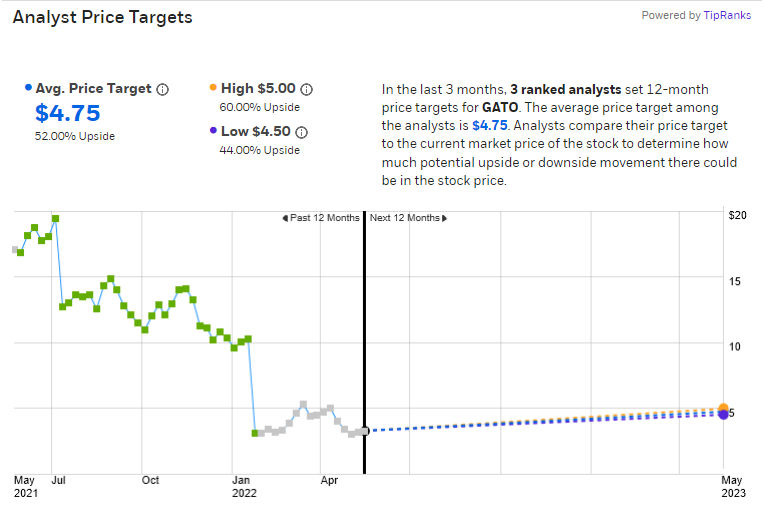

Gatos Silver (GATO)* $3.15

Gatos is going through a “bad press” period. I say bad press because IMO, the market has punished Gatos shares more than the news is bad. I see this as an opportunity. Estimated reserves have been put into question with the possibility of a 35% to 50% lowered asset reserve amount. Current operations are performing at record levels, however. It is my belief based on 1) a 30% Ownership by a financially strong and very successful mining history, involved in many resource companies, Thomas Kaplan (Electrum Gp) 2) only 20% of the current working property is explored in an asset rich district, 3) It is unknown at this time if the lower reserve applies to total assets or impacting one of the mineral groups, zinc or silver. IMO, there is a lot of room for positive surprise. Worst case would be a shorter life of mine, but no impact on operations today.

These are four companies in the three industries LOTM has taken a stand, in for surviving this bear market. Blockchain/Crypto – FinTech/Payments industry and Precious Metal/Battery Metal miners.

FinTech/Payments:

Underneath the sell-off May 18, was a firming of prices within the FinTech Industry. Most of the industry was trading higher in the morning with the Dow Jones down 500 points. As the market caved into selling in the afternoon and dropped an additional 600 points, FinTech stocks gave up their gains and slipped to negative pricing. The sell off in FinTech was mild and without panic. Hence our view that the lows are in, and we could have a very nice rally back in FinTech.

Metals:

Multiple automakers just announced their time targets to be 100% electric. 2030 to 2035 was the timeline range. Fact –

- GM to go all-electric by 2035, phase out gas and diesel engines

- Every Automaker’s EV Plans Through 2035 And Beyond

There isn’t enough mining capicity over the next five to ten years to provide the needed amount of Copper, Silver, Nickel, Lithium and other battery metals needed to meet the demand required to achieve these goals. Classic bottle-neck – metal prices are going to stay strong even if choked off by misguided government policy to crush the economy as a way to stop inflation. Volatile yes but use that downside volatility to make a lot of money coming out of this opportunity to buy low.

Precious Metals – we will have inflation for another five to ten years by design. The Federal Reserve and Treasury wants inflation as a tool to increase asset values to balance out the high levels of debt. Gold and silver miners as well as owning physical gold and silver will do just fine over the next three to five years.

Blockchain / Crypto.

Today the SEC announced they would classify crypto as securities. New regulation. Bitcoin would fall under the Commodity regulatory system. Short term this might seem a negative but longer-term this is a very big positive. It opened the door for instutions to own crypto.

- Chairs from the SEC and CFTC talk crypto regulation at ISDA meeting

- Russia will inevitably legalize crypto payments says trade minister

Crypto and Blockchain technology will be regulated, yes. That is not a negative. This is the door way into institutional acceptance and blockchain application.

Blockchain has the fastest annual compound rate of growth in human history at 112%. It is twice as fast as the previous fastest annual compounded growth industry – The Internet. Can you afford not to have a position in Blockchain?

Written by Tom Linzmeier, editor May 18, 2022.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()