- Soluna Holdings (SLNH)*

- EQT Corp (EQT)*

- Frontline (FRO)*

- Vermilion (VET)*

- Galaxy Digital (BRPHF)*

- Calumet (CLMT)*

- Karora Resources (KRRGF)*

- LOTM is going behind a pay-wall

Soluna Holdings – a Ten Under $10 for the Double position – a ten-x position at the current price.

Operations are solid. In terms of power used, Soluna ended

- 2020 used 3 Mega Watts of power

- 2022, Jan 30, using 53 Mega Watts of power

- 2022, Dec 30 projected utilizing 153 Mega Watts of power

- Letter Of Interest signed for 1,100 Mega Watts backlog.

If Soluna averages 200 Mega Watts of newly added Mega Watts per-year, they have 5.5 years of back-log. Balance sheet is strong. Management owns about 30 percent of the company and is loath to dilute the stock or load themselves up on debt. Best shareholder friendly I have ever seen. The price could be volatile, but the company is growing and in great position for future growth. Accumulate shares now and on weakness is our view.

EQT Corp (EQT)*

Our theme has been to own Commodities with Nat Gas, Base and Precious Metals as targeted areas within commodities. EQT is trading at about 8 times forward earnings with expanding cash flows projected for the next three years. EQT is the United States leader in Natural Gas production. We are well into a stage two chart pattern. Buy 10% pull backs. It will be on negative fossel fuel headlines so expect that if it happens.

Frontline (FRO)* a LOTM: Ten Under $10 for the Double position.

Frontline price per share has added about 23.6% since the beginning of the year vs the S&P 500’s decline of -18.2%. this is a trans continent shipper of oil. Not a stable industry but with the current disruptions in the sourcing and transport of oil, a high demand service. FRO has a history of paying large dividends in good times and no dividend in lean times. I expect from what the company has said the cash flows will be strong over the next two to three years and I am projecting a dividend will be distributed. This is a very tradable stock and appears to be extended. Consider selling call options. We think a longer term position will be rewarded.

Vermilion (VET) A LOTM: Ten Under $10 for the Double company.

A sleeper company. Canadian, so it is not closely followed in the US market. Trading at about 3 times forward earnings, this Oil and Nat Gas producer has production fields in the North Sea and in eastern Europe. They have direct access to selling into higher prices of Nat Gas in the EU. The company is healthy and projecting strong cash flows, debt reduction, increasing dividends and share buy backs. LOTM Ten Under $10 is up four-fold since we added this to Ten Under $10, for the Double. We think there is another double in the shares from the current price.

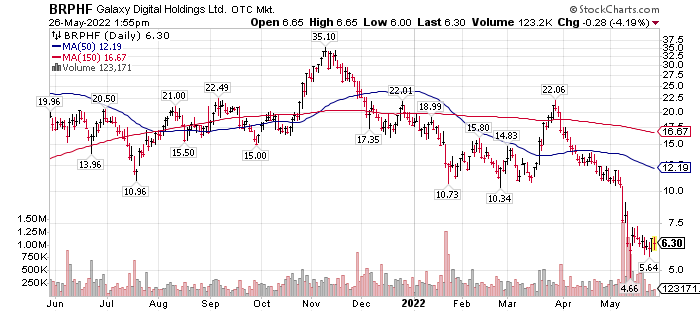

Galaxy Digital (BRPHF)*

Unfortunately, the Terra Luna crypto collapse in April/May hit Galaxy hard. They were exposed to Terra Luna through direct ownership. Galaxy said the were fine with liquidity and operating units were positive cash flowing. Management said they were beginning a 10% of floating shares buyback. This will take time to regroup. Personally, I am a over-the-top believer in Blockchain. I still believe Galaxy is the institutional leader for investment banking in the world. I will likely do some buying and selling to manage the position but as of now I have no reason to leave the position. Stuff like this happens in bear markets. Of note is a comment yesterday by JP Morgan, stating they preferred Bitcoin over Real Estate as an alternative asset at this time. Surprised me greatly. JP Morgan is a client of Galaxy. Buy slowly is our comment. The “slowly” because we think a base building period is needed before the shares rally. Positive news could explode the share price as it is well known in institutional circles.

Calumet CLMT)* a LOTM: Ten Under $10 for the Double company

Lots of good news at Calumet for bringing on stream its Bio-refinery in Q4 2022. Big projections for cash flow improvement when that happens. Expect a growing dividend. I seen multiple hedge funds talking a $50 to $60 price target in three years. Calumet is in a good position – low refinery capicity nationally will keep supply of their refined product in short supply. Well, positioned as a inflation positive investment with a growing dividend. Currently it is at $0.01 per month. The increases will be slow but real and as a percent , one penny increased to two pennies per month is percentage wise a nice start. Stock looks like it has bottomed out.

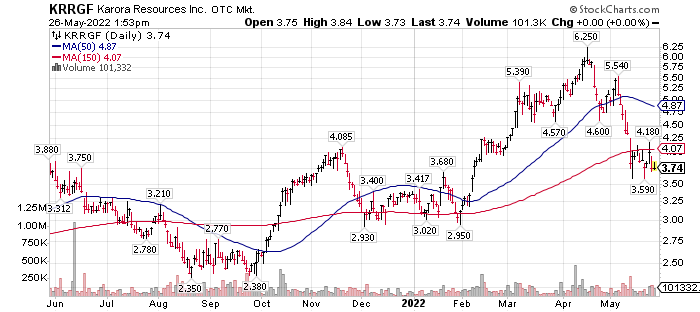

Karora Resources (KRRGF)*

I can’t say enough good things about Karora. A top pick gold miner globally for LOTM, and an over-weight LOTM: Ten Under $10 for the Double choice. Multiple cost points in Ten Under $10, with the lowest around $2.56. Grams per ton are increasing in their production. A second product, Nickel is being added to their profile from local owned claims. Could not think of a better mineral to add. They just bought a second processing mill which will increase their through put. From current operations they are projecting a doubling in production between now and 2024. Not sur if that is early 2024 or end of 2024. Roughly they project, production going from 100,000 ounces of gold equivalent (GE) to 200,0000 GE. News releases for Karora linked here. The price seems attractive at its current valuation. P/E going forward is about 6.

LOTM is going behind a Pay-wall.

- Starting June 14, 2022, LOTM will beginning charging for the newsletter.

Researching and writing with little interaction or feedback isn’t very rewarding. We are creating two levels of service. LOTM will never be a mass market news letter so we will work with a tightly focused them of finding overlooked value stocks that can double or more in price and dividend stocks with upside potential.

Level One is the newsletter only. The cost is $273, one time payment for an annual subscription.

The price was a result of pricing a medium sized, fresh cup of coffee at Starbucks. It is $2.10. I multiplied that by five days and again for 52 weeks in the year. I divided that total in half and came up with $273. If I am not worth two to three cups of coffee a week to readers, I have to question, why am I doing this? Simple logic.

Our goal is to identify stocks that could double and serve them up to you. That is our goal when boiled down in the simplest of terms. We have had many doubles or more in the time we have been writing from August 1, 2020, to present. We have a process. We don’t see any reason it is ending now in the current environment.

More on Level Two shortly. It will revolve around two themes. Let’s Make-a-Million$ for compounding to wealth and Cash Flow with Dividends & Options Sales. For those of you interested, I will work with you one-on-one to help you reach your goals.

I wanted to get this announced. Time for sharing thoughts questions and comments after the Holiday. Enjoy the weekend! Tom

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

.

![]()

Hello Tom,

I have subscribed to your newsletter off and on for more than decade. I have been wondering why you have not been charging for it lately as you provide valuable information and insight. I will be more than willing to pay for it. A number of years ago I was able to turn $2,500 into $9,000 within about 2.5 years, primarily based on the information from your newsletter. Unfortunately, a health issue forced me out of work and I needed to use the funds to hold me over until I could retire at 62.

Up until recently, I have considered my small-scale trading to be more recreational and a learning experience than a serious pursuit. However, at 65 and now in very good health, I am committed to put more time, energy and money into investing/trading, and your newsletter will be at the core of it all. I always look forward to your emails.

Apologies for not communicating with you sooner.

Don Black

P.S. I first learned about LOTM while attending two of your seminars at the Learning Exchange in Sacramento. I recall you mentioned canoeing the Boundary Waters. I spent a week paddling the BWCAW with some folks from St. Paul. It was one my favorite-ever adventures. Lots of great memories!

Pingback: LOTM: Ten Under $10 for the Double, June 5th, 2022 -