A reminder that this is a dynamic list. We will hold positions greater or less than ten in the portfolio. During neutral and positive trending markets, we will expand this list. However, when the over-all trend begins to decline, we will shrinking this list and will add to the companies we consider “core” positions. This strategy is not for the weak of heart or stomach. It has produced big gains over multiple market cycles for our accounts. This strategy is part of our risk management policy.

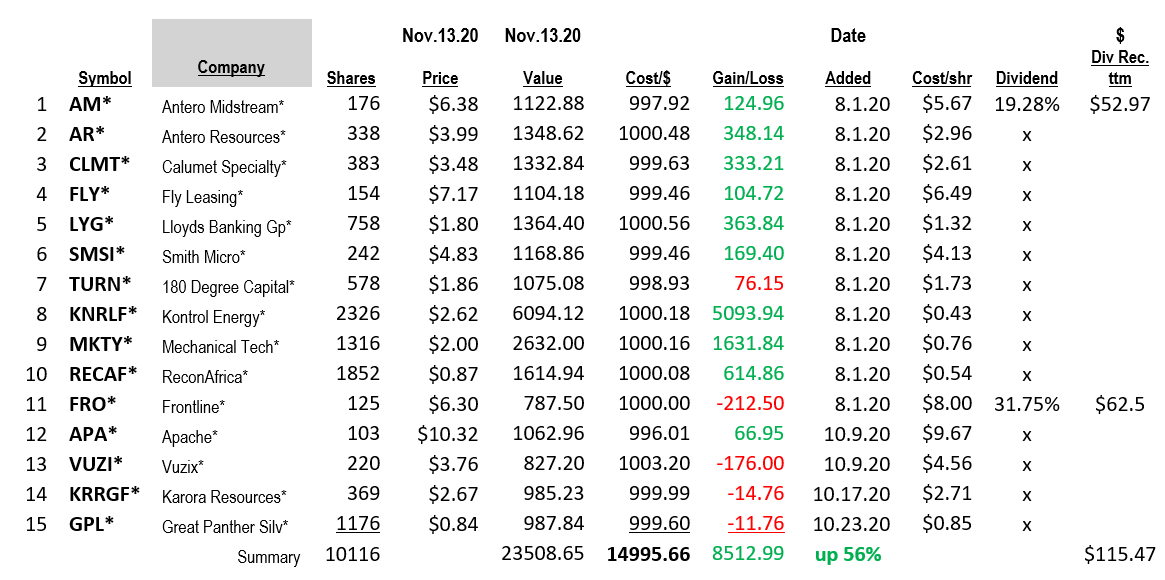

We were considering selling FLY and LYG on last Monday, but the market was up so much on Monday, we held back. Both stocks moved with the market, so we let them ride. These are on the sale block, so before year-end we will sell them. Looking for opportune time.

I do not know what to do with VUZIX. The company is the industry leader far out pacing a host of huge opponents – Microsoft, Apple, Facebook, Google. The stock is a dog at the moment. The company is too small to gain momentum from their company progress. One day this will take off or get bought out. That could be tomorrow, or it could be three years in the future. If management executes this will be a big name one day.

We are considering selling some Kontrol Energy. Only because the gain is so big, and the stock might just sit here or go down. The stock dropped a $1.00 per share last week on the positive Covid Vaccine news. That’s a $2,300 portfolio loss from one stock. Trimming shares would be the way to minimize some risk.

Karora Resources had great numbers and cash flow. We like this one a lot – they are gearing up for expanding production. Very few know the name outside the mining industry – both a positive and a negative.

TURN has numbers out this week. Think that is good for a 20% pop on the expected numbers. Let’s see.

FRO is a tweener for us – between – Love the dividend but – we are unsure what will happen to Oil and Gas demand. Frontline is the largest oil tanker (shipping) company in the world. Basically, the company pays out its free cash flow as a dividend – so a big dividend when times are good and no dividend when times are not so good.

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()