LOTM: Comment on Soluna, Galaxy Digital and more…

- Soluna and Galaxy Digital’s problem is more liquidity related than Company Problem

- Junior Gold Miners are cheap and not going way but requires patience.

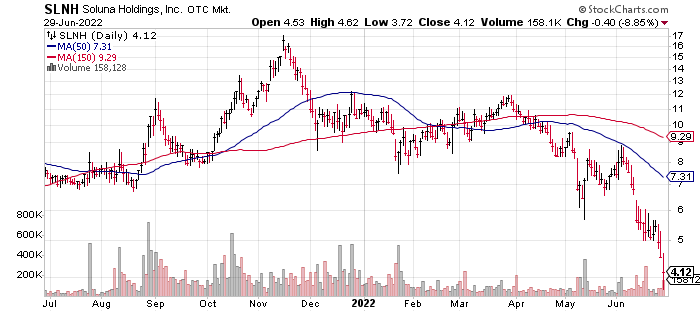

The price of Soluna went below $4.00 today – trading as low as $3.72.

I believe this has more to do with a low liquidity factor and nor so much to do with problems at the company. Anything can and does happen in life. Yes, Soluna could crash, burn and go out of business. Here are the reasons we believe there is a high probability Soluna as a company is fine.

- Management owns 30% of the company. They are very smart and structured the company with safeguards many other companies have not considered.

- The answer to the question that arises in the first bullet point, what have the done different to safeguard shareholders?

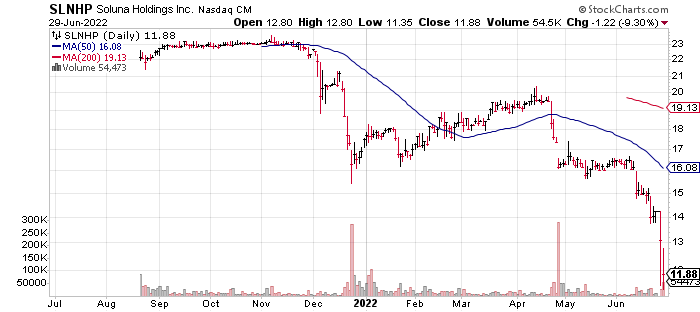

- They raised money for expansion through a preferred that has no maturity. There is no hard date the have to refinance or default on.

- The preferred dividend is cumulative, so owners are owed the money even if they suspend payment for a period of time. No default with a pause in the dividend payment. This provides the company flexibility yet tells owners of the preferred, we are thinking of you.

- The debt Soluna has is a loan on computer equipment. It is not going to put the company out of business if they default.

Soluna solves a problem for alternative energy. Putting wasted electricity to use that other wise has lost opportunity. Soluna facilitates the ability to Go Green as a world. There is no effective storage of excess electricity. This helps no one in the quest to go green. A very good explanation of Soluna’s value is in this article on Soluna’s May financing with Spring Lane Capital presented by Global Capital, linked here www.globalcapital.com/…

I will say accumulate slowly only because I not sure how low the low is in this correction. I “believe” it is a great value at higher prices, but I have been wrong. This is a tough market driven by fear.

18.8% dividend paid monthly if they keep paying the dividend. If they suspend the dividend, it is still owed to you. There is no maturity date on the preferred so no default date. The company “could,” buy this back in August 2026 or later date at $25.00 – a double. I added some shares today to existing positions. My personal projection – I think they will be fine but there are no guarantees.

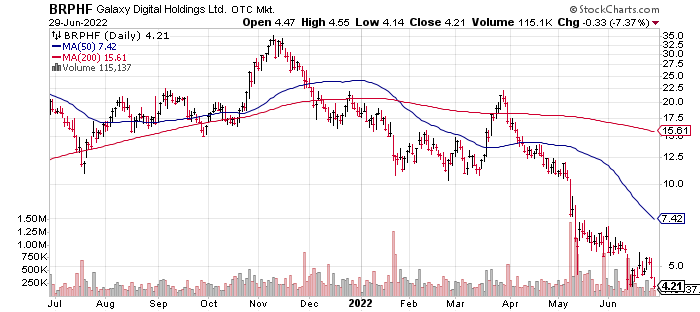

Galaxy Digital:

Galaxy has many moving parts so things could go wrong on a number of fronts. Everything seems fine and the company is acting as if everything is fine in a turbulent market. On the other hand, we recognize that investment bankers are very big BOOM and BUST vehicles in Bull and Bear markets. I am not going to guess a low- hopefully, the double bottom is being put in now. The company has enough cash that they are now executing on the 10 million share buy back announced earlier. A company with cash problems does not buy back 10 million shares. Press release.

- Separately: Galaxy Digital Holdings Ltd. (BRPHF) Director Dominic Docherty bought 19,570 shares of the company’s stock in a transaction on Tuesday, June 21st. The shares were bought at an average price of C$7.15 per share, for a total transaction of C$139,925.50. Following the completion of the acquisition, the director now directly owns 89,100 shares in the company, valued at approximately C$637,065.

Junior Gold Miners are cheap and not going way but requires patience.

This is a liquidity squeeze. Gold siler and battery metals are moving lower in reflection on the anticipation of a recession.

- See Video on drying up of big real estate deals and used car secondary market by George Gammon. 19 minutes

Junior mining stocks are very volatile – we like volatility at LOTM – and have sold lower for about a year now.

A nice thing about junior minors is that with physical metal prices where they are now there is almost zero chance of going out of business. In fact, cash flows for [producers is very high at this moment. I am still believing the Bull market in Natural Resources has four to eight years more to run. Since I an not trading these and in fact continuing to accumulate position size in multiple names, I thought the easiest thing to do was list ten of my favorites. The strategy is accumulate as cash becomes available. Sell 60% of the position when the price crosses a double on your averaged cost basis. Run the rest as long as you can stand it or have a mechanical exit strategy in place on the way up. Text me to set up a call if you want to discuss situations further.

Not listed in any order – and we have favorites but also own a basket of names to reduce company risk. My plan is 2% to 3% of the portfolio in ten different mining stocks with more in the favorites.

Names of miners I continue to accumulate no matter how low they go.

- Karora Resources (KRRGF)* $2.69

- Discovery Silver (DSVSF)* $0.93

- Vizsla Silver (VZLA)* $1.01

- Victoria Gold (VITFF)* $8.84

- Global X Funds Uranium (URA)* $18.85

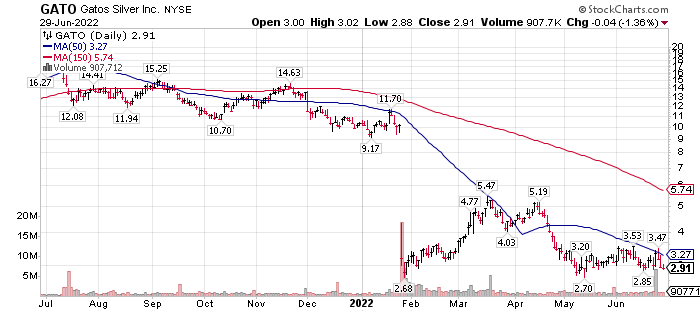

- Gatos Silver (GATO)* $2.91

- Silver One Resources (SLVRF)* $0.20

- Sassy Resources (SSYRF)* $0.23

- GoldSpot (SPOFF)* $0.291

- Pan American Silver (PAAS)* $20.52

Names are linked to charts at TradingView.com

There are another five to ten I wish I owned but for a lack of funds I don’t. There is so much exciting activity happening on the ground right now it is hard to stay focused.

There is one thing you might consider doing in taxable accounts that helps you feel better (with time).

- Let’s use GATO as the working example.

My average cost on GATO was about $10.50 when the shares got rocked by news that reserves might not be what they thought the were. The stock fell to about $2.68 on the drop of the news. I took the same amount of money, I had invested in Gatos at the higher price and over a month, bought shares of Gatos. After a month after my last purchase, I sold the original higher cost shares on rallies above my blended average cost which was about $5.00. Now I have more than 2X the number of shares I had when the shares were above $10. I realized a tax loss for the tax man but in reality, I sold at or above my average combined cost that was slightly above five dollars. So, I make money on the tax trade w\and own more that 2X the number of before that the higher price. Oh, Yes, my cost basis on remaining shares is $3.01. This way when I look at Gatos, I am not looking up at a $10 plus cost and getting depressed with the current price of $2.91.

Stock Position Management:

- Point one: we need all the psychological help we can give ourselves. This is a TOUGH game!

- Point two: even in hard times there is work we can do to improve our cost basis and get help from the tax man.

- Point three: Know your company. I had no fear of buying no matter how low the price because I took time to understand management, the property and the operations.

- Point four: Understanding the world you are playing in. A stock falls from above $10 to under $3, you are going to trigger massive margin liquidations. Once these margin calls are liquidated, the shares usually (a probability play) gives you a bounce. In this case it did.

Hope this can be of help in this difficult market environment! I have been using the same strategy with shares of PAGS and STNE to get my cost lower and target selling above my average break-even cost.

Written June 29, 2022, by Tom Linzmeier, editor of LOTM

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()

Pingback: LOTM: Metal Miners are too Cheap! -