Africa Oil is controled by the Lundin Group. The Lundin family is a well known family business in Canada. Founded by Adolf Lundin over 50 years ago, the Lundin Group comprises, 11 separate, individually managed public companies focused on the resource sector. Africa Oil is one of their 11 public companies. The Lundin Group itself, is a privately held organization.

AFRICA OIL ANNOUNCES ITS INTENTION TO LAUNCH A SHARE BUYBACK PROGRAM UNDER A NORMAL COURSE ISSUER BID

8:00 PM ET 8/10/22 | Dow Jones

VANCOUVER, BC, Aug. 10, 2022 /CNW/ – (TSX: AOI) (Nasdaq-Stockholm: AOI) — Africa Oil Corp. (“Africa Oil”, “AOC” or the “Company”) is pleased to announce that it has Board approval to submit an application to launch its first share buyback program under a Normal Course Issuer Bid (“NCIB”) scheme. The Company’s intention is to repurchase up to ten percent of its public float, the maximum permitted over a twelve month period under Canadian and Swedish securities law, subject to customary approvals. View PDF Version

Once approved, the buyback program would expand on the Company’s existing shareholder capital returns program with an annual base dividend of $0.05 per share, distributed in two semi-annual payments. A further update on the process and timing, including a launch press release, will be issued upon regulatory approval and once the Board has formally resolved to launch the NCIB. Link to full story

In this Q2 announcement (below) I noticed that:

- Africa Oil is debt free however in the 50% owned company Prime, Prime has a cash position of $330.6 million and gross debt balance of $501.0 million at June 30, 2022 (Prime net debt to Africa Oil of $170.4 million), which combined with the $191 million cash balance at the Africa Oil corporate level results in a net cash position of $20.6 million; this also gives a robust Net Debt to EBITDAX7 ratio for the twelve months ended June 30, 2022, of 0.3x (twelve months ended December 31, 2021 – 0.4x);

- 50% owned Prime Had Free Cash Flow (FCF) in Q2 of $52 per barrel of Energy equivalent.

Full press release on Africa Oil linked here. Impressive and not exploited yet by institutional investors.

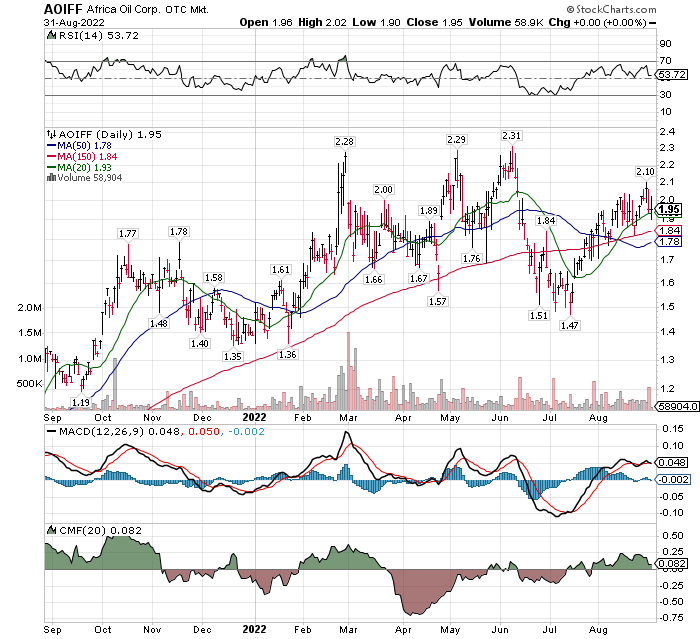

Technically Speaking: AOIFF is on buy signals from all technical indicators we use.

- RSI is above 50% line.

- MACD is on a cross-over buy signal, though getting softer.

- CMF is showing accumulation

- Price is above both the 50-day and 150-day moving average.

- The 20-day moving average is above the 50-day and 150-day moving average.

- Price resistance is at $2.25 to $2.30 area.

- Price support would be in the area between the 150-day and 50-day moving averages. Those prices are $1.77 and $1.83.

LOTM is not suggesting a buy in AOIFF based on Technical signals, we are suggesting a buy based on Fundamentals. Therefore, our selected risk management style would be accumulate slowly with a dollar-cost averaging approach.

Edited Aug 31, 2022.

Edited Aug 31, 2022.

LOTM expects a string of positive fundamental developments from Africa Oil. Share buy-backs, base rate dividend payout, now trading at a low P/E ratio of about 6, very high volume strike from a new discovery off Namibia. The discovery is meaningful to AOIFF, but they only own 6% of the project. Current company cash flow is coming from the Nigerian joint venture, where AOIFF is 50% owner.

A Fox News video, linked here, shows what is happening in the EU and energy. It is not pretty. We can all assume that the video is sensationalized. What is not in the video, is the fact that France and Germany are well ahead schedule in re-filling their Nat Gas supplies. Capacity is three months. Reserves are expected to be at full capacity as winter starts. EU prices are at their annual high of US$50 per Million BTU. The Nat Gas price in the USA is $9.75 per Million BTU. Globally, Nat Gas is averaging $15 per Million BTU.

Based on the Video and price of Nat Gas in the EU and Globally, there seems to be enough Nat Gas available, but the issues are the logistics of getting to the client at a reasonable price. It appears that prices will stay high for a while which is good for the producing Nat Gas energy companies. Short-term with news that EU is reaching capicity we will likely see a back off on oil and gas stocks as a pause & wait period unfolds. Traders might take profits. Investors might do the same. If you do sell, consider buying the dip. For the next year or two it appears oil and gas will run strong.

Of course, we have the primary dangers to high oil prices:

- Peace in the Ukraine. This assumes Russian oil and gas is bought again in the EU.

- Federal Reserve threat of killing demand for Energy through raising rates.

- Signing the Iranian Nuclear Deal, allowing Iranian oil to ship 93 million barrels of oil onto the market.

Since the problem is a supply and logistics issue, why wouldn’t we solve the problem there, rather than crush the economy with high interest rates. This is a risk if it becomes politically acceptable to drill for fossil fuels again in the USA. This might result from a reversal in ESG policy.

As long as the problem is addressed from a demand side solution, my best guess is oil and gas prices will remain high. Not a comforting thought and owning oil and gas in some form is a defensive play on our personal buying power in critical assets.

In the Ten Under $10 we now have five positions related to energy.

- African Oil (AOIFF)* $1.95 trailing P/E ratio of 6.2. 2.5% dividend.

- Vermilion Energy (VET)* $27.07- a trailing P/E ratio of 3.

- Calumet (CLMT)* $16.90 – Forward P/E ratio of 16.

- Recon Africa (RECAF)* $2.54 – Exploration stage company.

- Journey Energy (JRNGF) $4.65– with a trailing P/E ratio of 2.5.

Cash flows for the companies above are more attractive than even these low P/E ratios. Recon Africa is the exception as they have no cash flow.

Company related Comments:

Recon Africa is still in the exploration stage – not the production stage. There is a lot of press/pressure on Recon from environmental groups to get out of Namibia and Botswana. This will pressure will not go away. The local governments are solidly behind Recon in wanting the national development of oil and gas. As a comment on owning or not owning Recon Accounts related to Recon. Related accounts have sold shares of RECAF (announced) above $9.00 and again at lower prices. The shares remaining in the Ten Under $10 are at a very low cost of $0.56 per share. We view those shares as a lottery ticket, not an active accumulate the shares as a position intent. Oil & gas production from Recon’s property is a number of years in the future, so any near-term price action will need to come from news of discoveries. Please note that Recon is an exploration company with no revenue or cash flow. This is a developing theme that will continue to play out. In the markets focus on Past, Present or Future news perspective, Recon is out of favor. It you cannot look backwards and see revenue, cash flow or earnings you will be punished in today’s stock market as a stock price. The market will demand visibility looking “backwards.” That is no guarantee from avoiding a declining price – just viewed more favorable at this moment in time. At some time, forward looking companies with no positive cash flow and or positive earnings will be so cheap, they are set to explode upwards. We are not there yet.

Vermilion has been a great position, still cheap on an earnings basis. The Projected P/E ratio for 2023 is at about 3, according to the Finviz site. This “could be” peak oil pricing, so some money might be harvested. On the other hand, a potential war with China or continued war in Ukraine are bullish events for oil. Oil is getting more expensive to find, but there is not a real shortage of oil or gas. VET will do well for the next couple of years but with the market as fickle as it is there are times to sell just because the price is attractive to sell regardless of the future outlook. The hardest call is to decide if or when the price starts discounting the “good’ and begins to price in an abundance of oil. Certainly, peace in Ukraine will bring about a drop in oil prices.

Calumet has similar comments as Vermilion. It has been a great run. Long-term, CLMT projects a higher price by comments from within the analyst community. While there is no shortage of oil there is a shortage of refiners in the USA. CLMT has one of the newest refineries in the USA. In the Ten Under $10 list, we did reduce from owning three units to scale back to two units held. We are longer-term bullish on CLMT and would buy into a pull-back in price.

Journey Energy is a new position to Ten Under $10. A small market cap company of $261 million with 52 million shares outstanding. Journey has a trailing P/E ratio of 2.5. We will follow-up in a future blog post.

- Q2 Revenue of C$67.93M, up 146.8% Y/Y.

- Fiscal 2022 guidance: Cash Funds Flow per basic share of C$2.25 – C$2.40 up from prior C$2.00 – C$2.09.

- Total Debt C$51.3M – Cash C$35M

Linked here is an August 30, 2022, comment on oil and gold by Goldman Sachs commodity department head Jeff Currie. Currie does not believe we have seen the lows on oil. For gold “if” the Fed busts inflation, he sees lower prices for gold. If the inflation rate is a constant theme, then he believes gold will move higher.

Have a great day! Best of success always.

Just When the Caterpillar thought its world was ending, it became a Butterfly.

Written Aug 30, 2022, by Tom Linzmeier, editor of Tom’s Blog at www.LivingOffTheMarket.com

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()