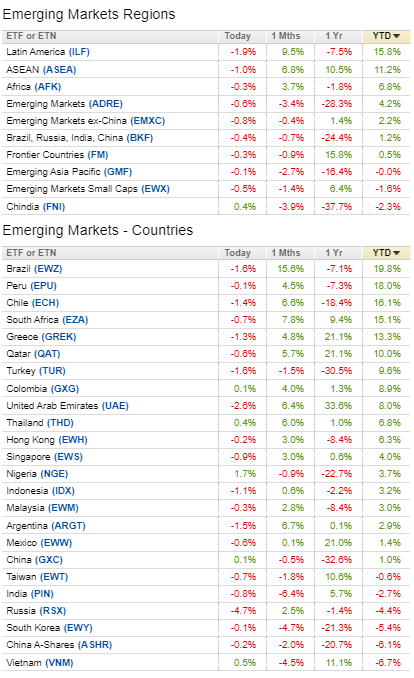

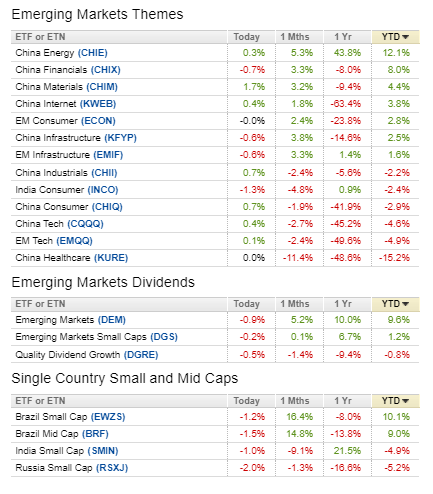

Emerging Market ETFs are in lower risk chart patterns but are lacking a strong catalyst for driving their price higher.

Catalysts likely are, a falling US Dollar, rising commodity prices, and asset rotation out of US equities and debt.

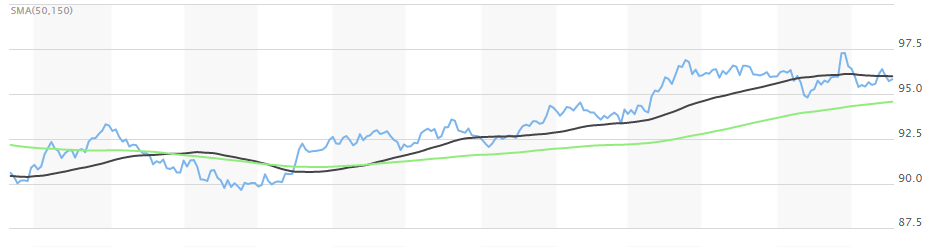

VWO appears to be the better positioned of the emerging Market ETFs in relationship to its moving averages.

Vanguard FTSE Emerging Market ETF

Columbia Emerging Markets Consumer ETF

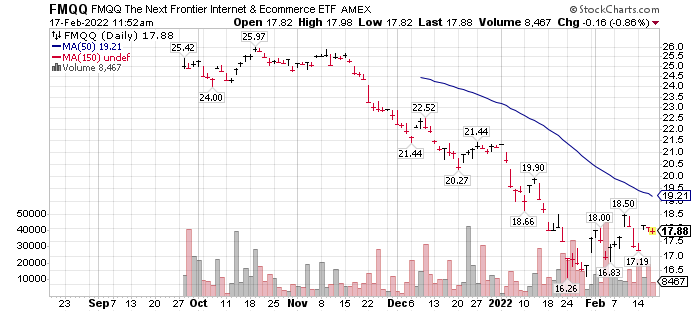

Emerging Markets Internet & eCommerce ETF

iShares MSCI Frontier and Select EM ETF

Sourced from Seeking Alpha, dated February 17, 2022

US Dollar (DXY) sourced from MarketWatch Feb 17, 2022

LOTM emails have mentioned many times that the 2020’s will be the decade of Commodities. For many third world countries, commodities are their primary export product. This fact, combined with the strong demand for commodities to transition the world to all green / all electric, is very positive for countries that are commodity exporters. In this pdf we have a number of potential investment paths presented. Consider this an idea stimulator for

- investing in emerging countries that export as well as have growing middle classes that are consumers.

- investing in commodities through different paths – some are broad in scope like commodity ETFs or funds and others very directed as in the commodity itself or individual companies that produce or process a commodity.

Is this an investment theme you want to invest in? Then consider how you want to invest in it.

Invesco DB Commodity Index Tracking Fund (DBC)

Invesco DB Base Metals Fund (DBB)

It is a new world for investing Vs the prior decade.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()