- IBM is Breaking upwards in this market. New three-year closing high.

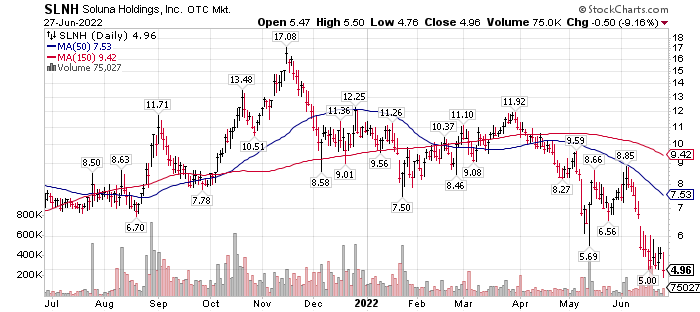

- Soluna Computing (SLNH)*

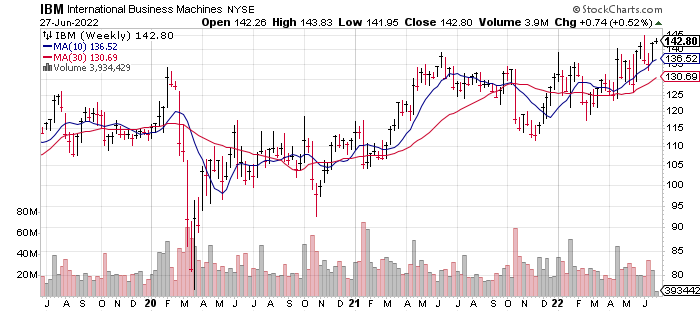

Three-year chart IBM

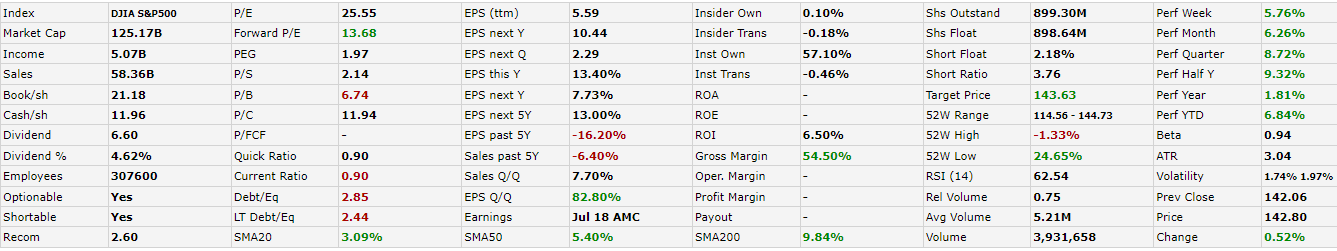

Stats on IBM from Finviz:

- Dividend of 4.62%

- Forward PE of 13.68

- Earnings/Share Q/Q of increase of 82%

From Morgan Stanley – May 11, 2022: Linked here at eTrade.

We believe IBM is set to outperform in 2022, and investments position them to capitalize on long-term trends of hybrid cloud & AI. This week we attended IBM’s Think 2022 Conference, and the main takeaway from the event is that IBM continues to invest heavily in their hybrid/multi-cloud, AI, and security capabilities. We believe IBM’s focus on their strategic priorities, improved messaging, and recent go-to-market changes are resonating with customers, which can be seen through the company’s strong 1Q performance (~6% Y/Y revenue growth ex-divestitures, FX, and internal revenue and guide for the high-end of mid-single digit Y/Y CY22 revenue growth). M&A commentary hasn’t changed, and potential targets include software assets focused on hybrid cloud, cybersecurity, AI and automation, and potentially SaaS. We believe the company will continue to do tuck-ins, with the potential to pull-forward multiple years of spend to do a more transformative deal. Importantly, CEO Arvind Krishna does not yet see IT spending caution in Europe (although it’s something he is tracking closely), and he sees Consulting demand as more insulated from the macro environment given technology remains a core strategic imperative for companies in the Data Era. We remain Overweight and believe IBM’s high recurring revenue, software/services mix, and positioning as a critical technology partner sets it up to outperform peers late in the economic cycle.

LOTM: IMO, Morgan Stanley tends to be big BULL and little BEAR is its publishing views so consider that.

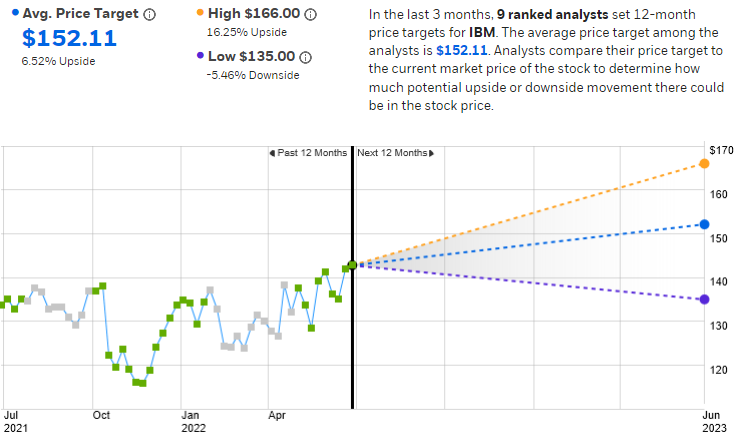

Technically and Fundamentally, we need some analysts to become believers in the company and get those price targets higher. Of course, stocks rising with little belief in them is a great situation.

IBM is too complicated for me to give an analyst like opinion. However, the market has been a pile of dung so far this year and IBM is at a three year high. Proof is in the visual. Buy the dips on IBM until the highs no longer get higher and the lows do go lower. That is fancy Technical speak.

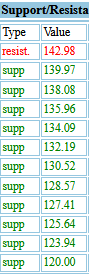

Here are IBM support and resistance levels from StockTA.com

| Analysis | Overall | Short | Intermediate | Long |

| Bullish | Bullish | Bullish | Bullish |

TipRank.com:

Soluna Holdings (SLNH)* $4.96

From StockTA.com

| Analysis | Overall | Short | Intermediate | Long |

| Bearish | Bearish | Bearish | Bearish |

Not much good to share in the technicals.

In related accounts I don’t expect to sell SLNH except for necessary reasons (client withdrawals). I don’t use margin so no leverage to worry about. The company is slowing down its expansion rate, but I don’t have concern for the company. Its growth rate is why people own Soluna, however. Soluna is very illiquid trading stock. If you have a decent size position it could be hard to reenter. I believe the stock will rebound pretty quickly once this sell off is over. No one know when that will be.

The market is in a transition period. Fear od inflation has transitioned to a fear of the recession. A number of economic projection are looing for a 60 basis point decline in interest rates in late Q4 ’21 or Q1 ’22. That is after the current rate hiking cycle gets to 4%.

I suggest watching ten-year treasuries as your interest rate indicator. It has been accurate in front running the Fed’s action.

In the ten -year bond chart (below) interest rates are not pushing to higher highs. Doesn’t mean they will not but perhaps “the market” is more worried about the recession than stopping inflation.

- This is a long way of suggesting that Soluna could be closer to a bottom than not from an interest rate perspective.

- In Soluna’s case however, it price is very sensitive to the price action of Bitcoin. Crypto is it product at the moment. It profit margin is dependent on the price it gets from the sale of Crypto.

In summary:

The bottom line is that Bitcoin is the visible representative of all crypto. When Bitcoin starts to recover expect Soluna’s price to recover. The same is true for Galaxy Digital (BRPHF),* another of our favorite but beaten down positions. We expect Gold / Silver / Crypto and Nat Gas to be leaders in the rally coming out of this correction or as some would say Bear Market. Nat Gas can be expected to rally perhaps more because of the fall and winter months. There will be shortages of Nat Gas for heating and electricity.

In the last 12 months ten year treasury rates have traversed from 1.2% to 3.4%. Much of the “Rate of Change” in interest rates was in March, April, May and June. If you look at the chart of Soluna the price waterfall dropped in April, May and June. Soluna is very sensitive interest rates and bitcoin price action. Use that information in future recovery move or consideration on your actions in the shares.

Written June 28, 2022, by Tom Linzmeier.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()