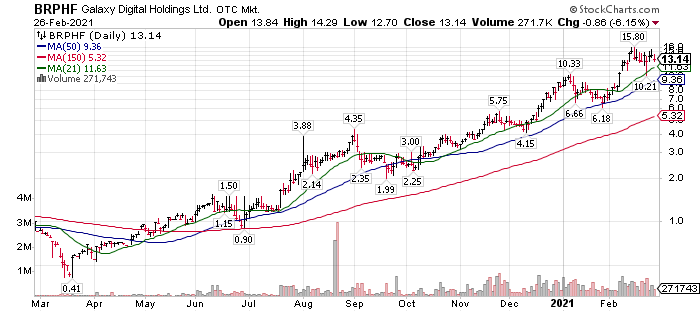

Today, Feb 24, 2021, Galaxy Digital (BRPHF)* $14.40 announced preliminary Q4 and year-end numbers. Final #’s announcement to follow at a future date.

Please note the multiple revenue streams Galaxy is building in building supporting infrastructure around Blockchain adaption.

- Asset management

- Investment banking

- Invested in 55 Portfolio Companies

- Trading

This is what we want to invest in when focused on Blockchain and crypto – The infrastructure growing around the Blockchain technology. Owning Portfolio companies we would not have access to any other way.

While cash flow first and earnings second are important in the early stages of company development for Galaxy, Assets Under Management (AUM) is the important most important number we track.

For our purposes, not qualifying as experts in the spectrum of opportunities in Blockchain, Galaxy is a very good way to participate. This stock is volatile, and we will be looking for sharp sell offs to accumulate an increasing long-term share position in Galaxy Digital. We view it as a core holding to be added to when the opportunity presents itself. No doubt, should the price appreciate too quickly, we will scale out of a small percentage to buy back into on price weakness. In other words, we will trade around the core position while looking to expand the core position over time.

- Website: https://www.galaxydigital.io/

- Chart at TradingView: https://www.tradingview.com/symbols/OTC-BRPHF/

- News Flow involving Galaxy Digital, Founder, Mike Novogratz

NEWS RELEASE TODAY:

Galaxy Digital Announces Preliminary Fourth Quarter 2020 and 2021 Year-to-Date Update

5:20 PM ET 2/24/21 | Dow Jones

Comprehensive Income(1) increased over 650% in the Fourth Quarter 2020

Counterparty trading volumes increased over 80% in the Fourth Quarter 2020

Net Book Value Per Share(2) increased over 75% in the Fourth Quarter 2020

Assets Under Management (“AUM”) increased over 100% in the Fourth Quarter 2020

NEW YORK, Feb. 24, 2021 /PRNewswire/ – Galaxy Digital Holdings Ltd. (TSX: GLXY) (the “Company” or “GDH Ltd.”) today announced preliminary financial results for the quarter ended December 31, 2020 for both itself and Galaxy Digital Holdings LP (the “Partnership” or “GDH LP”).

Given the material change in the operating environment of the cryptocurrency and digital sector since the Company reported Q3 2020 earnings, as well as the shifts in digital asset prices, the management team believes it is prudent to provide our stakeholders with an update on our performance for the quarter ended December 31, 2020 and 2021 year-to-date.

Select Financial Highlights for the fourth quarter of 2020, ended December 31, 2020

— The Company expects to report Comprehensive Income1 for the quarter ended December 31, 2020 to exceed $325 million, representing a sequential quarter-over-quarter increase of over 650%.

— The Company also expects that the Partnership’s Net Book Value Per Share2 as of December 31, 2020, increased in excess of 75% since September 30, 2020.

— The primary drivers of these results include appreciation in the value of the Company’s digital assets and other principal investments, as well as increased counterparty trading volumes and revenues.

Select Operational Highlights for the fourth quarter of 2020, ended December 31, 2020

–– Galaxy Digital Trading (“GDT”) expects to report a sequential quarter-over-quarter counterparty trading volume increase of approximately over 80%.

— Galaxy Digital Lending (“GDL”) expects to report that the Company’s counterparty loan book grew in excess of 300% to more than $110 million and that the Company grew gross counterparty loan originations in excess of 90% to $110 million in the period ended December 31, 2020.

— There was no significant change in the Company’s digital asset holdings3 during the fourth quarter of 2020, and the Company has, as a result, benefited from the increase in asset prices since September 30, 2020.

— Galaxy Digital Asset Management (“GDAM”) AUM(a) as of December 31, 2020 was approximately $815 million, representing an increase of over 100% since September 30, 2020.

— GDAM saw an increase of over 200% in investor subscription transactions, representing an over 400% increase in dollar terms. In December 2020, GDAM launched the CI Galaxy Bitcoin Fund (Ticker: BTCG), a TSX-listed closed end mutual fund, in partnership with CI Financial. Additionally, the Bloomberg Galaxy Bitcoin Index (Ticker: BTC) went live, and GDAM entered into two new distribution partnerships.

— The Company completed seven new investments in companies and held approximately 70 investments across 50 portfolio companies as of December 31, 2020.

Select Operational Highlights as of February 19, 2021

–– GDT counterparty trading volumes continued significant growth between January 1, 2021 and February 19, 2021 and represented approximately 93% of counterparty trading volumes for the quarter ended December 31, 2020.

— GDL continued to experience strong growth in the Company’s counterparty loan book for the period from January 1, 2021 to February 19, 2021, increasing in excess of 230% to approximately $370 million and grew gross counterparty loan originations in excess of 234% to approximately $367 million since December 31, 2020.

— There was no significant change in the Company’s digital asset holdings since December 31, 2020, and the Company has, as a result, benefited from the increase in asset prices since the start of the year.

— GDAM’s AUM(a) currently stands at approximately $1,180 million as of February 19, 2021, representing an increase of approximately 45% since December 31, 2020.

— Recent GDAM product launches include the Galaxy Ethereum Funds and the CI Galaxy Bitcoin ETF, for which Galaxy has been named sub-advisor and a preliminary prospectus has been filed in Canada. The Galaxy Ethereum Funds will track the newly launched Bloomberg Galaxy Ethereum Index (Ticker: ETH), the third in the Bloomberg-Galaxy family of indices.

— In the period between January 1, 2021 and February 19, 2021, the Company completed eight new investments in companies and now holds approximately 78 investments across 55 portfolio companies, spanning blockchain-based payments, institutional custody, retail consumer services platforms, smart contract digitization services, cyber security and blockchain surveillance, mining, and mining-related services, staking services, and various decentralized protocols covering network scaling, exchange, lending, and open-source code collaboration. The Company cautions that the data in this press release is preliminary, unaudited, and subject to change as management completes its year-end financial procedures and annual independent audit. Further, the Company may elect to provide different key operating and financial metrics in the future, given its evolving business mix. The Company plans to announce its fourth quarter and 2020 year-end results at the end of March 2021.

(a) AUM is an internal estimate inclusive of a sub-advised fund, committed capital in a closed-end vehicle, and seed investments by affiliates. Changes in AUM are generally the result of performance, contributions, and withdrawals.

Training, Coaching & Mentoring available

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()