Traditionally, analysts issue something like a Buy, Sell or Hold opinion. Analysts don’t want to make enemies of Management teams for the companies they follow or be cut off from the ability to contact the company at will. Therefore, they rarely issue a sell opinion. So, we can assume a down-grade to a Hold, is the same as a Sell.

This is where I am coming from with Galaxy. A hold opinion doesn’t exist (for me), so I am either a buyer or a seller. No “fence sitters” allowed, haha. If you like the story well enough not to sell, be a buyer or waiting for a buying opportunity. If you don’t like the story enough to buy – then sell.

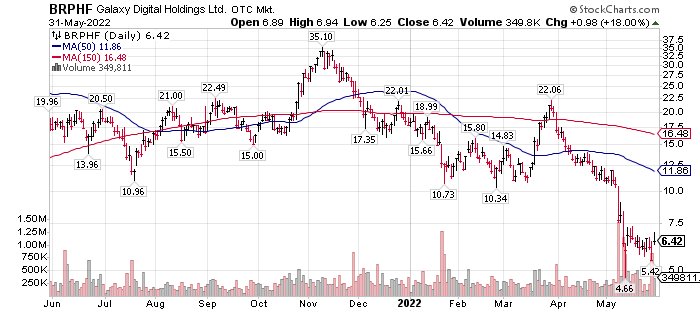

Sometimes we make things more dramatic than it needs to be. A long-time ago, as well as in the last two weeks, I said I am a buyer of Galaxy all the way down. I still hold that opinion. If analysts are going to down-grade their opinion of a company, it is usually right after an earnings announcement. Earnings were announced May 9, 2022. Three weeks have passed and no downgrade. The company said they are ok with corporate liquidity, and they approved a 10% share buy-back of the Float. That does not mean they will do a buy-back. Sometimes management does get political and tries to shape opinion.

Yes, there is the potential for negative developments. Perhaps the buy-out of BitGo will not happen because the price of Galaxy has fallen so deeply. Perhaps the SEC will not approve the US exchange listing. Perhaps there is another shoe to drop in Crypto-Land.

In the game you and I have chosen to participate in, there are no odds in right or wrong decisions. We will always be wrong and right. Assuming we do this a lot and by chance we should be 50/50 in initial stock selection. Hopefully better than 50/50. We can increase the probabilities of success by letting the winners win and managing the position for cost and taxes. Understanding the Company is key in this approach.

- Buy good to great companies. Good to Great is not assured nor limited to brand recognized companies.

- Dollar-cost-averaging or using stop-losses makes a big impact on results. Use risk management of some kind.

- Lengthening the time, we are willing to own the position increases the odds of success. Note – dollar-cost-averaging shortens the time of holding by lowering the cost basis.

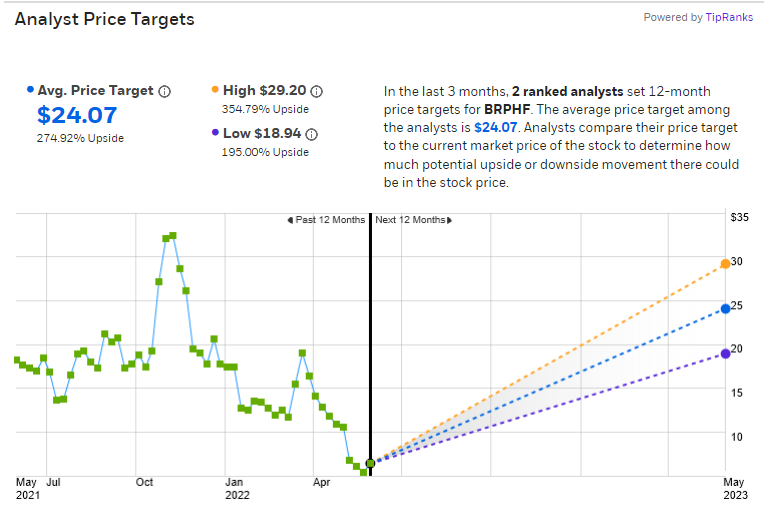

With Galaxy at its current price of $6.45, the percentage returns on projected targets look attractive.

More stock Ideas / Less strategy

LOTM will change its focus slightly and spend more time on presenting stock ideas, large cap and small cap that we believe can double or more in six to 24 months. If we have to manage the position like Galaxy, we want to get a double or more in four-years, that in simple math is 25% annually not compounded.

I have noticed that the articles that focus only on stock ideas get more readers than strategy comments. If you have a view on this, send me an email. We are looking for exceptional value &/or growth much faster than inflation. A catalyst for drawing institutional attention.

A potential for a double in stock price in less than 24 months is the goal. LOTM will feed you our best ideas. You have to put the puck in the net. This is the Level One subscription.

There will be a Level Two subscription for anyone who would like more than just ideas. Training, Coaching or Mentoring is available to get you to your goal, whatever that might be. We will focus on Ten Grand to a Million$ and High Dividend Payment Ideas as tighter themes to put some structure on Specialty Coaching programs we offer.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()